Popular Posts

👌JuCoin to List GDA/HI Trading Pair on August 18, 2025

🔷Deposit Time: August 17, 2025 at 09:00 (UTC)

🔷Trading Time: August 18, 2025 at 09:00 (UTC)

🔷Withdrawal Time: August 19, 2025 at 09:00 (UTC)

👉 More Detail:https://bit.ly/45jcyJv

JuCoin Community

2025-08-01 06:47

📢New Listing

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The altcoin market is experiencing significant resurgence with institutional backing and regulatory clarity driving unprecedented growth opportunities. Here's what's shaping the current landscape:

💰 Market Dynamics:

-

Post-Bitcoin capital rotation (Bitcoin hit $118K in July 2025)

86% of institutional investors have or plan digital asset exposure

Altcoin Season Index at 50 (early-stage rotation phase)

Enhanced liquidity through potential altcoin ETPs

🎯 Leading Sectors & Narratives:

1️⃣ AI & Blockchain Integration

-

AI-powered altcoins transitioning from speculation to utility

Autonomous agents creating economic value in crypto ecosystems

2️⃣ Real-World Asset (RWA) Tokenization

-

Market surged to $25B in Q2 2025 (245x increase since 2020)

Bridging traditional finance with blockchain technology

Fractional ownership of real estate, commodities, and fine art

3️⃣ DeFi Evolution

-

Focus on Layer 2 solutions and high-performance blockchains

Innovative liquid staking and restaking protocols

More user-friendly and cost-effective transactions

4️⃣ Gaming & Metaverse

-

Sustainable play-to-earn models

Interoperable metaverse experiences

🏛️ Regulatory Catalysts:

-

EU's MiCA regulation providing comprehensive framework

U.S. stablecoin bills (GENIUS Act) enhancing stability

Spot altcoin ETP discussions (Solana, XRP gaining traction)

XRP hitting multi-year highs amid favorable regulations

💡 Key Investment Insights:

-

Diversify into altcoins with strong fundamentals in emerging sectors

Monitor regulatory developments for institutional flow opportunities

Prioritize projects with active communities and continuous innovation

Understand capital rotation patterns from Bitcoin to altcoins

Focus on utility-driven tokens over speculative assets

🔮 Market Outlook: The shift from speculative to utility-driven altcoins is accelerating, with institutional adoption providing stability and legitimacy. Projects solving real-world problems through AI integration, RWA tokenization, and advanced DeFi protocols are positioned for sustained growth.

Read the complete market analysis with detailed sector breakdowns and investment strategies: 👇 https://blog.jucoin.com/explore-the-current-altcoin-market-in-2025/

#Altcoin #Crypto #Blockchain #AI #RWA #DeFi #Institutional #Regulation #Bitcoin #Ethereum #Solana #XRP #JuCoin #Tokenization #Web3 #Investment #2025 #DigitalAssets #MiCA #ETP

JU Blog

2025-07-31 13:37

🚀 Altcoin Market in 2025: Institutional-Driven Growth & Innovation Surge!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🕙Event Duration: July 24, 16:00 – August 24, 15:59 (UTC)

🏆 Weekly Prize Pool: $25,000 in JU Hashrate

Eligible Trading Pairs: All MEME tokens in the Spot MEME Zone + On-Chain Preferred Zone

❕Hashrate Mining Highlights:

Mine While You Trade: Earn JU hashrate based on tasks, settled weekly

High-Yield Bonus: Earn JU continuously from your awarded hashrate

On-Chain Transparency: All JU earnings are verifiable on-chain

JuCoin Community

2025-07-31 06:21

🎁 MEME Trading Carnival is Here! Share $100,000 JU Hashrate – Trade & Mine at the Same Time!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

This is my first JuSqaure Post!

#cryptocurrency

JCUSER-Rj4NMyiW

2025-07-31 03:52

My First Post

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Best Times to Trade During the XT Carnival

The XT Carnival is one of the most anticipated events in the cryptocurrency trading calendar. It attracts thousands of traders, investors, and enthusiasts eager to capitalize on heightened market activity. Understanding when to trade during this event can significantly influence your success, especially given its characteristic high liquidity and volatility. This guide aims to help traders identify the most strategic times for trading during the XT Carnival based on recent insights and market patterns.

What Is the XT Carnival?

The XT Carnival is an annual gathering organized by XT.com, a leading cryptocurrency exchange. It features a series of activities including trading competitions, workshops, seminars, and networking opportunities designed for both novice and experienced traders. The event's core appeal lies in its ability to generate increased market activity—traders are motivated by prizes from competitions and educational content that enhances their skills.

This event typically spans several days with fluctuating schedules each year but consistently draws large participation due to its reputation for high liquidity and volatility. These conditions create both opportunities for profit through quick trades or swing strategies as well as risks that require careful risk management.

Why Timing Matters During the XT Carnival

Timing your trades during such a dynamic period can make a significant difference in outcomes. High liquidity means more buying and selling activity which often leads to rapid price movements—both upward surges and sharp declines. For traders aiming to maximize gains or minimize losses, understanding when these movements are likely occurs is crucial.

Market openings at the start of each day or session tend to be volatile as new information enters markets or participants react collectively after overnight developments. Similarly, periods around scheduled activities like workshops or competition deadlines often see spikes in trading volume because participants adjust their positions based on new insights gained from educational sessions or competitive results.

Key Periods When Trading Is Most Active

Based on recent trends observed during past editions of the XT Carnival—and supported by general market behavior—the following periods are typically characterized by increased activity:

Market Openings: The beginning of each trading day within the event usually witnesses notable price swings as traders digest overnight news or react quickly after initial announcements.

Mid-Day Sessions (Lunch Breaks): Around midday—often coinciding with breaks in scheduled events—trading volume tends to increase as participants reassess their strategies based on early-day developments.

During Trading Competitions: When specific contests are active—such as "Crypto Trading Challenge" winners being announced—the surge in participant engagement leads directly to higher liquidity.

Post-Educational Workshops: After seminars focusing on technical analysis or risk management conclude, many attendees actively implement learned strategies immediately afterward; this creates short-term volatility spikes.

Pre-Event Announcements & Market Updates: Any significant news released just before key segments can trigger rapid price adjustments across various cryptocurrencies involved in those updates.

How Traders Can Maximize Opportunities

To effectively leverage these peak periods:

- Monitor Event Schedules Closely: Keep track of daily agendas including workshop timings, competition phases, and announcement windows.

- Use Real-Time Data & Alerts: Employ tools like live charts with alerts set around expected volatile periods so you can act swiftly when opportunities arise.

- Practice Risk Management: Given high volatility potential—even during prime times—it’s essential always to use stop-loss orders and position sizing appropriate for your risk appetite.

- Focus on Liquid Pairs: During busy periods like competition peaks or session openings, prioritize highly liquid cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), or top altcoins which facilitate smoother entry/exit points without slippage.

Risks Associated With Peak Trading Times

While these windows offer lucrative opportunities due to increased movement, they also come with heightened risks:

- Sudden Price Swings: Rapid fluctuations may lead inexperienced traders into significant losses if not managed properly.

- Market Manipulation Concerns: High-liquidity events sometimes attract manipulative practices; however, reputable platforms like XT.com implement measures against such activities.

- Emotional Trading: Increased excitement might lead some traders into impulsive decisions rather than disciplined strategies.

Understanding these risks underscores why preparation—including education about technical analysis—is vital before engaging heavily during peak times at events like the XT Carnival.

Final Thoughts: Strategic Planning Enhances Success

Knowing when best times occur isn’t enough; successful trading also depends on preparation beforehand — including analyzing historical data from previous Carnivals—and maintaining discipline throughout volatile sessions. By aligning your trading schedule with key activity windows identified above while practicing sound risk management principles you stand better chances at capitalizing on this vibrant event’s full potential without exposing yourself unnecessarily to downside risks.

In summary:

- Focus on opening hours

- Watch mid-day shifts

- Participate actively during competitions

- Stay alert post-workshopsThese strategic timings combined with proper planning will help you navigate one of crypto’s most exciting seasons effectively while safeguarding your investments amidst unpredictable swings typical of high-volatility environments like the XT Carnival.

Lo

2025-06-09 08:03

What are the best times to trade during the XT Carnival?

Best Times to Trade During the XT Carnival

The XT Carnival is one of the most anticipated events in the cryptocurrency trading calendar. It attracts thousands of traders, investors, and enthusiasts eager to capitalize on heightened market activity. Understanding when to trade during this event can significantly influence your success, especially given its characteristic high liquidity and volatility. This guide aims to help traders identify the most strategic times for trading during the XT Carnival based on recent insights and market patterns.

What Is the XT Carnival?

The XT Carnival is an annual gathering organized by XT.com, a leading cryptocurrency exchange. It features a series of activities including trading competitions, workshops, seminars, and networking opportunities designed for both novice and experienced traders. The event's core appeal lies in its ability to generate increased market activity—traders are motivated by prizes from competitions and educational content that enhances their skills.

This event typically spans several days with fluctuating schedules each year but consistently draws large participation due to its reputation for high liquidity and volatility. These conditions create both opportunities for profit through quick trades or swing strategies as well as risks that require careful risk management.

Why Timing Matters During the XT Carnival

Timing your trades during such a dynamic period can make a significant difference in outcomes. High liquidity means more buying and selling activity which often leads to rapid price movements—both upward surges and sharp declines. For traders aiming to maximize gains or minimize losses, understanding when these movements are likely occurs is crucial.

Market openings at the start of each day or session tend to be volatile as new information enters markets or participants react collectively after overnight developments. Similarly, periods around scheduled activities like workshops or competition deadlines often see spikes in trading volume because participants adjust their positions based on new insights gained from educational sessions or competitive results.

Key Periods When Trading Is Most Active

Based on recent trends observed during past editions of the XT Carnival—and supported by general market behavior—the following periods are typically characterized by increased activity:

Market Openings: The beginning of each trading day within the event usually witnesses notable price swings as traders digest overnight news or react quickly after initial announcements.

Mid-Day Sessions (Lunch Breaks): Around midday—often coinciding with breaks in scheduled events—trading volume tends to increase as participants reassess their strategies based on early-day developments.

During Trading Competitions: When specific contests are active—such as "Crypto Trading Challenge" winners being announced—the surge in participant engagement leads directly to higher liquidity.

Post-Educational Workshops: After seminars focusing on technical analysis or risk management conclude, many attendees actively implement learned strategies immediately afterward; this creates short-term volatility spikes.

Pre-Event Announcements & Market Updates: Any significant news released just before key segments can trigger rapid price adjustments across various cryptocurrencies involved in those updates.

How Traders Can Maximize Opportunities

To effectively leverage these peak periods:

- Monitor Event Schedules Closely: Keep track of daily agendas including workshop timings, competition phases, and announcement windows.

- Use Real-Time Data & Alerts: Employ tools like live charts with alerts set around expected volatile periods so you can act swiftly when opportunities arise.

- Practice Risk Management: Given high volatility potential—even during prime times—it’s essential always to use stop-loss orders and position sizing appropriate for your risk appetite.

- Focus on Liquid Pairs: During busy periods like competition peaks or session openings, prioritize highly liquid cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), or top altcoins which facilitate smoother entry/exit points without slippage.

Risks Associated With Peak Trading Times

While these windows offer lucrative opportunities due to increased movement, they also come with heightened risks:

- Sudden Price Swings: Rapid fluctuations may lead inexperienced traders into significant losses if not managed properly.

- Market Manipulation Concerns: High-liquidity events sometimes attract manipulative practices; however, reputable platforms like XT.com implement measures against such activities.

- Emotional Trading: Increased excitement might lead some traders into impulsive decisions rather than disciplined strategies.

Understanding these risks underscores why preparation—including education about technical analysis—is vital before engaging heavily during peak times at events like the XT Carnival.

Final Thoughts: Strategic Planning Enhances Success

Knowing when best times occur isn’t enough; successful trading also depends on preparation beforehand — including analyzing historical data from previous Carnivals—and maintaining discipline throughout volatile sessions. By aligning your trading schedule with key activity windows identified above while practicing sound risk management principles you stand better chances at capitalizing on this vibrant event’s full potential without exposing yourself unnecessarily to downside risks.

In summary:

- Focus on opening hours

- Watch mid-day shifts

- Participate actively during competitions

- Stay alert post-workshopsThese strategic timings combined with proper planning will help you navigate one of crypto’s most exciting seasons effectively while safeguarding your investments amidst unpredictable swings typical of high-volatility environments like the XT Carnival.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is the BlackRock IBIT Spot Bitcoin ETF?

The BlackRock IBIT Spot Bitcoin ETF is a financial product designed to give investors exposure to Bitcoin without the need to directly purchase or hold the cryptocurrency itself. As an exchange-traded fund (ETF), it operates within traditional financial markets, allowing investors to buy and sell shares on stock exchanges just like stocks. This ETF is actively managed, meaning professional fund managers oversee its holdings and strategies to closely track Bitcoin’s price movements.

Unlike some other investment vehicles that rely on futures contracts or derivatives, the IBIT Spot Bitcoin ETF aims to mirror the actual spot price of Bitcoin. This means it holds assets that are directly linked to the current market value of Bitcoin, providing a more straightforward way for investors to participate in cryptocurrency price fluctuations through familiar investment channels.

How Does It Work?

The core mechanism behind this ETF involves holding a basket of assets—most likely including actual Bitcoins or derivatives closely tied to their value—that reflect real-time changes in Bitcoin’s market price. The fund's management team continuously adjusts its holdings based on market conditions, ensuring that its share price remains aligned with Bitcoin's spot rate.

Investors can purchase shares of this ETF via their brokerage accounts without needing specialized knowledge about digital wallets or private keys associated with cryptocurrencies. This accessibility makes it an attractive option for both institutional and retail investors seeking exposure while avoiding direct crypto ownership complexities.

Why Is It Significant?

The introduction of BlackRock’s IBIT Spot Bitcoin ETF marks a pivotal moment in mainstream finance because it bridges traditional investment methods with digital assets. Managed by one of the world’s largest asset managers—BlackRock—the product signals growing confidence among institutional players regarding cryptocurrencies as legitimate investments.

This development also responds directly to increasing investor demand for diversified portfolios that include digital assets. By offering a regulated and transparent vehicle for investing in Bitcoin, BlackRock helps reduce barriers such as security concerns and regulatory uncertainties often associated with direct crypto investments.

Key Features at a Glance

- Launch Date: February 14, 2023

- Management: Managed by BlackRock Investment Institute

- Trading Platform: Listed on NYSE under ticker symbol IBIT

- Investment Approach: Tracks bitcoin's spot price through direct holdings or derivatives

- Accessibility: No minimum investment requirements typically apply

Impact on Financial Markets

Since its launch, the BlackRock IBIT Spot Bitcoin ETF has garnered significant attention from both individual and institutional investors. Its presence has increased trading volumes in related markets such as bitcoin futures contracts and other cryptocurrency-related securities. The product has also contributed positively toward legitimizing cryptocurrencies within traditional finance sectors by demonstrating regulatory acceptance and institutional backing.

Moreover, this ETF facilitates easier access for those who may be hesitant about managing private keys or navigating complex crypto exchanges but still want exposure to bitcoin’s potential upside—and risk profile—in their portfolios.

Challenges & Future Outlook

Despite its promising prospects, there are inherent challenges tied to cryptocurrency investments—primarily volatility. The prices of digital currencies like bitcoin can fluctuate sharply due to factors including regulatory developments, technological changes, macroeconomic trends, or shifts in investor sentiment.

Regulatory scrutiny remains an ongoing concern; authorities worldwide continue evaluating how best to oversee these new financial products while protecting investors from potential risks such as market manipulation or fraud. As regulators become more comfortable approving similar products over time, we may see further innovations like additional ETFs tracking different cryptocurrencies or related indices.

Looking ahead, if successful—and if broader acceptance continues—the BlackRock IBIT Spot Bitcoin ETF could pave the way for more mainstream adoption of crypto-based investment solutions across global markets. Increased participation from large institutions might lead not only toward greater liquidity but also toward stabilization efforts within volatile digital asset markets.

Why Investors Are Turning Toward Cryptocurrency ETFs

Investors increasingly seek alternative ways into emerging asset classes like cryptocurrencies due to several compelling reasons:

- Simplified access via regulated platforms

- Reduced security risks compared with holding private keys

- Greater transparency through established custodians

- Portfolio diversification benefits

Cryptocurrency ETFs serve as an essential bridge between innovative blockchain technology and conventional finance systems—making them appealing options amid evolving investor preferences.

Regulatory Environment Surrounding Cryptocurrency ETFs

The approval process for cryptocurrency-based ETFs varies significantly across jurisdictions but generally involves rigorous review by securities regulators such as the U.S Securities and Exchange Commission (SEC). While some proposals have faced delays due primarilyto concerns over market manipulationand lackof sufficient oversight,the recent approvalof productslikeBlackrock'sIBITindicatesa gradual shifttowardacceptanceandregulatory clarityinthisspace.This trend suggeststhat future offeringsmay benefitfrom clearer guidelinesand increased confidenceamonginvestorsandissuers alike.

Final Thoughts: The Long-Term Potential

As mainstream financial institutions continue embracing cryptocurrencies through products like blackrock ibit spot bitcoin etf,the landscape is poisedfor further growthand innovation.Investors who adopt these vehicles gain opportunitiesfor diversificationwhile benefitingfromthe credibilityofferedby established firms.Blackrock's move signals thatcryptocurrenciesare becoming integral componentswithin diversified portfolios,and ongoing developments could reshape how individualsand institutions approach digital asset investments moving forward.

kai

2025-06-07 17:11

What is the BlackRock IBIT Spot Bitcoin ETF?

What Is the BlackRock IBIT Spot Bitcoin ETF?

The BlackRock IBIT Spot Bitcoin ETF is a financial product designed to give investors exposure to Bitcoin without the need to directly purchase or hold the cryptocurrency itself. As an exchange-traded fund (ETF), it operates within traditional financial markets, allowing investors to buy and sell shares on stock exchanges just like stocks. This ETF is actively managed, meaning professional fund managers oversee its holdings and strategies to closely track Bitcoin’s price movements.

Unlike some other investment vehicles that rely on futures contracts or derivatives, the IBIT Spot Bitcoin ETF aims to mirror the actual spot price of Bitcoin. This means it holds assets that are directly linked to the current market value of Bitcoin, providing a more straightforward way for investors to participate in cryptocurrency price fluctuations through familiar investment channels.

How Does It Work?

The core mechanism behind this ETF involves holding a basket of assets—most likely including actual Bitcoins or derivatives closely tied to their value—that reflect real-time changes in Bitcoin’s market price. The fund's management team continuously adjusts its holdings based on market conditions, ensuring that its share price remains aligned with Bitcoin's spot rate.

Investors can purchase shares of this ETF via their brokerage accounts without needing specialized knowledge about digital wallets or private keys associated with cryptocurrencies. This accessibility makes it an attractive option for both institutional and retail investors seeking exposure while avoiding direct crypto ownership complexities.

Why Is It Significant?

The introduction of BlackRock’s IBIT Spot Bitcoin ETF marks a pivotal moment in mainstream finance because it bridges traditional investment methods with digital assets. Managed by one of the world’s largest asset managers—BlackRock—the product signals growing confidence among institutional players regarding cryptocurrencies as legitimate investments.

This development also responds directly to increasing investor demand for diversified portfolios that include digital assets. By offering a regulated and transparent vehicle for investing in Bitcoin, BlackRock helps reduce barriers such as security concerns and regulatory uncertainties often associated with direct crypto investments.

Key Features at a Glance

- Launch Date: February 14, 2023

- Management: Managed by BlackRock Investment Institute

- Trading Platform: Listed on NYSE under ticker symbol IBIT

- Investment Approach: Tracks bitcoin's spot price through direct holdings or derivatives

- Accessibility: No minimum investment requirements typically apply

Impact on Financial Markets

Since its launch, the BlackRock IBIT Spot Bitcoin ETF has garnered significant attention from both individual and institutional investors. Its presence has increased trading volumes in related markets such as bitcoin futures contracts and other cryptocurrency-related securities. The product has also contributed positively toward legitimizing cryptocurrencies within traditional finance sectors by demonstrating regulatory acceptance and institutional backing.

Moreover, this ETF facilitates easier access for those who may be hesitant about managing private keys or navigating complex crypto exchanges but still want exposure to bitcoin’s potential upside—and risk profile—in their portfolios.

Challenges & Future Outlook

Despite its promising prospects, there are inherent challenges tied to cryptocurrency investments—primarily volatility. The prices of digital currencies like bitcoin can fluctuate sharply due to factors including regulatory developments, technological changes, macroeconomic trends, or shifts in investor sentiment.

Regulatory scrutiny remains an ongoing concern; authorities worldwide continue evaluating how best to oversee these new financial products while protecting investors from potential risks such as market manipulation or fraud. As regulators become more comfortable approving similar products over time, we may see further innovations like additional ETFs tracking different cryptocurrencies or related indices.

Looking ahead, if successful—and if broader acceptance continues—the BlackRock IBIT Spot Bitcoin ETF could pave the way for more mainstream adoption of crypto-based investment solutions across global markets. Increased participation from large institutions might lead not only toward greater liquidity but also toward stabilization efforts within volatile digital asset markets.

Why Investors Are Turning Toward Cryptocurrency ETFs

Investors increasingly seek alternative ways into emerging asset classes like cryptocurrencies due to several compelling reasons:

- Simplified access via regulated platforms

- Reduced security risks compared with holding private keys

- Greater transparency through established custodians

- Portfolio diversification benefits

Cryptocurrency ETFs serve as an essential bridge between innovative blockchain technology and conventional finance systems—making them appealing options amid evolving investor preferences.

Regulatory Environment Surrounding Cryptocurrency ETFs

The approval process for cryptocurrency-based ETFs varies significantly across jurisdictions but generally involves rigorous review by securities regulators such as the U.S Securities and Exchange Commission (SEC). While some proposals have faced delays due primarilyto concerns over market manipulationand lackof sufficient oversight,the recent approvalof productslikeBlackrock'sIBITindicatesa gradual shifttowardacceptanceandregulatory clarityinthisspace.This trend suggeststhat future offeringsmay benefitfrom clearer guidelinesand increased confidenceamonginvestorsandissuers alike.

Final Thoughts: The Long-Term Potential

As mainstream financial institutions continue embracing cryptocurrencies through products like blackrock ibit spot bitcoin etf,the landscape is poisedfor further growthand innovation.Investors who adopt these vehicles gain opportunitiesfor diversificationwhile benefitingfromthe credibilityofferedby established firms.Blackrock's move signals thatcryptocurrenciesare becoming integral componentswithin diversified portfolios,and ongoing developments could reshape how individualsand institutions approach digital asset investments moving forward.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Are the Benefits of Using USDC?

USDC, or USD Coin, has become one of the most prominent stablecoins in the cryptocurrency ecosystem. Its primary appeal lies in its ability to combine blockchain technology's efficiency with the stability of traditional fiat currencies like the US dollar. For users ranging from individual investors to large financial institutions, understanding the benefits of USDC is crucial for making informed decisions about its role within digital finance.

Stability and Reliability in Digital Transactions

One of USDC’s core advantages is its stability. Unlike volatile cryptocurrencies such as Bitcoin or Ethereum, USDC maintains a 1:1 peg with the US dollar. This means that each token is backed by a corresponding dollar held in reserve, providing users with confidence that their holdings will not experience sudden fluctuations. This stability makes USDC an attractive medium for transactions where predictability and security are essential—such as remittances, payroll payments, or trading pairs on crypto exchanges.

The transparency surrounding USDC’s supply further enhances trustworthiness. The issuing entity regularly publishes attestations confirming that every issued coin is fully backed by reserves. Such transparency aligns with regulatory standards and reassures both retail and institutional users about its integrity.

Cost-Effective Cross-Border Payments

Traditional cross-border transactions often involve high fees and lengthy settlement times due to banking intermediaries and currency conversion processes. In contrast, using USDC on blockchain networks significantly reduces these costs while speeding up transaction times.

Blockchain technology enables near-instantaneous transfers across borders without relying on conventional banking infrastructure. For businesses engaged in international trade or remittance services, this can translate into substantial savings—lower transaction fees and faster settlement periods—making global commerce more efficient.

Accessibility for Retail Investors and Institutions

USDC’s design promotes inclusivity within financial markets by offering a stable digital asset accessible to both retail investors and large institutions alike. Its peg to the dollar provides a familiar reference point for those new to cryptocurrencies who might be wary of volatility risks associated with other tokens.

Major financial players such as Coinbase, Circle (the issuer), BlackRock, Fidelity Investments, and JPMorgan have integrated or expressed interest in stablecoins like USDC as part of their broader digital asset strategies. This institutional backing lends credibility while expanding usability across various platforms—from decentralized finance (DeFi) applications to payment processors—further increasing accessibility for everyday users seeking reliable crypto options.

Regulatory Compliance Ensures Long-Term Viability

Regulatory compliance remains a critical factor influencing cryptocurrency adoption worldwide—and this is where USDC stands out among stablecoins. Designed explicitly to meet legal standards set forth by regulators like U.S authorities—including anti-money laundering (AML) policies—it offers reassurance that it operates within established legal frameworks.

This compliance facilitates smoother integration into traditional financial systems while reducing risks associated with regulatory crackdowns or bans common among less regulated tokens. As governments worldwide develop clearer guidelines around stablecoins’ use cases—including issuance procedures—the long-term viability of assets like USDC becomes more assured for both issuers and users alike.

Multi-Chain Support Enhances Flexibility

Initially launched on Ethereum—a leading blockchain platform—USDC has expanded onto other blockchains such as Solana and Algorand through multi-chain support initiatives. This development allows users greater flexibility when choosing networks based on factors like transaction speed, cost-efficiency, or compatibility with specific applications.

Multi-chain support also improves scalability; as demand grows globally—with millions adopting stablecoins—the ability to operate seamlessly across different platforms ensures continued usability without bottlenecks caused by network congestion or high fees typical during peak periods on single chains.

Use Cases Driving Adoption Across Sectors

The versatility offered by USDC extends beyond simple transfers:

- Decentralized Finance (DeFi): Users leverage USDC for lending protocols — earning interest—or borrowing funds against collateral.

- Trading: Many exchanges list USD pairs involving USDC due to its stability.

- Remittances: Migrants send money home efficiently using stablecoin transfers.

- Business Payments: Companies utilize it for payrolls or vendor settlements without exposing themselves excessively to market volatility.

These diverse use cases contribute significantly toward mainstream acceptance—a trend reinforced by growing institutional interest aiming at integrating digital dollars into existing financial workflows securely under regulatory oversight.

Risks & Challenges Facing Stablecoin Adoption

While benefits are compelling—and many stakeholders see potential—the landscape isn’t without hurdles:

Some concerns revolve around regulatory uncertainty; governments are still developing comprehensive frameworks governing stablecoin issuance and usage globally—which could impact future operations if regulations tighten unexpectedly.Scalability issues may also arise if network congestion increases dramatically during surges in demand—potentially raising transaction costs temporarily.Market risks linked indirectly through systemic events could influence even pegged assets if broader cryptocurrency markets experience downturns affecting liquidity levels.

Final Thoughts: Why Choosing Stablecoins Like USDC Matters

For anyone involved in digital finance today—from individual traders seeking safer assets during volatile periods—to enterprises looking at efficient cross-border solutions—USDC offers tangible advantages rooted in transparency, stability,and compliance standards aligned with evolving regulations worldwide.

As technological advancements continue—with multi-chain integrations—and adoption expands across sectors including DeFi platforms,big tech firms,and traditional banks—the role of stablecoins like USD Coin will likely grow stronger over time.As always,the key lies in staying informed about ongoing developments,potential risks,and how best these tools can serve your specific needs within an increasingly interconnected global economy.

JCUSER-WVMdslBw

2025-05-29 08:55

What are the benefits of using USDC?

What Are the Benefits of Using USDC?

USDC, or USD Coin, has become one of the most prominent stablecoins in the cryptocurrency ecosystem. Its primary appeal lies in its ability to combine blockchain technology's efficiency with the stability of traditional fiat currencies like the US dollar. For users ranging from individual investors to large financial institutions, understanding the benefits of USDC is crucial for making informed decisions about its role within digital finance.

Stability and Reliability in Digital Transactions

One of USDC’s core advantages is its stability. Unlike volatile cryptocurrencies such as Bitcoin or Ethereum, USDC maintains a 1:1 peg with the US dollar. This means that each token is backed by a corresponding dollar held in reserve, providing users with confidence that their holdings will not experience sudden fluctuations. This stability makes USDC an attractive medium for transactions where predictability and security are essential—such as remittances, payroll payments, or trading pairs on crypto exchanges.

The transparency surrounding USDC’s supply further enhances trustworthiness. The issuing entity regularly publishes attestations confirming that every issued coin is fully backed by reserves. Such transparency aligns with regulatory standards and reassures both retail and institutional users about its integrity.

Cost-Effective Cross-Border Payments

Traditional cross-border transactions often involve high fees and lengthy settlement times due to banking intermediaries and currency conversion processes. In contrast, using USDC on blockchain networks significantly reduces these costs while speeding up transaction times.

Blockchain technology enables near-instantaneous transfers across borders without relying on conventional banking infrastructure. For businesses engaged in international trade or remittance services, this can translate into substantial savings—lower transaction fees and faster settlement periods—making global commerce more efficient.

Accessibility for Retail Investors and Institutions

USDC’s design promotes inclusivity within financial markets by offering a stable digital asset accessible to both retail investors and large institutions alike. Its peg to the dollar provides a familiar reference point for those new to cryptocurrencies who might be wary of volatility risks associated with other tokens.

Major financial players such as Coinbase, Circle (the issuer), BlackRock, Fidelity Investments, and JPMorgan have integrated or expressed interest in stablecoins like USDC as part of their broader digital asset strategies. This institutional backing lends credibility while expanding usability across various platforms—from decentralized finance (DeFi) applications to payment processors—further increasing accessibility for everyday users seeking reliable crypto options.

Regulatory Compliance Ensures Long-Term Viability

Regulatory compliance remains a critical factor influencing cryptocurrency adoption worldwide—and this is where USDC stands out among stablecoins. Designed explicitly to meet legal standards set forth by regulators like U.S authorities—including anti-money laundering (AML) policies—it offers reassurance that it operates within established legal frameworks.

This compliance facilitates smoother integration into traditional financial systems while reducing risks associated with regulatory crackdowns or bans common among less regulated tokens. As governments worldwide develop clearer guidelines around stablecoins’ use cases—including issuance procedures—the long-term viability of assets like USDC becomes more assured for both issuers and users alike.

Multi-Chain Support Enhances Flexibility

Initially launched on Ethereum—a leading blockchain platform—USDC has expanded onto other blockchains such as Solana and Algorand through multi-chain support initiatives. This development allows users greater flexibility when choosing networks based on factors like transaction speed, cost-efficiency, or compatibility with specific applications.

Multi-chain support also improves scalability; as demand grows globally—with millions adopting stablecoins—the ability to operate seamlessly across different platforms ensures continued usability without bottlenecks caused by network congestion or high fees typical during peak periods on single chains.

Use Cases Driving Adoption Across Sectors

The versatility offered by USDC extends beyond simple transfers:

- Decentralized Finance (DeFi): Users leverage USDC for lending protocols — earning interest—or borrowing funds against collateral.

- Trading: Many exchanges list USD pairs involving USDC due to its stability.

- Remittances: Migrants send money home efficiently using stablecoin transfers.

- Business Payments: Companies utilize it for payrolls or vendor settlements without exposing themselves excessively to market volatility.

These diverse use cases contribute significantly toward mainstream acceptance—a trend reinforced by growing institutional interest aiming at integrating digital dollars into existing financial workflows securely under regulatory oversight.

Risks & Challenges Facing Stablecoin Adoption

While benefits are compelling—and many stakeholders see potential—the landscape isn’t without hurdles:

Some concerns revolve around regulatory uncertainty; governments are still developing comprehensive frameworks governing stablecoin issuance and usage globally—which could impact future operations if regulations tighten unexpectedly.Scalability issues may also arise if network congestion increases dramatically during surges in demand—potentially raising transaction costs temporarily.Market risks linked indirectly through systemic events could influence even pegged assets if broader cryptocurrency markets experience downturns affecting liquidity levels.

Final Thoughts: Why Choosing Stablecoins Like USDC Matters

For anyone involved in digital finance today—from individual traders seeking safer assets during volatile periods—to enterprises looking at efficient cross-border solutions—USDC offers tangible advantages rooted in transparency, stability,and compliance standards aligned with evolving regulations worldwide.

As technological advancements continue—with multi-chain integrations—and adoption expands across sectors including DeFi platforms,big tech firms,and traditional banks—the role of stablecoins like USD Coin will likely grow stronger over time.As always,the key lies in staying informed about ongoing developments,potential risks,and how best these tools can serve your specific needs within an increasingly interconnected global economy.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Are the Advantages of Using a Market Order?

When engaging in financial trading, understanding different order types is essential for executing strategies effectively. Among these, the market order stands out as one of the most straightforward and widely used tools. Its simplicity and immediacy make it particularly appealing to traders who prioritize quick execution over price precision. This article explores the key advantages of using a market order, providing insights into why traders across various markets—stocks, cryptocurrencies, commodities—prefer this type of instruction.

Immediate Execution Ensures Quick Entry and Exit

One of the primary benefits of a market order is its ability to execute immediately upon placement. When a trader submits a market order, it is sent directly to the exchange or broker for instant processing. This feature is especially valuable in fast-moving markets where prices can fluctuate rapidly within seconds. For traders aiming to capitalize on short-term movements or needing to exit positions swiftly to limit losses, immediate execution can be critical.

In volatile environments like cryptocurrency markets or during significant news events affecting stock prices, delays in execution could mean missing out on optimal entry or exit points. Market orders eliminate this concern by prioritizing speed over price specificity.

Flexibility Across Asset Classes

Market orders are versatile and applicable across various asset classes including stocks, bonds, commodities, ETFs (Exchange-Traded Funds), and cryptocurrencies. Whether an investor wants to buy shares in a company during an IPO or sell Bitcoin quickly during sudden price swings—market orders facilitate these transactions seamlessly.

This flexibility simplifies trading strategies because traders do not need to specify complex parameters such as limit prices unless they wish to do so later with other types of orders like limit or stop-loss orders. The ease of use makes market orders suitable for both novice investors learning about trading mechanics and experienced professionals executing rapid trades.

Simplicity Makes Trading More Accessible

Placing a market order requires minimal input: typically just specifying what security you want to buy or sell and how much you want involved. Unlike more complex instructions that involve setting specific target prices (limit orders) or conditional triggers (stop-loss), market orders are straightforward commands that anyone can understand easily.

This simplicity reduces potential errors during trade placement—a crucial factor for beginners who may find detailed instructions intimidating at first glance—and speeds up decision-making processes when quick action is needed.

Risk Management Through Speed

While some might assume that placing an immediate buy or sell exposes traders solely to risks related to unfavorable prices due to volatility; many see it as part of effective risk management when used appropriately. By executing trades instantly at current market conditions, traders avoid situations where their intended transaction gets delayed due to network issues or hesitation that could lead them into worse pricing scenarios later on.

Furthermore, combining market orders with other risk mitigation tools such as stop-losses allows traders not only for swift entry/exit but also controlled risk exposure based on predefined thresholds rather than waiting indefinitely for ideal conditions which may never materialize amid turbulent markets.

Cost Efficiency Compared To Limit Orders

In some cases—particularly in highly liquid markets—market orders can be more cost-effective than limit orders because they guarantee execution without additional fees associated with setting specific price points that might not be reached promptly—or at all—in volatile conditions.

Since limit orders require patience until your specified price level is hit—which might never happen if the asset's price moves away quickly—a market order ensures your trade goes through immediately without waiting for favorable pricing conditions that may no longer exist by then.

However, it's important for traders aware of potential slippage—the difference between expected transaction prices and actual executed prices—to weigh whether immediate execution outweighs possible costs from less favorable fill rates during periods of high volatility.

Contexts Where Market Orders Are Particularly Useful

Market orders are especially advantageous under certain circumstances:

- High Volatility Markets: During rapid price changes—as seen frequently in cryptocurrency exchanges—they allow quick entry/exit before significant shifts occur.

- Time-Sensitive Trades: When timing matters most—for example: reacting swiftly after earnings reports—they enable prompt action.

- Liquidity-Rich Environments: In highly traded assets like major stocks listed on prominent exchanges where bid-ask spreads are narrow.

Despite their advantages, users should remain cautious about potential drawbacks such as slippage—the difference between expected purchase/sale price versus actual executed rate—which becomes more pronounced during low liquidity periods.

Recent Trends Enhancing Market Order Utility

Advancements in technology have significantly improved how efficiently investors utilize market orders today:

- Automated Trading Algorithms: High-frequency trading systems execute thousands of transactions per second using algorithms optimized around immediate executions.

- Enhanced Trading Platforms: Modern online brokers provide intuitive interfaces allowing even novice users instant access with minimal delay.

- Regulatory Oversight: Authorities have implemented guidelines aimed at protecting investors from manipulative practices involving rapid-fire trades driven by high-frequency algorithms utilizing large volumes of market-orders.

These developments ensure that while risks remain—especially concerning flash crashes caused by algorithmic trading—the overall utility and safety profile surrounding well-managed use cases continue improving.

Key Considerations When Using Market Orders

While offering many benefits—including speed and simplicity—it’s vital for traders employing market orders also consider certain factors:

- Slippage Risks: During volatile periods or low liquidity times (e.g., after-hours trading), actual fill prices may differ significantly from current quotes.

- Overtrading Potential: The ease with which one can place multiple rapid-fire trades might lead inexperienced investors toward impulsive decisions lacking strategic planning.

- Market Manipulation Concerns: In less regulated environments like some cryptocurrency exchanges—or through tactics such as quote stuffing—high volumes of aggressive-market-orders could distort true supply/demand signals if unchecked.

Final Thoughts on Using Market Orders Effectively

Market orders serve as powerful tools within any trader’s arsenal due primarily to their ability to deliver swift transaction executions across diverse financial instruments worldwide. Their inherent simplicity makes them accessible even for newcomers while providing seasoned professionals with rapid response capabilities essential amid dynamic markets characterized by high volatility—and increasingly sophisticated technological infrastructure supporting these operations globally.

To maximize benefits while mitigating risks associated with slippage and overtrading requires understanding when best suited—for instance: urgent entries/exits versus strategic positioning requiring precise control over purchase/sale levels—and integrating them thoughtfully within broader risk management frameworks such as stop-losses combined with other advanced order types.

By grasping both their strengths and limitations comprehensively—from immediate execution advantages through technological trends shaping modern trading environments—you position yourself better equipped either as an active trader seeking efficiency or an investor aiming informed decision-making aligned with evolving global markets' realities

JCUSER-WVMdslBw

2025-05-29 02:01

What are the advantages of using a market order?

What Are the Advantages of Using a Market Order?

When engaging in financial trading, understanding different order types is essential for executing strategies effectively. Among these, the market order stands out as one of the most straightforward and widely used tools. Its simplicity and immediacy make it particularly appealing to traders who prioritize quick execution over price precision. This article explores the key advantages of using a market order, providing insights into why traders across various markets—stocks, cryptocurrencies, commodities—prefer this type of instruction.

Immediate Execution Ensures Quick Entry and Exit

One of the primary benefits of a market order is its ability to execute immediately upon placement. When a trader submits a market order, it is sent directly to the exchange or broker for instant processing. This feature is especially valuable in fast-moving markets where prices can fluctuate rapidly within seconds. For traders aiming to capitalize on short-term movements or needing to exit positions swiftly to limit losses, immediate execution can be critical.

In volatile environments like cryptocurrency markets or during significant news events affecting stock prices, delays in execution could mean missing out on optimal entry or exit points. Market orders eliminate this concern by prioritizing speed over price specificity.

Flexibility Across Asset Classes

Market orders are versatile and applicable across various asset classes including stocks, bonds, commodities, ETFs (Exchange-Traded Funds), and cryptocurrencies. Whether an investor wants to buy shares in a company during an IPO or sell Bitcoin quickly during sudden price swings—market orders facilitate these transactions seamlessly.

This flexibility simplifies trading strategies because traders do not need to specify complex parameters such as limit prices unless they wish to do so later with other types of orders like limit or stop-loss orders. The ease of use makes market orders suitable for both novice investors learning about trading mechanics and experienced professionals executing rapid trades.

Simplicity Makes Trading More Accessible

Placing a market order requires minimal input: typically just specifying what security you want to buy or sell and how much you want involved. Unlike more complex instructions that involve setting specific target prices (limit orders) or conditional triggers (stop-loss), market orders are straightforward commands that anyone can understand easily.

This simplicity reduces potential errors during trade placement—a crucial factor for beginners who may find detailed instructions intimidating at first glance—and speeds up decision-making processes when quick action is needed.

Risk Management Through Speed

While some might assume that placing an immediate buy or sell exposes traders solely to risks related to unfavorable prices due to volatility; many see it as part of effective risk management when used appropriately. By executing trades instantly at current market conditions, traders avoid situations where their intended transaction gets delayed due to network issues or hesitation that could lead them into worse pricing scenarios later on.

Furthermore, combining market orders with other risk mitigation tools such as stop-losses allows traders not only for swift entry/exit but also controlled risk exposure based on predefined thresholds rather than waiting indefinitely for ideal conditions which may never materialize amid turbulent markets.

Cost Efficiency Compared To Limit Orders

In some cases—particularly in highly liquid markets—market orders can be more cost-effective than limit orders because they guarantee execution without additional fees associated with setting specific price points that might not be reached promptly—or at all—in volatile conditions.

Since limit orders require patience until your specified price level is hit—which might never happen if the asset's price moves away quickly—a market order ensures your trade goes through immediately without waiting for favorable pricing conditions that may no longer exist by then.

However, it's important for traders aware of potential slippage—the difference between expected transaction prices and actual executed prices—to weigh whether immediate execution outweighs possible costs from less favorable fill rates during periods of high volatility.

Contexts Where Market Orders Are Particularly Useful

Market orders are especially advantageous under certain circumstances:

- High Volatility Markets: During rapid price changes—as seen frequently in cryptocurrency exchanges—they allow quick entry/exit before significant shifts occur.

- Time-Sensitive Trades: When timing matters most—for example: reacting swiftly after earnings reports—they enable prompt action.

- Liquidity-Rich Environments: In highly traded assets like major stocks listed on prominent exchanges where bid-ask spreads are narrow.

Despite their advantages, users should remain cautious about potential drawbacks such as slippage—the difference between expected purchase/sale price versus actual executed rate—which becomes more pronounced during low liquidity periods.

Recent Trends Enhancing Market Order Utility

Advancements in technology have significantly improved how efficiently investors utilize market orders today:

- Automated Trading Algorithms: High-frequency trading systems execute thousands of transactions per second using algorithms optimized around immediate executions.

- Enhanced Trading Platforms: Modern online brokers provide intuitive interfaces allowing even novice users instant access with minimal delay.

- Regulatory Oversight: Authorities have implemented guidelines aimed at protecting investors from manipulative practices involving rapid-fire trades driven by high-frequency algorithms utilizing large volumes of market-orders.

These developments ensure that while risks remain—especially concerning flash crashes caused by algorithmic trading—the overall utility and safety profile surrounding well-managed use cases continue improving.

Key Considerations When Using Market Orders

While offering many benefits—including speed and simplicity—it’s vital for traders employing market orders also consider certain factors:

- Slippage Risks: During volatile periods or low liquidity times (e.g., after-hours trading), actual fill prices may differ significantly from current quotes.

- Overtrading Potential: The ease with which one can place multiple rapid-fire trades might lead inexperienced investors toward impulsive decisions lacking strategic planning.

- Market Manipulation Concerns: In less regulated environments like some cryptocurrency exchanges—or through tactics such as quote stuffing—high volumes of aggressive-market-orders could distort true supply/demand signals if unchecked.

Final Thoughts on Using Market Orders Effectively

Market orders serve as powerful tools within any trader’s arsenal due primarily to their ability to deliver swift transaction executions across diverse financial instruments worldwide. Their inherent simplicity makes them accessible even for newcomers while providing seasoned professionals with rapid response capabilities essential amid dynamic markets characterized by high volatility—and increasingly sophisticated technological infrastructure supporting these operations globally.

To maximize benefits while mitigating risks associated with slippage and overtrading requires understanding when best suited—for instance: urgent entries/exits versus strategic positioning requiring precise control over purchase/sale levels—and integrating them thoughtfully within broader risk management frameworks such as stop-losses combined with other advanced order types.

By grasping both their strengths and limitations comprehensively—from immediate execution advantages through technological trends shaping modern trading environments—you position yourself better equipped either as an active trader seeking efficiency or an investor aiming informed decision-making aligned with evolving global markets' realities

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Who Created Bitcoin (BTC)?

Understanding the origins of Bitcoin is essential for grasping its significance in the digital currency landscape. Bitcoin was created by an individual or a group operating under the pseudonym Satoshi Nakamoto. Despite extensive speculation and numerous claims, Nakamoto’s true identity remains unknown, adding an element of mystery that has fueled both intrigue and debate within the cryptocurrency community. This anonymity has contributed to Bitcoin’s decentralized ethos, emphasizing that no single entity controls it.

The creation of Bitcoin marked a revolutionary shift in how we perceive money and financial transactions. Unlike traditional currencies issued by governments or central banks, Bitcoin operates on a peer-to-peer network without intermediaries such as banks or payment processors. This decentralization aims to provide users with greater control over their assets while reducing reliance on centralized authorities.

The story begins with Nakamoto publishing the whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System" on October 31, 2008. This document laid out the technical blueprint for a new kind of digital currency that could facilitate secure, transparent transactions without third-party oversight. The whitepaper detailed innovative concepts like blockchain technology—a distributed ledger system—and proof-of-work consensus mechanisms that underpin Bitcoin's security.

When Was Bitcoin Launched?

Bitcoin officially came into existence on January 3, 2009, with the mining of its first block known as the Genesis Block. Embedded within this initial block was a message referencing contemporary economic concerns: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks." This message not only timestamped its creation but also subtly critiqued traditional banking systems and monetary policies—highlighting one of Bitcoin’s core motivations: providing an alternative to fiat currencies susceptible to inflation and government control.

What Is Blockchain Technology?

At its core, Bitcoin relies heavily on blockchain technology—a decentralized ledger maintained collectively by thousands of computers worldwide called nodes. Each transaction is verified through cryptographic processes and added as a block linked sequentially to previous blocks—forming an immutable chain accessible publicly for transparency purposes.

This open-source nature ensures no single authority can alter transaction history unilaterally, fostering trust among participants despite lacking central oversight. Blockchain's resilience against tampering makes it highly secure but also requires significant computational power—especially during mining—to validate new transactions efficiently.

How Does Mining Work?

Mining is fundamental to how new Bitcoins are created and how transaction integrity is maintained within the network. Miners use powerful hardware to solve complex mathematical puzzles—a process known as proof-of-work—which validates transactions before they are recorded onto the blockchain.

Successful miners are rewarded with newly minted Bitcoins; this process introduces new coins into circulation while incentivizing miners’ participation in maintaining network security. Initially set at 50 BTC per block when launched in 2009, this reward halves approximately every four years during scheduled “halving” events—reducing supply inflation over time.

Recent Developments in Bitcoin

Halving Events

Bitcoin's protocol includes programmed halving events designed to control supply growth systematically:

- The third halving occurred on May 11, 2020 — reducing rewards from 12.5 BTC to 6.25 BTC per block.

- The upcoming fourth halving is expected around mid-2024 — further decreasing rewards to approximately 3.125 BTC per block.

These halvings tend to influence market dynamics significantly by constraining supply growth amid increasing demand.

Regulatory Environment

Globally, regulatory attitudes toward cryptocurrencies vary widely:

- El Salvador made headlines as it became the first country officially adopting Bitcoin as legal tender in September 2021.

- In contrast, countries like China have imposed strict bans on crypto trading and mining activities.

In jurisdictions like the United States, agencies such as SEC actively regulate aspects related to cryptocurrencies—including enforcement actions against entities involved in securities violations related to tokens like XRP issued by Ripple Labs.

Market Volatility & Institutional Adoption

Bitcoin remains highly volatile; prices can swing dramatically due primarily to regulatory news or macroeconomic factors affecting investor sentiment globally—for example:

- Price surges driven by institutional interest from firms like Fidelity or PayPal offering integrated services.

- Sharp declines during market corrections or adverse regulatory developments (e.g., dropping below $30K during late-2022).

Technological Innovations

Advancements continue at pace:

- Layer two solutions such as Lightning Network aim at scaling capabilities—enabling faster transactions with lower fees suitable for everyday use.

- Efforts toward integrating smart contract functionalities into existing protocols are ongoing through proposals like RSK (Rootstock), which seeks compatibility with Ethereum-based smart contracts while leveraging Bitcoin’s security model.

Potential Risks Facing Cryptocurrency

While innovation propels adoption forward, several risks threaten long-term stability:

Regulatory Risks: Uncertain legal frameworks could lead governments worldwide either embracing or restricting usage altogether—impacting investor confidence significantly.

Security Concerns: Despite robust cryptography securing most operations today—including high-profile hacks such as Mt Gox—the threat persists from potential attacks like “51% attacks,” where malicious actors gain majority control over mining power enabling double-spending frauds if unchecked.

Environmental Impact: The energy-intensive nature of proof-of-work mining has sparked debates about sustainability; some advocate transitioning toward greener alternatives without compromising decentralization principles fully yet remain cautious about environmental costs associated with current practices.

Market Volatility & Future Outlook

Price fluctuations remain characteristic features influencing both retail investors and institutional players alike—from rapid bull runs followed by sharp corrections—as seen during recent years including dips below $30K amid broader economic uncertainties in late 2022.

Despite these challenges—and ongoing discussions about regulation—the overall trajectory indicates growing acceptance across sectors worldwide coupled with technological innovations aimed at scalability and sustainability.

Understanding these elements provides crucial insights into what shapes bitcoin’s past evolution—and what might influence its future path amidst evolving global financial landscapes.

By examining who created bitcoin along with key milestones since inception—including technological advances and regulatory shifts—we gain comprehensive perspective essential for anyone interested in cryptocurrency markets today.

Lo

2025-05-22 14:31

Who created Bitcoin (BTC)?

Who Created Bitcoin (BTC)?

Understanding the origins of Bitcoin is essential for grasping its significance in the digital currency landscape. Bitcoin was created by an individual or a group operating under the pseudonym Satoshi Nakamoto. Despite extensive speculation and numerous claims, Nakamoto’s true identity remains unknown, adding an element of mystery that has fueled both intrigue and debate within the cryptocurrency community. This anonymity has contributed to Bitcoin’s decentralized ethos, emphasizing that no single entity controls it.

The creation of Bitcoin marked a revolutionary shift in how we perceive money and financial transactions. Unlike traditional currencies issued by governments or central banks, Bitcoin operates on a peer-to-peer network without intermediaries such as banks or payment processors. This decentralization aims to provide users with greater control over their assets while reducing reliance on centralized authorities.

The story begins with Nakamoto publishing the whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System" on October 31, 2008. This document laid out the technical blueprint for a new kind of digital currency that could facilitate secure, transparent transactions without third-party oversight. The whitepaper detailed innovative concepts like blockchain technology—a distributed ledger system—and proof-of-work consensus mechanisms that underpin Bitcoin's security.

When Was Bitcoin Launched?

Bitcoin officially came into existence on January 3, 2009, with the mining of its first block known as the Genesis Block. Embedded within this initial block was a message referencing contemporary economic concerns: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks." This message not only timestamped its creation but also subtly critiqued traditional banking systems and monetary policies—highlighting one of Bitcoin’s core motivations: providing an alternative to fiat currencies susceptible to inflation and government control.

What Is Blockchain Technology?

At its core, Bitcoin relies heavily on blockchain technology—a decentralized ledger maintained collectively by thousands of computers worldwide called nodes. Each transaction is verified through cryptographic processes and added as a block linked sequentially to previous blocks—forming an immutable chain accessible publicly for transparency purposes.

This open-source nature ensures no single authority can alter transaction history unilaterally, fostering trust among participants despite lacking central oversight. Blockchain's resilience against tampering makes it highly secure but also requires significant computational power—especially during mining—to validate new transactions efficiently.

How Does Mining Work?

Mining is fundamental to how new Bitcoins are created and how transaction integrity is maintained within the network. Miners use powerful hardware to solve complex mathematical puzzles—a process known as proof-of-work—which validates transactions before they are recorded onto the blockchain.

Successful miners are rewarded with newly minted Bitcoins; this process introduces new coins into circulation while incentivizing miners’ participation in maintaining network security. Initially set at 50 BTC per block when launched in 2009, this reward halves approximately every four years during scheduled “halving” events—reducing supply inflation over time.

Recent Developments in Bitcoin

Halving Events

Bitcoin's protocol includes programmed halving events designed to control supply growth systematically:

- The third halving occurred on May 11, 2020 — reducing rewards from 12.5 BTC to 6.25 BTC per block.

- The upcoming fourth halving is expected around mid-2024 — further decreasing rewards to approximately 3.125 BTC per block.

These halvings tend to influence market dynamics significantly by constraining supply growth amid increasing demand.

Regulatory Environment

Globally, regulatory attitudes toward cryptocurrencies vary widely:

- El Salvador made headlines as it became the first country officially adopting Bitcoin as legal tender in September 2021.

- In contrast, countries like China have imposed strict bans on crypto trading and mining activities.

In jurisdictions like the United States, agencies such as SEC actively regulate aspects related to cryptocurrencies—including enforcement actions against entities involved in securities violations related to tokens like XRP issued by Ripple Labs.

Market Volatility & Institutional Adoption

Bitcoin remains highly volatile; prices can swing dramatically due primarily to regulatory news or macroeconomic factors affecting investor sentiment globally—for example:

- Price surges driven by institutional interest from firms like Fidelity or PayPal offering integrated services.

- Sharp declines during market corrections or adverse regulatory developments (e.g., dropping below $30K during late-2022).

Technological Innovations

Advancements continue at pace:

- Layer two solutions such as Lightning Network aim at scaling capabilities—enabling faster transactions with lower fees suitable for everyday use.

- Efforts toward integrating smart contract functionalities into existing protocols are ongoing through proposals like RSK (Rootstock), which seeks compatibility with Ethereum-based smart contracts while leveraging Bitcoin’s security model.

Potential Risks Facing Cryptocurrency

While innovation propels adoption forward, several risks threaten long-term stability:

Regulatory Risks: Uncertain legal frameworks could lead governments worldwide either embracing or restricting usage altogether—impacting investor confidence significantly.

Security Concerns: Despite robust cryptography securing most operations today—including high-profile hacks such as Mt Gox—the threat persists from potential attacks like “51% attacks,” where malicious actors gain majority control over mining power enabling double-spending frauds if unchecked.

Environmental Impact: The energy-intensive nature of proof-of-work mining has sparked debates about sustainability; some advocate transitioning toward greener alternatives without compromising decentralization principles fully yet remain cautious about environmental costs associated with current practices.

Market Volatility & Future Outlook

Price fluctuations remain characteristic features influencing both retail investors and institutional players alike—from rapid bull runs followed by sharp corrections—as seen during recent years including dips below $30K amid broader economic uncertainties in late 2022.

Despite these challenges—and ongoing discussions about regulation—the overall trajectory indicates growing acceptance across sectors worldwide coupled with technological innovations aimed at scalability and sustainability.

Understanding these elements provides crucial insights into what shapes bitcoin’s past evolution—and what might influence its future path amidst evolving global financial landscapes.

By examining who created bitcoin along with key milestones since inception—including technological advances and regulatory shifts—we gain comprehensive perspective essential for anyone interested in cryptocurrency markets today.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Trading Time: August 5, 2025, 15:00 (UTC)

🪧More:https://bit.ly/40PNbO4

JuCoin Community

2025-08-05 09:12

JuCoin to List TOWNS/USDT Trading Pair on August 5

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

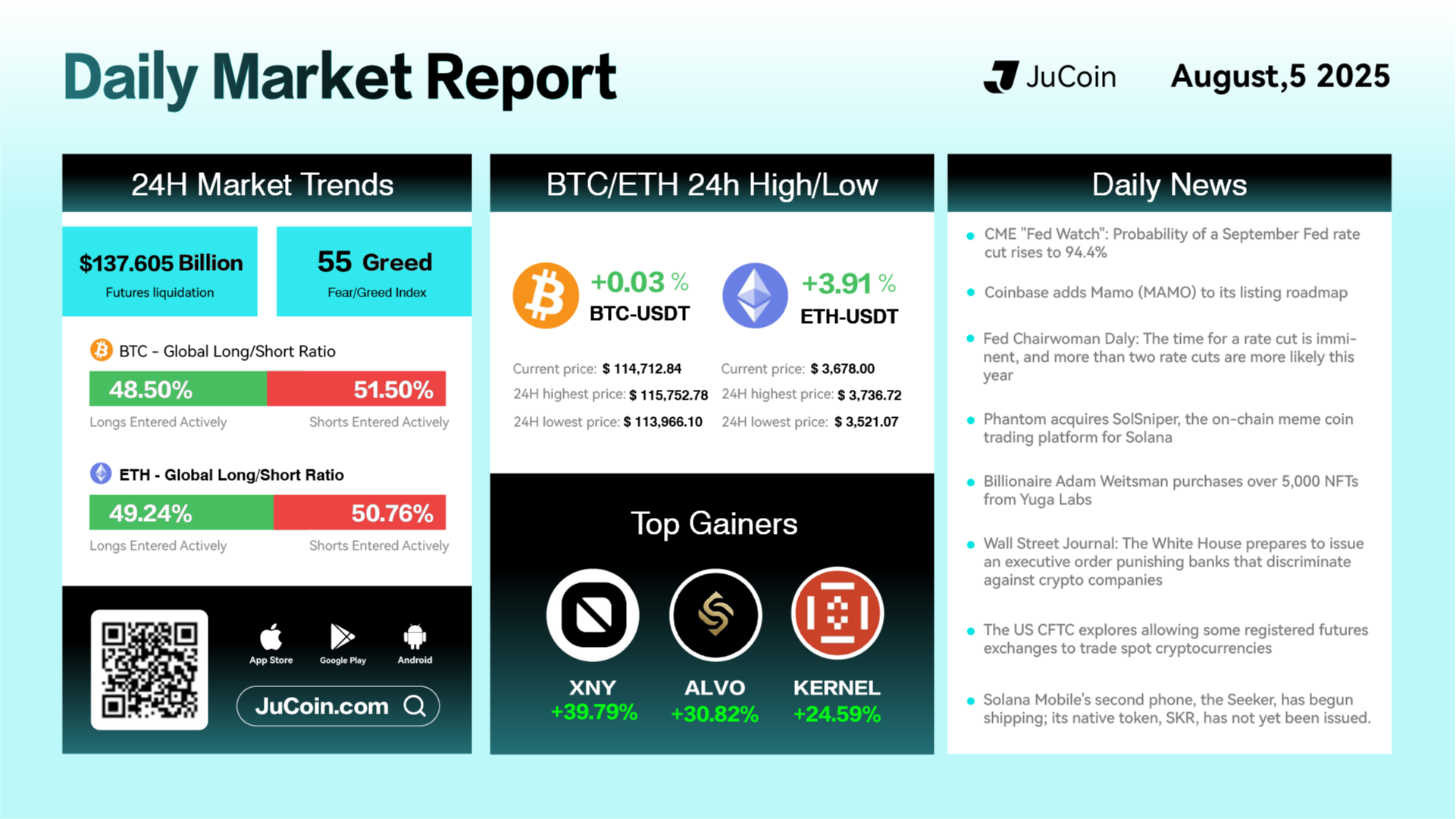

📅 August 5 2025

🎉 Stay updated with the latest crypto market trends!

👉 Trade on:https://bit.ly/3DFYq30

👉 X:https://twitter.com/Jucoinex

👉 APP download: https://www.jucoin.com/en/community-downloads

JuCoin Community

2025-08-05 04:32

🚀 #JuCoin Daily Market Report

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🔹Deposit/Withdrawal Time: August 10, 2025, 01:50 (UTC)

🔹Trading Time: August 11, 2025, 01:50 (UTC)

🪧More:https://bit.ly/3UeEBF0

JuCoin Community

2025-08-05 02:44

JuCoin to List D3XAI/USDT Trading Pair on August 11, 2025

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

👌JuCoin will list the CMEW/USDT trading pair on August 7, 2025

🔹 Deposit: August 6, 2025 at 04:00 (UTC)

🔹 Trading: August 7, 2025 at 09:00 (UTC)

🔹 Withdrawal: August 8, 2025 at 09:00 (UTC)

🪧More:https://bit.ly/458FkfG

JuCoin Community

2025-08-04 07:45

📢 New Listing|CMEW (CelestialMew) 🔥

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The DeFi sector is experiencing a remarkable resurgence in 2025, transforming from speculative arena to robust financial infrastructure. Here's what's driving this explosive growth:

💰 Key Growth Drivers:

-

Layer 2 solutions (Optimism, Arbitrum, zk-Rollups) slashing costs & boosting speeds by 20%

$153 billion TVL reached in July 2025 - a three-year high!

Major institutional investment with $1.69B+ Ethereum holdings from leading firms

Enhanced regulatory clarity through EU's MiCA framework

🎯 What's Powering the Momentum:

1️⃣ Cross-Chain Revolution: Seamless asset transfers across Ethereum, Solana, Avalanche ecosystems 2️⃣ Yield Farming Evolution: Advanced protocols offering up to 25% returns on stablecoin strategies 3️⃣ Solana DEX Dominance: 81% of all DEX transactions, $890B trading volume in 5 months 4️⃣ Real-World Asset Tokenization: Converting real estate, commodities into tradeable blockchain tokens

🏆 Innovation Highlights:

-

Jupiter Perps averaging $1B daily perpetual trading volume

AI-powered security with real-time risk alerts and scam detection

Decentralized stablecoins driving cross-chain liquidity

Enhanced composability creating "money legos" for complex financial products

💡 Market Impact:

-

Ethereum maintains 60% DeFi TVL dominance with Lido & Aave leading

Solana surpassing Ethereum in transaction volumes and daily active users

Liquid restaking protocols attracting massive institutional inflows

Multi-signature wallets & advanced auditing boosting security confidence

🔮 Future Outlook: The shift from speculation to utility-focused infrastructure signals DeFi's maturation. With improved security, regulatory clarity, and institutional adoption, the sector is positioned for mainstream financial integration.

Read the complete analysis with detailed insights and market projections: 👇

https://blog.jucoin.com/explore-the-catalysts-behind-defis-recent-surge/?utm_source=blog

#DeFi #Layer2 #Ethereum #Solana #YieldFarming #Crypto #Blockchain #TVL #Institutions #RWA #CrossChain #JuCoin #Web3 #TradFi #Stablecoins #DEX #AI #Security

JU Blog

2025-08-01 08:54

🚀 DeFi Hits $153B TVL - Exploring the Key Catalysts Behind 2025's Massive Surge!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

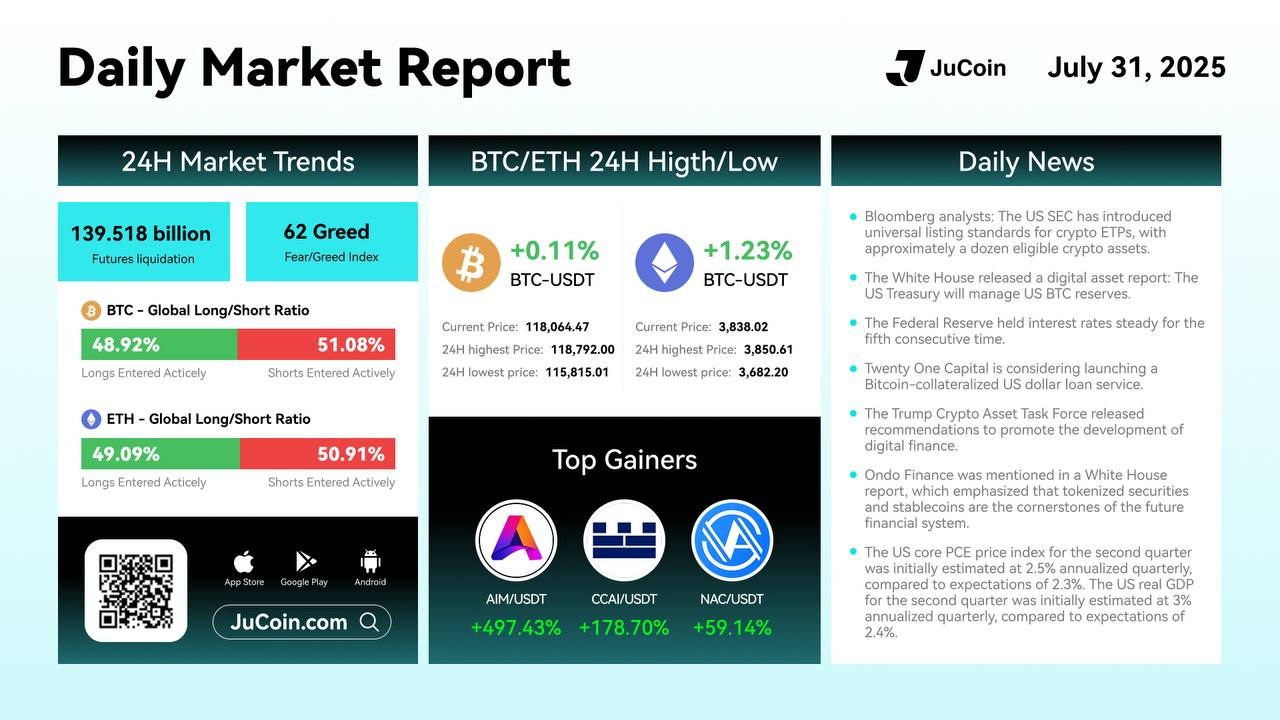

📅 July 31 2025

🎉 Stay updated with the latest crypto market trends!

👉 Trade on:https://bit.ly/3DFYq30

👉 X:https://twitter.com/Jucoinex

👉 APP download: https://www.jucoin.com/en/community-downloads

JuCoin Community

2025-07-31 06:30

🚀 #JuCoin Daily Market Report

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

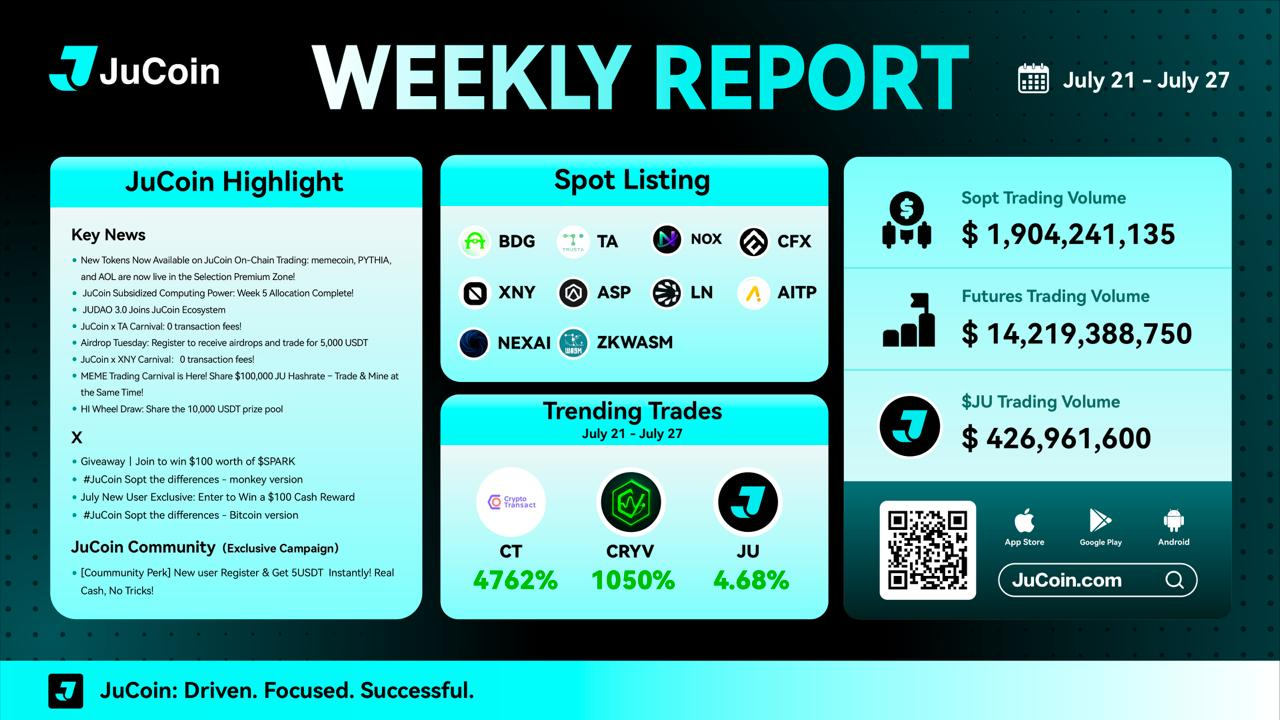

💚10 new spot listings added