Popular Posts

Benefits of Using Chainlink (LINK)

Understanding the advantages of Chainlink (LINK) is essential for anyone interested in blockchain technology, decentralized finance (DeFi), or smart contract development. As a leading decentralized oracle network, Chainlink plays a pivotal role in bridging real-world data with blockchain applications. This article explores the key benefits that make Chainlink an indispensable component in the evolving blockchain ecosystem.

Decentralization and Security Enhances Trust

One of the primary advantages of using Chainlink is its decentralized architecture, which significantly boosts security and trustworthiness. Unlike centralized data providers that can be vulnerable to manipulation or censorship, Chainlink employs multiple independent nodes to fetch and verify data feeds. These nodes operate under a consensus mechanism that ensures data accuracy before it reaches smart contracts.

This decentralization minimizes single points of failure and reduces risks associated with malicious attacks or data tampering. For users and developers, this means more reliable execution of smart contracts based on real-world information—be it weather conditions, financial market prices, or sensor readings—without relying on a single trusted entity.

Facilitates Integration with Multiple Blockchain Platforms

Chainlink’s interoperability stands out as another major benefit. It supports integration across various blockchain networks such as Ethereum, Binance Smart Chain, Polkadot, and others. This multi-platform compatibility allows developers to incorporate external data into different ecosystems seamlessly.

For businesses operating in diverse blockchain environments or planning cross-chain applications, this flexibility simplifies development processes and broadens potential use cases. It also encourages collaboration among different projects by providing standardized access to off-chain data sources through a unified oracle network.

Access to Real-World Data for Complex Smart Contracts

Smart contracts are inherently limited by their inability to access external information directly; they require an intermediary like an oracle service for real-world inputs. Chainlink addresses this challenge effectively by providing secure APIs and off-chain computation capabilities.

This enables smart contracts to perform complex functions dependent on external events—such as executing insurance claims based on weather reports or adjusting supply chain logistics according to sensor inputs—thus expanding their practical utility beyond simple transactions.

Scalability Through Off-Chain Data Processing

Blockchain networks face scalability challenges due to high transaction costs and limited throughput capacity when processing large volumes of off-chain information directly on-chain. Chainlink mitigates this issue by handling much of the heavy lifting off-chain via its node operators before delivering verified results onto the blockchain.

This approach reduces congestion within mainnet blockchains while maintaining high levels of security through cryptographic proofs and consensus mechanisms among nodes. Consequently, developers can build scalable applications without compromising performance or security standards—a critical factor for enterprise adoption.

Incentivizing Accurate Data Provision with LINK Token

The native LINK token plays a vital role within the Chainlink ecosystem by incentivizing honest participation from node operators who provide external data feeds. Operators stake LINK tokens as collateral; they earn rewards in LINK for delivering accurate information consistently over time.

This economic incentive aligns individual interests with network integrity: dishonest behavior leads to penalties such as loss of staked tokens while truthful reporting results in earnings. Such mechanisms foster reliability across the entire oracle network—a crucial aspect given that many DeFi protocols depend heavily on precise market prices or other sensitive datasets sourced via Chainlink.

Community Engagement Drives Continuous Improvement

A vibrant community comprising developers, node operators, researchers—and increasingly institutional partners—contributes significantly toward enhancing Network robustness over time.

Open-source contributions help identify vulnerabilities early while fostering innovation around new use cases like insurance automation or supply chain transparency.

Active engagement also accelerates adoption rates across industries ranging from finance & healthcare to gaming & IoT devices—all leveraging secure external data provided through trusted channels like those offered by Chainlink.

Summary: Why Choose Chainlink (LINK)?

In summary:

- Decentralized architecture ensures trustworthy data feeds resistant to manipulation.

- Multi-blockchain support facilitates seamless integration across diverse platforms.

- Real-world data access unlocks new functionalities for smart contracts.

- Off-chain processing enhances scalability without sacrificing security.

- The LINK token incentives promote honest participation among node operators.

- An active community fosters ongoing innovation & resilience within its ecosystem.

Final Thoughts

As blockchain technology continues expanding into mainstream sectors such as finance, healthcare management systems—and even government infrastructure—the importance of reliable external data sources becomes ever more critical. By offering secure decentralization combined with interoperability features backed by strong economic incentives—and supported through active community involvement—Chainlink positions itself at the forefront of enabling smarter contract execution grounded firmly in real-world context.

Keywords: Blockchain Oracle Benefits, Decentralized Data Feeds, Smart Contract Integration, Cross-Chain Compatibility, Secure External Data, DeFi Infrastructure, Chainlink Ecosystem

Lo

2025-05-29 02:39

What are the benefits of using Chainlink (LINK)?

Benefits of Using Chainlink (LINK)

Understanding the advantages of Chainlink (LINK) is essential for anyone interested in blockchain technology, decentralized finance (DeFi), or smart contract development. As a leading decentralized oracle network, Chainlink plays a pivotal role in bridging real-world data with blockchain applications. This article explores the key benefits that make Chainlink an indispensable component in the evolving blockchain ecosystem.

Decentralization and Security Enhances Trust

One of the primary advantages of using Chainlink is its decentralized architecture, which significantly boosts security and trustworthiness. Unlike centralized data providers that can be vulnerable to manipulation or censorship, Chainlink employs multiple independent nodes to fetch and verify data feeds. These nodes operate under a consensus mechanism that ensures data accuracy before it reaches smart contracts.

This decentralization minimizes single points of failure and reduces risks associated with malicious attacks or data tampering. For users and developers, this means more reliable execution of smart contracts based on real-world information—be it weather conditions, financial market prices, or sensor readings—without relying on a single trusted entity.

Facilitates Integration with Multiple Blockchain Platforms

Chainlink’s interoperability stands out as another major benefit. It supports integration across various blockchain networks such as Ethereum, Binance Smart Chain, Polkadot, and others. This multi-platform compatibility allows developers to incorporate external data into different ecosystems seamlessly.

For businesses operating in diverse blockchain environments or planning cross-chain applications, this flexibility simplifies development processes and broadens potential use cases. It also encourages collaboration among different projects by providing standardized access to off-chain data sources through a unified oracle network.

Access to Real-World Data for Complex Smart Contracts

Smart contracts are inherently limited by their inability to access external information directly; they require an intermediary like an oracle service for real-world inputs. Chainlink addresses this challenge effectively by providing secure APIs and off-chain computation capabilities.

This enables smart contracts to perform complex functions dependent on external events—such as executing insurance claims based on weather reports or adjusting supply chain logistics according to sensor inputs—thus expanding their practical utility beyond simple transactions.

Scalability Through Off-Chain Data Processing

Blockchain networks face scalability challenges due to high transaction costs and limited throughput capacity when processing large volumes of off-chain information directly on-chain. Chainlink mitigates this issue by handling much of the heavy lifting off-chain via its node operators before delivering verified results onto the blockchain.

This approach reduces congestion within mainnet blockchains while maintaining high levels of security through cryptographic proofs and consensus mechanisms among nodes. Consequently, developers can build scalable applications without compromising performance or security standards—a critical factor for enterprise adoption.

Incentivizing Accurate Data Provision with LINK Token

The native LINK token plays a vital role within the Chainlink ecosystem by incentivizing honest participation from node operators who provide external data feeds. Operators stake LINK tokens as collateral; they earn rewards in LINK for delivering accurate information consistently over time.

This economic incentive aligns individual interests with network integrity: dishonest behavior leads to penalties such as loss of staked tokens while truthful reporting results in earnings. Such mechanisms foster reliability across the entire oracle network—a crucial aspect given that many DeFi protocols depend heavily on precise market prices or other sensitive datasets sourced via Chainlink.

Community Engagement Drives Continuous Improvement

A vibrant community comprising developers, node operators, researchers—and increasingly institutional partners—contributes significantly toward enhancing Network robustness over time.

Open-source contributions help identify vulnerabilities early while fostering innovation around new use cases like insurance automation or supply chain transparency.

Active engagement also accelerates adoption rates across industries ranging from finance & healthcare to gaming & IoT devices—all leveraging secure external data provided through trusted channels like those offered by Chainlink.

Summary: Why Choose Chainlink (LINK)?

In summary:

- Decentralized architecture ensures trustworthy data feeds resistant to manipulation.

- Multi-blockchain support facilitates seamless integration across diverse platforms.

- Real-world data access unlocks new functionalities for smart contracts.

- Off-chain processing enhances scalability without sacrificing security.

- The LINK token incentives promote honest participation among node operators.

- An active community fosters ongoing innovation & resilience within its ecosystem.

Final Thoughts

As blockchain technology continues expanding into mainstream sectors such as finance, healthcare management systems—and even government infrastructure—the importance of reliable external data sources becomes ever more critical. By offering secure decentralization combined with interoperability features backed by strong economic incentives—and supported through active community involvement—Chainlink positions itself at the forefront of enabling smarter contract execution grounded firmly in real-world context.

Keywords: Blockchain Oracle Benefits, Decentralized Data Feeds, Smart Contract Integration, Cross-Chain Compatibility, Secure External Data, DeFi Infrastructure, Chainlink Ecosystem

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Makes a Non-Fungible Token (NFT) Unique Compared to a Fungible Token?

Understanding the fundamental differences between non-fungible tokens (NFTs) and fungible tokens is essential for anyone interested in digital assets, blockchain technology, or the evolving landscape of digital ownership. While both are types of tokens stored on blockchain networks, their core characteristics set them apart significantly. This distinction influences how they are used, valued, and perceived within various markets.

The Nature of Fungibility in Digital Assets

Fungibility refers to the ability of an asset to be exchanged on a one-to-one basis with another identical asset. Traditional currencies like US dollars or cryptocurrencies such as Bitcoin exemplify fungibility because each unit holds the same value and can be swapped seamlessly without losing any worth. For example, one Bitcoin is always equal in value to another Bitcoin; they are interchangeable.

In contrast, fungible tokens are designed for uniformity and liquidity. They facilitate transactions where individual units do not need differentiation—making them ideal for currency use or utility within decentralized applications.

What Defines Non-Fungibility?

Non-fungible tokens break this mold by representing unique items that cannot be replaced with identical counterparts without losing some aspect of their value or meaning. Each NFT has distinct attributes that make it different from every other token—this could include specific metadata, provenance information, or embedded rights tied to a particular digital item.

The key features that define NFTs include:

- Uniqueness: Every NFT has a unique identifier encoded on the blockchain.

- Ownership Rights: NFTs serve as proof of ownership over specific digital content.

- Provenance & Authenticity: Blockchain records provide transparent history and authenticity verification.

- Immutability: Once created or transferred via smart contracts, NFT data cannot be altered retroactively.

These features ensure that NFTs function as verifiable certificates of authenticity rather than interchangeable units like traditional currencies.

How Blockchain Technology Ensures Uniqueness

Blockchain technology underpins NFTs by providing an immutable ledger where each token's details—such as creator information, transaction history, and ownership status—are permanently recorded. This decentralization eliminates reliance on centralized authorities like banks or auction houses for verifying authenticity.

Smart contracts automate many aspects related to NFTs: transferring ownership upon sale automatically updates records without intermediaries while enforcing predefined rules embedded within the contract code. This automation enhances transparency and trustworthiness in transactions involving valuable digital assets such as artwork or collectibles.

Practical Differences Between NFTs and Fungible Tokens

While fungible tokens excel at facilitating exchanges due to their interchangeability—they're ideal for payments or staking purposes—NFTs serve more specialized roles centered around uniqueness:

Digital Art & Collectibles: Artists create one-of-a-kind pieces verified through blockchain; collectors purchase these items knowing their provenance is secure.

Gaming Assets: Unique characters or items within video games can be represented as NFTs with distinct attributes.

Real Estate & Intellectual Property Rights: Ownership rights over virtual land parcels or patents can also be tokenized uniquely via NFTs.

This specialization makes non-fungible tokens particularly appealing for creators seeking new monetization avenues while offering collectors assurance about rarity and authenticity.

Why Uniqueness Matters in Digital Ownership

In traditional art markets—or physical collectibles—the rarity significantly influences value. Similarly, in the digital realm where copying files is trivial but establishing genuine ownership is challenging, NFTs fill this gap by providing verifiable proof that someone owns an original piece—even if copies exist elsewhere online.

This concept extends beyond art into domains like music licensing rights —where owning an NFT might confer exclusive access—or virtual worlds where land parcels have intrinsic scarcity driven by blockchain-based scarcity models. The ability to prove originality enhances trust among buyers and sellers alike while enabling new economic models based on scarcity-driven valuation.

How Differentiation Impacts Market Value

The inherent uniqueness embedded within each NFT often results in highly variable market prices influenced by factors such as creator reputation, cultural relevance, rarity level—and current market demand dynamics. Unlike cryptocurrencies whose values fluctuate based solely on supply-demand mechanics tied to monetary policy considerations—a single Bitcoin’s worth remains consistent across exchanges—increased rarity tends to drive higher valuations for individual NFTs.

Addressing Challenges Related To Uniqueness

Despite their advantages regarding proof-of-authenticity and exclusivity—their uniqueness also introduces challenges:

- Market Volatility: Prices can swing dramatically based on trends rather than intrinsic worth.

- Intellectual Property Concerns: Questions about copyright infringement arise when artworks are minted without proper authorization.

- Environmental Impact: Creating unique assets often involves energy-intensive processes depending on blockchain protocols used (e.g., Ethereum’s proof-of-work system).

Understanding these issues helps investors appreciate both opportunities—and risks—in engaging with non-fungible assets.

Final Thoughts: The Significance of Distinctiveness

The defining characteristic that sets non-fungible tokens apart from traditional cryptocurrencies lies precisely in their individuality—they embody rare digital objects secured through transparent ledger systems ensuring provenance integrity worldwide. As technology advances alongside growing adoption across industries—from art markets to gaming ecosystems—the importance placed upon authenticating originality will only increase.

By grasping what makes an NFT unique compared with its fungible counterparts—including its underlying technological framework—you gain insight into how these innovative assets could reshape notions of ownership across diverse sectors now embracing digitization at unprecedented levels.

JCUSER-IC8sJL1q

2025-05-22 23:18

What makes a non-fungible token (NFT) unique compared to a fungible token?

What Makes a Non-Fungible Token (NFT) Unique Compared to a Fungible Token?

Understanding the fundamental differences between non-fungible tokens (NFTs) and fungible tokens is essential for anyone interested in digital assets, blockchain technology, or the evolving landscape of digital ownership. While both are types of tokens stored on blockchain networks, their core characteristics set them apart significantly. This distinction influences how they are used, valued, and perceived within various markets.

The Nature of Fungibility in Digital Assets

Fungibility refers to the ability of an asset to be exchanged on a one-to-one basis with another identical asset. Traditional currencies like US dollars or cryptocurrencies such as Bitcoin exemplify fungibility because each unit holds the same value and can be swapped seamlessly without losing any worth. For example, one Bitcoin is always equal in value to another Bitcoin; they are interchangeable.

In contrast, fungible tokens are designed for uniformity and liquidity. They facilitate transactions where individual units do not need differentiation—making them ideal for currency use or utility within decentralized applications.

What Defines Non-Fungibility?

Non-fungible tokens break this mold by representing unique items that cannot be replaced with identical counterparts without losing some aspect of their value or meaning. Each NFT has distinct attributes that make it different from every other token—this could include specific metadata, provenance information, or embedded rights tied to a particular digital item.

The key features that define NFTs include:

- Uniqueness: Every NFT has a unique identifier encoded on the blockchain.

- Ownership Rights: NFTs serve as proof of ownership over specific digital content.

- Provenance & Authenticity: Blockchain records provide transparent history and authenticity verification.

- Immutability: Once created or transferred via smart contracts, NFT data cannot be altered retroactively.

These features ensure that NFTs function as verifiable certificates of authenticity rather than interchangeable units like traditional currencies.

How Blockchain Technology Ensures Uniqueness

Blockchain technology underpins NFTs by providing an immutable ledger where each token's details—such as creator information, transaction history, and ownership status—are permanently recorded. This decentralization eliminates reliance on centralized authorities like banks or auction houses for verifying authenticity.

Smart contracts automate many aspects related to NFTs: transferring ownership upon sale automatically updates records without intermediaries while enforcing predefined rules embedded within the contract code. This automation enhances transparency and trustworthiness in transactions involving valuable digital assets such as artwork or collectibles.

Practical Differences Between NFTs and Fungible Tokens

While fungible tokens excel at facilitating exchanges due to their interchangeability—they're ideal for payments or staking purposes—NFTs serve more specialized roles centered around uniqueness:

Digital Art & Collectibles: Artists create one-of-a-kind pieces verified through blockchain; collectors purchase these items knowing their provenance is secure.

Gaming Assets: Unique characters or items within video games can be represented as NFTs with distinct attributes.

Real Estate & Intellectual Property Rights: Ownership rights over virtual land parcels or patents can also be tokenized uniquely via NFTs.

This specialization makes non-fungible tokens particularly appealing for creators seeking new monetization avenues while offering collectors assurance about rarity and authenticity.

Why Uniqueness Matters in Digital Ownership

In traditional art markets—or physical collectibles—the rarity significantly influences value. Similarly, in the digital realm where copying files is trivial but establishing genuine ownership is challenging, NFTs fill this gap by providing verifiable proof that someone owns an original piece—even if copies exist elsewhere online.

This concept extends beyond art into domains like music licensing rights —where owning an NFT might confer exclusive access—or virtual worlds where land parcels have intrinsic scarcity driven by blockchain-based scarcity models. The ability to prove originality enhances trust among buyers and sellers alike while enabling new economic models based on scarcity-driven valuation.

How Differentiation Impacts Market Value

The inherent uniqueness embedded within each NFT often results in highly variable market prices influenced by factors such as creator reputation, cultural relevance, rarity level—and current market demand dynamics. Unlike cryptocurrencies whose values fluctuate based solely on supply-demand mechanics tied to monetary policy considerations—a single Bitcoin’s worth remains consistent across exchanges—increased rarity tends to drive higher valuations for individual NFTs.

Addressing Challenges Related To Uniqueness

Despite their advantages regarding proof-of-authenticity and exclusivity—their uniqueness also introduces challenges:

- Market Volatility: Prices can swing dramatically based on trends rather than intrinsic worth.

- Intellectual Property Concerns: Questions about copyright infringement arise when artworks are minted without proper authorization.

- Environmental Impact: Creating unique assets often involves energy-intensive processes depending on blockchain protocols used (e.g., Ethereum’s proof-of-work system).

Understanding these issues helps investors appreciate both opportunities—and risks—in engaging with non-fungible assets.

Final Thoughts: The Significance of Distinctiveness

The defining characteristic that sets non-fungible tokens apart from traditional cryptocurrencies lies precisely in their individuality—they embody rare digital objects secured through transparent ledger systems ensuring provenance integrity worldwide. As technology advances alongside growing adoption across industries—from art markets to gaming ecosystems—the importance placed upon authenticating originality will only increase.

By grasping what makes an NFT unique compared with its fungible counterparts—including its underlying technological framework—you gain insight into how these innovative assets could reshape notions of ownership across diverse sectors now embracing digitization at unprecedented levels.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Error executing ChatgptTask

JCUSER-IC8sJL1q

2025-05-22 09:41

How do sidechains compare to layer-2 networks in terms of security?

Error executing ChatgptTask

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is the Future of Solana in Blockchain and DeFi?

Solana has rapidly emerged as a leading blockchain platform, capturing attention with its high throughput, low latency, and innovative consensus mechanism. As the landscape of decentralized finance (DeFi) continues to evolve, many investors and developers are asking: what does the future hold for Solana? This article explores Solana’s current position, recent developments, challenges, and potential trajectory within the broader blockchain ecosystem.

Understanding Solana’s Technology and Ecosystem

Launched in 2017 by Anatoly Yakovenko along with Greg Fitzgerald and Stephen Akridge, Solana was designed to address common scalability issues faced by earlier blockchains like Bitcoin and Ethereum. Its core innovation is the Proof of History (PoH) consensus algorithm—a unique timestamping method that enables faster transaction processing without compromising security.

This architecture allows Solana to process thousands of transactions per second (TPS), making it highly suitable for applications requiring high throughput such as DeFi protocols, non-fungible tokens (NFTs), gaming platforms, and enterprise solutions. Its ability to scale efficiently positions it as a formidable competitor in an increasingly crowded market dominated by Ethereum but challenged by newer entrants like Binance Smart Chain or Polkadot.

The platform's robust ecosystem includes a variety of decentralized applications—ranging from lending protocols to stablecoins—and has attracted significant institutional interest. Notably, major players have invested millions into projects built on or related to Solana—highlighting confidence in its long-term potential.

Recent Price Movements Indicate Growing Adoption

As of May 2025, Solana’s native token SOL experienced a notable surge past $150 amid heightened trading activity. This price rally reflects increased investor confidence driven by several factors:

- Institutional Investment: The launch of financial products such as the SOLZ ETF has garnered attention from institutional investors. Bloomberg predicts high approval rates for these ETFs amid favorable regulatory trends.

- Ecosystem Expansion: New projects launching on Solana—including DeFi platforms offering yield farming or lending services—have contributed to demand.

- Market Sentiment: Broader bullish trends across cryptocurrencies have also played a role in boosting SOL prices temporarily.

However, analysts warn that this rally could be susceptible to short-term volatility due to macroeconomic factors affecting global markets or shifts within crypto sentiment itself.

Regulatory Environment: Opportunities & Risks

The evolving regulatory landscape remains one of the most critical factors influencing Solana's future prospects. While clarity around cryptocurrency regulations can foster investor confidence—and potentially lead to mainstream adoption—any adverse policy changes could hinder growth prospects significantly.

In 2025 alone, regulators worldwide are scrutinizing digital assets more closely; some countries have introduced stricter compliance requirements while others explore central bank digital currencies (CBDCs). For platforms like Solana that host numerous dApps—including those involved with DeFi—the risk lies in potential restrictions on certain activities such as yield farming or token issuance.

Nevertheless, proactive engagement with regulators coupled with transparent compliance strategies can help mitigate these risks over time.

Institutional Interest Signaling Long-Term Confidence

One notable development is Neptune Digital Assets Corp.'s increased holdings in Bitcoin alongside investments in Solana-based projects. Such moves suggest growing institutional recognition that blockchain ecosystems like Solana may offer sustainable growth opportunities beyond retail speculation alone.

Institutional backing often translates into greater liquidity support and credibility for blockchain networks—factors crucial for long-term success especially when competing against well-established chains like Ethereum which benefits from extensive developer communities but faces scalability issues itself.

Furthermore, large-scale investments tend to attract more developers seeking reliable infrastructure for their decentralized applications—a positive feedback loop reinforcing network effects over time.

Challenges Facing Future Growth

Despite promising signs ahead; several hurdles could impact how farSolano can go:

Market Volatility: Cryptocurrency markets are inherently volatile; sharp corrections can affect investor sentiment regardless of underlying technology.

Competition: Platforms such as Ethereum 2.0 upgrade efforts aim at improving scalability but still face congestion issues; Binance Smart Chain offers lower fees but less decentralization; Polkadot emphasizes interoperability—all vying for market share.

Security Concerns: As more complex dApps emerge on solanA’s network—including meme coins like $TRUMP launched early 2025—the risk profile increases regarding smart contract vulnerabilities or malicious attacks.

Addressing these challenges requires ongoing technological innovation combined with strategic community engagement and regulatory compliance efforts.

The Road Ahead: Will Solarna Maintain Its Momentum?

Looking forward into 2025+ , several key factors will influence whether solanA sustains its current momentum:

- Continued Ecosystem Development: Expanding partnerships with enterprises and onboarding new developers will be vital.

- Regulatory Adaptation: Navigating evolving legal frameworks effectively can prevent setbacks caused by policy shifts.

- Technological Innovation: Upgrades enhancing security features while maintaining speed will reinforce trust among users.

- Market Conditions: Broader economic stability may reduce volatility-driven sell-offs enabling steady growth trajectories.

While no project is immune from risks inherent within crypto markets; solanA's innovative architecture combined with increasing institutional interest suggests it could remain at the forefront among scalable Layer 1 blockchains if it manages these dynamics well.

Final Thoughts

Solano stands out today not just because of its impressive technical capabilities but also due to growing adoption across sectors—from DeFi protocols through NFTs—to enterprise use cases . Its ability to adapt amidst competition hinges on continuous innovation paired with strategic regulation navigation .

As we move further into this decade marked by rapid technological change , solanA's future appears promising—but cautious optimism remains prudent given inherent market uncertainties . Stakeholders should monitor ongoing developments closely while leveraging its strengths toward building resilient decentralized ecosystems.

Note: This overview aims at providing an informed perspective based on current data up until October 2023 plus recent developments noted through early 2025 — always consider ongoing updates when evaluating long-term prospects

JCUSER-F1IIaxXA

2025-05-09 03:47

what is the future of Solana ?

What Is the Future of Solana in Blockchain and DeFi?

Solana has rapidly emerged as a leading blockchain platform, capturing attention with its high throughput, low latency, and innovative consensus mechanism. As the landscape of decentralized finance (DeFi) continues to evolve, many investors and developers are asking: what does the future hold for Solana? This article explores Solana’s current position, recent developments, challenges, and potential trajectory within the broader blockchain ecosystem.

Understanding Solana’s Technology and Ecosystem

Launched in 2017 by Anatoly Yakovenko along with Greg Fitzgerald and Stephen Akridge, Solana was designed to address common scalability issues faced by earlier blockchains like Bitcoin and Ethereum. Its core innovation is the Proof of History (PoH) consensus algorithm—a unique timestamping method that enables faster transaction processing without compromising security.

This architecture allows Solana to process thousands of transactions per second (TPS), making it highly suitable for applications requiring high throughput such as DeFi protocols, non-fungible tokens (NFTs), gaming platforms, and enterprise solutions. Its ability to scale efficiently positions it as a formidable competitor in an increasingly crowded market dominated by Ethereum but challenged by newer entrants like Binance Smart Chain or Polkadot.

The platform's robust ecosystem includes a variety of decentralized applications—ranging from lending protocols to stablecoins—and has attracted significant institutional interest. Notably, major players have invested millions into projects built on or related to Solana—highlighting confidence in its long-term potential.

Recent Price Movements Indicate Growing Adoption

As of May 2025, Solana’s native token SOL experienced a notable surge past $150 amid heightened trading activity. This price rally reflects increased investor confidence driven by several factors:

- Institutional Investment: The launch of financial products such as the SOLZ ETF has garnered attention from institutional investors. Bloomberg predicts high approval rates for these ETFs amid favorable regulatory trends.

- Ecosystem Expansion: New projects launching on Solana—including DeFi platforms offering yield farming or lending services—have contributed to demand.

- Market Sentiment: Broader bullish trends across cryptocurrencies have also played a role in boosting SOL prices temporarily.

However, analysts warn that this rally could be susceptible to short-term volatility due to macroeconomic factors affecting global markets or shifts within crypto sentiment itself.

Regulatory Environment: Opportunities & Risks

The evolving regulatory landscape remains one of the most critical factors influencing Solana's future prospects. While clarity around cryptocurrency regulations can foster investor confidence—and potentially lead to mainstream adoption—any adverse policy changes could hinder growth prospects significantly.

In 2025 alone, regulators worldwide are scrutinizing digital assets more closely; some countries have introduced stricter compliance requirements while others explore central bank digital currencies (CBDCs). For platforms like Solana that host numerous dApps—including those involved with DeFi—the risk lies in potential restrictions on certain activities such as yield farming or token issuance.

Nevertheless, proactive engagement with regulators coupled with transparent compliance strategies can help mitigate these risks over time.

Institutional Interest Signaling Long-Term Confidence

One notable development is Neptune Digital Assets Corp.'s increased holdings in Bitcoin alongside investments in Solana-based projects. Such moves suggest growing institutional recognition that blockchain ecosystems like Solana may offer sustainable growth opportunities beyond retail speculation alone.

Institutional backing often translates into greater liquidity support and credibility for blockchain networks—factors crucial for long-term success especially when competing against well-established chains like Ethereum which benefits from extensive developer communities but faces scalability issues itself.

Furthermore, large-scale investments tend to attract more developers seeking reliable infrastructure for their decentralized applications—a positive feedback loop reinforcing network effects over time.

Challenges Facing Future Growth

Despite promising signs ahead; several hurdles could impact how farSolano can go:

Market Volatility: Cryptocurrency markets are inherently volatile; sharp corrections can affect investor sentiment regardless of underlying technology.

Competition: Platforms such as Ethereum 2.0 upgrade efforts aim at improving scalability but still face congestion issues; Binance Smart Chain offers lower fees but less decentralization; Polkadot emphasizes interoperability—all vying for market share.

Security Concerns: As more complex dApps emerge on solanA’s network—including meme coins like $TRUMP launched early 2025—the risk profile increases regarding smart contract vulnerabilities or malicious attacks.

Addressing these challenges requires ongoing technological innovation combined with strategic community engagement and regulatory compliance efforts.

The Road Ahead: Will Solarna Maintain Its Momentum?

Looking forward into 2025+ , several key factors will influence whether solanA sustains its current momentum:

- Continued Ecosystem Development: Expanding partnerships with enterprises and onboarding new developers will be vital.

- Regulatory Adaptation: Navigating evolving legal frameworks effectively can prevent setbacks caused by policy shifts.

- Technological Innovation: Upgrades enhancing security features while maintaining speed will reinforce trust among users.

- Market Conditions: Broader economic stability may reduce volatility-driven sell-offs enabling steady growth trajectories.

While no project is immune from risks inherent within crypto markets; solanA's innovative architecture combined with increasing institutional interest suggests it could remain at the forefront among scalable Layer 1 blockchains if it manages these dynamics well.

Final Thoughts

Solano stands out today not just because of its impressive technical capabilities but also due to growing adoption across sectors—from DeFi protocols through NFTs—to enterprise use cases . Its ability to adapt amidst competition hinges on continuous innovation paired with strategic regulation navigation .

As we move further into this decade marked by rapid technological change , solanA's future appears promising—but cautious optimism remains prudent given inherent market uncertainties . Stakeholders should monitor ongoing developments closely while leveraging its strengths toward building resilient decentralized ecosystems.

Note: This overview aims at providing an informed perspective based on current data up until October 2023 plus recent developments noted through early 2025 — always consider ongoing updates when evaluating long-term prospects

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Bitcoin Investment — every time she walks by, even the ETH crowd turns their heads 🫣 Main character energy in the crypto streets 🧿 She’s the MVP of the blockchain

Check out our YouTube Channel 👉

#BitcoinInvestment #MainCharacterVibes #CryptoAttraction

JuCoin Media

2025-08-01 11:21

How a Bitcoin Investment Steals the Show Every Time ✨

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The altcoin market is experiencing significant resurgence with institutional backing and regulatory clarity driving unprecedented growth opportunities. Here's what's shaping the current landscape:

💰 Market Dynamics:

-

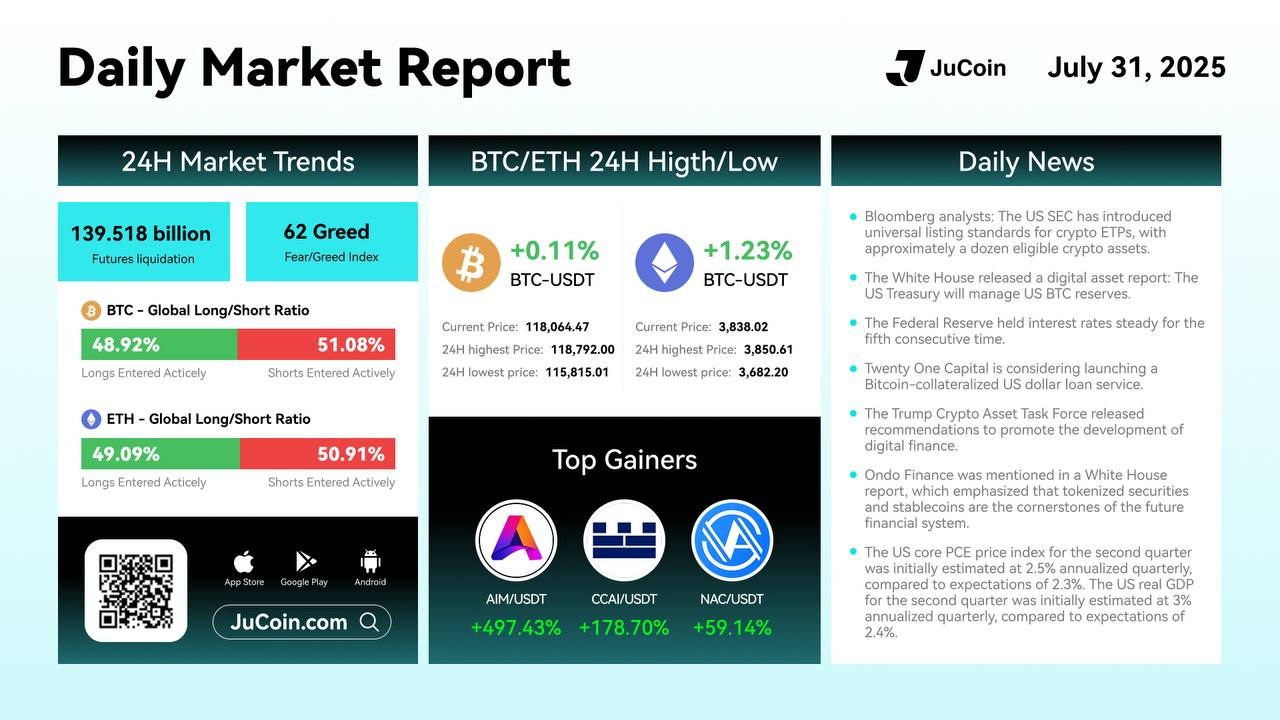

Post-Bitcoin capital rotation (Bitcoin hit $118K in July 2025)

86% of institutional investors have or plan digital asset exposure

Altcoin Season Index at 50 (early-stage rotation phase)

Enhanced liquidity through potential altcoin ETPs

🎯 Leading Sectors & Narratives:

1️⃣ AI & Blockchain Integration

-

AI-powered altcoins transitioning from speculation to utility

Autonomous agents creating economic value in crypto ecosystems

2️⃣ Real-World Asset (RWA) Tokenization

-

Market surged to $25B in Q2 2025 (245x increase since 2020)

Bridging traditional finance with blockchain technology

Fractional ownership of real estate, commodities, and fine art

3️⃣ DeFi Evolution

-

Focus on Layer 2 solutions and high-performance blockchains

Innovative liquid staking and restaking protocols

More user-friendly and cost-effective transactions

4️⃣ Gaming & Metaverse

-

Sustainable play-to-earn models

Interoperable metaverse experiences

🏛️ Regulatory Catalysts:

-

EU's MiCA regulation providing comprehensive framework

U.S. stablecoin bills (GENIUS Act) enhancing stability

Spot altcoin ETP discussions (Solana, XRP gaining traction)

XRP hitting multi-year highs amid favorable regulations

💡 Key Investment Insights:

-

Diversify into altcoins with strong fundamentals in emerging sectors

Monitor regulatory developments for institutional flow opportunities

Prioritize projects with active communities and continuous innovation

Understand capital rotation patterns from Bitcoin to altcoins

Focus on utility-driven tokens over speculative assets

🔮 Market Outlook: The shift from speculative to utility-driven altcoins is accelerating, with institutional adoption providing stability and legitimacy. Projects solving real-world problems through AI integration, RWA tokenization, and advanced DeFi protocols are positioned for sustained growth.

Read the complete market analysis with detailed sector breakdowns and investment strategies: 👇 https://blog.jucoin.com/explore-the-current-altcoin-market-in-2025/

#Altcoin #Crypto #Blockchain #AI #RWA #DeFi #Institutional #Regulation #Bitcoin #Ethereum #Solana #XRP #JuCoin #Tokenization #Web3 #Investment #2025 #DigitalAssets #MiCA #ETP

JU Blog

2025-07-31 13:37

🚀 Altcoin Market in 2025: Institutional-Driven Growth & Innovation Surge!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🐣 New to Crypto? Start Here!

🔸 1-min to know what #FUD is → https://youtube.com/shorts/i6s2QQ9XEDw?feature=share

📌 Bookmark this thread – your ultimate starter kit👇

#CryptoBeginner #Blockchain101 #LearnWeb3

JuCoin Official

2025-07-31 09:12

🐣 New to Crypto? Start Here!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

👉 Trade Now: https://bit.ly/4eDheON

JuCoin Community

2025-07-31 06:28

$JU successfully reached 12 USDT, setting a new record high! The price rose 120x since its listing

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Understanding the CARV Token and Its Ecosystem

The CARV token is a digital asset associated with the CARV ecosystem, which aims to provide innovative solutions within the blockchain space. While specific details about its core functions may vary, tokens like CARV are typically used to facilitate transactions, governance, or access within their respective platforms. The ecosystem could encompass decentralized finance (DeFi) applications, non-fungible tokens (NFTs), or other blockchain-based services designed to enhance user engagement and utility.

Investors and enthusiasts interested in cryptocurrencies should understand that the value of such tokens often depends on factors like ecosystem development, community support, partnerships, and overall market conditions. As with many emerging projects in crypto markets, staying informed about recent updates and strategic moves by project developers is crucial for making educated investment decisions.

How to Participate in Sharing 5819 CARV Tokens

The article emphasizes an opportunity for readers to share a total of 5819 CARV tokens as part of a promotional campaign or community engagement initiative. Typically, such sharing programs involve steps like:

- Registering on official platforms or participating in specific campaigns.

- Completing certain tasks such as social media sharing or inviting friends.

- Following guidelines provided by the project team to ensure eligibility.

Participation methods can vary depending on ongoing promotions but generally aim to increase awareness and adoption of the token while rewarding active community members. It’s essential for participants to verify official sources before engaging in any sharing activities to avoid scams.

Key Uses and Benefits of Holding CARV Tokens

Understanding what you can do with CARV tokens helps clarify their potential value proposition. Common uses include:

- Governance: Token holders may have voting rights on platform upgrades or decision-making processes.

- Staking: Locking up tokens might earn rewards through staking mechanisms that support network security.

- Access: Certain features within the ecosystem could require holding or spending CARV tokens.

- Trading: Like other cryptocurrencies, CARV can be bought or sold on exchanges based on market demand.

Holding these tokens might also offer benefits such as participation incentives during promotional events—like earning additional rewards through sharing campaigns—and potential appreciation if the ecosystem grows successfully over time.

Recent Developments Impacting the CARV Ecosystem

Keeping track of recent updates is vital for assessing future prospects. Notable developments include:

- Market Performance Trends: Analyzing recent price movements reveals volatility levels typical in crypto markets but also indicates investor interest spikes following positive news.

- Partnership Announcements: Collaborations with other blockchain projects or mainstream companies can boost credibility and expand use cases.

- Platform Upgrades: Introduction of new features—such as enhanced security measures, user interface improvements, or additional functionalities—can influence adoption rates positively.

- Regulatory Environment Changes: Evolving legal frameworks around cryptocurrencies globally may impact how easily users can trade or utilize CARV tokens across different jurisdictions.

Staying updated through official channels ensures investors are aware of these developments promptly.

Risks Associated With Investing in Carv Tokens

While opportunities exist within emerging crypto projects like Carv, risks must be carefully considered:

- Market Volatility: Cryptocurrency prices are highly volatile; sudden swings could lead to significant losses.

- Security Concerns: Hacks targeting exchanges or wallets holding Carv could compromise funds if proper security measures aren’t followed.

- Regulatory Risks: Changes in laws governing digital assets might restrict trading options or usage rights for certain jurisdictions.

Additionally,

Community trust plays a critical role; any negative news regarding project management transparency—or technical vulnerabilities—could diminish confidence among investors and users alike.

Strategies for Engaging With Carv Investment Opportunities

For those interested in participating actively with Carv's ecosystem beyond just holding its token:

- Conduct thorough research into project whitepapers and official announcements

- Follow reputable sources discussing market trends related to Carv

- Join community forums where users share insights

- Consider diversification strategies rather than concentrating investments solely into one asset

- Stay cautious about promotional offers promising guaranteed returns without clear backing

By combining due diligence with strategic planning aligned with personal risk tolerance levels — especially considering cryptocurrency’s inherent volatility — investors can better position themselves within this evolving landscape.

This overview provides a comprehensive understanding of what potential investors need when exploring opportunities related to the Carv token—from its purpose within its broader ecosystem through recent developments impacting its value—and highlights key considerations necessary before engaging actively with this digital asset class while emphasizing responsible investing practices rooted in transparency and informed decision-making standards common among reputable financial advice sources today.*

Lo

2025-06-09 21:22

What topics are covered in the 'Learn About CARV to Share 5819 CARV Tokens' article?

Understanding the CARV Token and Its Ecosystem

The CARV token is a digital asset associated with the CARV ecosystem, which aims to provide innovative solutions within the blockchain space. While specific details about its core functions may vary, tokens like CARV are typically used to facilitate transactions, governance, or access within their respective platforms. The ecosystem could encompass decentralized finance (DeFi) applications, non-fungible tokens (NFTs), or other blockchain-based services designed to enhance user engagement and utility.

Investors and enthusiasts interested in cryptocurrencies should understand that the value of such tokens often depends on factors like ecosystem development, community support, partnerships, and overall market conditions. As with many emerging projects in crypto markets, staying informed about recent updates and strategic moves by project developers is crucial for making educated investment decisions.

How to Participate in Sharing 5819 CARV Tokens

The article emphasizes an opportunity for readers to share a total of 5819 CARV tokens as part of a promotional campaign or community engagement initiative. Typically, such sharing programs involve steps like:

- Registering on official platforms or participating in specific campaigns.

- Completing certain tasks such as social media sharing or inviting friends.

- Following guidelines provided by the project team to ensure eligibility.

Participation methods can vary depending on ongoing promotions but generally aim to increase awareness and adoption of the token while rewarding active community members. It’s essential for participants to verify official sources before engaging in any sharing activities to avoid scams.

Key Uses and Benefits of Holding CARV Tokens

Understanding what you can do with CARV tokens helps clarify their potential value proposition. Common uses include:

- Governance: Token holders may have voting rights on platform upgrades or decision-making processes.

- Staking: Locking up tokens might earn rewards through staking mechanisms that support network security.

- Access: Certain features within the ecosystem could require holding or spending CARV tokens.

- Trading: Like other cryptocurrencies, CARV can be bought or sold on exchanges based on market demand.

Holding these tokens might also offer benefits such as participation incentives during promotional events—like earning additional rewards through sharing campaigns—and potential appreciation if the ecosystem grows successfully over time.

Recent Developments Impacting the CARV Ecosystem

Keeping track of recent updates is vital for assessing future prospects. Notable developments include:

- Market Performance Trends: Analyzing recent price movements reveals volatility levels typical in crypto markets but also indicates investor interest spikes following positive news.

- Partnership Announcements: Collaborations with other blockchain projects or mainstream companies can boost credibility and expand use cases.

- Platform Upgrades: Introduction of new features—such as enhanced security measures, user interface improvements, or additional functionalities—can influence adoption rates positively.

- Regulatory Environment Changes: Evolving legal frameworks around cryptocurrencies globally may impact how easily users can trade or utilize CARV tokens across different jurisdictions.

Staying updated through official channels ensures investors are aware of these developments promptly.

Risks Associated With Investing in Carv Tokens

While opportunities exist within emerging crypto projects like Carv, risks must be carefully considered:

- Market Volatility: Cryptocurrency prices are highly volatile; sudden swings could lead to significant losses.

- Security Concerns: Hacks targeting exchanges or wallets holding Carv could compromise funds if proper security measures aren’t followed.

- Regulatory Risks: Changes in laws governing digital assets might restrict trading options or usage rights for certain jurisdictions.

Additionally,

Community trust plays a critical role; any negative news regarding project management transparency—or technical vulnerabilities—could diminish confidence among investors and users alike.

Strategies for Engaging With Carv Investment Opportunities

For those interested in participating actively with Carv's ecosystem beyond just holding its token:

- Conduct thorough research into project whitepapers and official announcements

- Follow reputable sources discussing market trends related to Carv

- Join community forums where users share insights

- Consider diversification strategies rather than concentrating investments solely into one asset

- Stay cautious about promotional offers promising guaranteed returns without clear backing

By combining due diligence with strategic planning aligned with personal risk tolerance levels — especially considering cryptocurrency’s inherent volatility — investors can better position themselves within this evolving landscape.

This overview provides a comprehensive understanding of what potential investors need when exploring opportunities related to the Carv token—from its purpose within its broader ecosystem through recent developments impacting its value—and highlights key considerations necessary before engaging actively with this digital asset class while emphasizing responsible investing practices rooted in transparency and informed decision-making standards common among reputable financial advice sources today.*

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Understanding the Role of Volume in Wave 3 Analysis

Wave analysis, particularly within the framework of Elliott Wave Theory, is a powerful tool used by traders and investors to interpret market movements. Among the five waves that compose a typical Elliott wave cycle, Wave 3 stands out as often being the most significant in terms of price action and market momentum. A key factor that helps validate and analyze this wave is trading volume. Proper understanding of how volume interacts with Wave 3 can enhance decision-making processes, improve trade timing, and reduce risks.

What Is Wave 3 in Elliott Wave Theory?

Elliott Wave Theory posits that financial markets move in repetitive patterns called waves, driven by investor psychology. These waves are categorized into impulsive waves (which move with the trend) and corrective waves (which move against it). In an impulsive sequence consisting of five waves labeled 1 through 5, Wave 3 is typically characterized as:

- The longest and most powerful segment

- Marked by strong upward price movement

- Driven by increasing investor enthusiasm

Because it often signifies a robust bullish phase, identifying when Wave 3 begins can be crucial for traders aiming to capitalize on sustained gains.

How Does Volume Confirm Market Strength During Wave 3?

Volume serves as an essential indicator for confirming whether a particular wave—especially Wave 3—is genuine or potentially misleading. When analyzing this phase:

- High trading volume during Wave 3 suggests strong buying pressure from institutional investors and retail traders alike.

- It indicates broad participation across market participants rather than isolated moves.

This increased activity confirms that the upward momentum is supported by real demand rather than speculative or false breakouts. Consequently, high volume during this period enhances confidence that the trend will continue.

Key Functions of Volume in Validating Wave 3

- Confirmation of Trend Strength: Elevated volume supports the idea that buyers are committed to pushing prices higher.

- Breakout Validation: When prices break through resistance levels with high volume, it signals a genuine breakout rather than a temporary fluctuation.

- Momentum Measurement: Rising volumes reflect growing investor interest; if volumes decline unexpectedly during what appears to be an ongoing wave, it may suggest waning momentum.

Recent Trends Highlighting Volume’s Importance

In recent years—particularly within cryptocurrency markets—volume has played an increasingly prominent role in validating major price moves associated with Elliott Waves:

- During Bitcoin's bull run in late 2020 and early 2021, high-volume surges coincided with rapid increases during what analysts identified as potential third-wave phases.

- Similarly, stock indices like S&P 500 experienced heightened trading activity during their own impulsive phases post-pandemic recovery; these periods saw significant gains supported by robust volumes.

Modern technical analysis tools now integrate volume metrics seamlessly into charting platforms such as TradingView or MetaTrader4/5. These tools enable traders to visualize relationships between price movements and traded quantities more effectively—making it easier to identify authentic Waves Three scenarios.

Potential Risks When Interpreting Volume During Wave 3

While high volume generally indicates strength during a bullish impulse like Wave 3—and thus offers valuable confirmation—it also carries some risks if misinterpreted:

- Excessively high volumes might signal overbought conditions where many investors have already entered positions; this could precede short-term corrections or reversals.

Conversely,

- A sudden drop in trading volume amid what appears to be an ongoing upward trend could indicate exhaustion among buyers—a warning sign that momentum may fade soon or reverse altogether.

Understanding these nuances helps prevent premature entries or exits based solely on raw data without context.

Key Facts About Volume’s Role in Market Movements

To deepen your understanding:

Ralph Nelson Elliott developed his theory back in the early1930s based on observing recurring patterns across various markets.

The lengthening or shortening of Waves often correlates with changes observed through accompanying volume shifts.

Modern technical analysis emphasizes combining multiple indicators—including moving averages alongside volumetric data—to improve accuracy when predicting future trends related to Waves like #3.

Important Considerations for Traders:

- Always verify whether rising prices are accompanied by increasing volumes before assuming strength.

- Be cautious about interpreting extremely high volumes without considering broader market conditions—they might signal overextension instead of continued growth.

By integrating these insights into your strategy rooted firmly within E-A-T principles (Expertise–Authoritativeness–Trustworthiness), you can develop more reliable interpretations aligned with sound analytical practices.

In summary, understanding how trading volume interacts with Elliot's third wave provides critical insights into market strength and potential reversals. High-volume confirmation supports bullish continuation signals while declining volumes warn against overconfidence or impending corrections—a nuanced approach essential for informed trading decisions today’s dynamic markets demand

JCUSER-WVMdslBw

2025-05-29 07:14

What role does Volume play in Wave 3 analysis?

Understanding the Role of Volume in Wave 3 Analysis

Wave analysis, particularly within the framework of Elliott Wave Theory, is a powerful tool used by traders and investors to interpret market movements. Among the five waves that compose a typical Elliott wave cycle, Wave 3 stands out as often being the most significant in terms of price action and market momentum. A key factor that helps validate and analyze this wave is trading volume. Proper understanding of how volume interacts with Wave 3 can enhance decision-making processes, improve trade timing, and reduce risks.

What Is Wave 3 in Elliott Wave Theory?

Elliott Wave Theory posits that financial markets move in repetitive patterns called waves, driven by investor psychology. These waves are categorized into impulsive waves (which move with the trend) and corrective waves (which move against it). In an impulsive sequence consisting of five waves labeled 1 through 5, Wave 3 is typically characterized as:

- The longest and most powerful segment

- Marked by strong upward price movement

- Driven by increasing investor enthusiasm

Because it often signifies a robust bullish phase, identifying when Wave 3 begins can be crucial for traders aiming to capitalize on sustained gains.

How Does Volume Confirm Market Strength During Wave 3?

Volume serves as an essential indicator for confirming whether a particular wave—especially Wave 3—is genuine or potentially misleading. When analyzing this phase:

- High trading volume during Wave 3 suggests strong buying pressure from institutional investors and retail traders alike.

- It indicates broad participation across market participants rather than isolated moves.

This increased activity confirms that the upward momentum is supported by real demand rather than speculative or false breakouts. Consequently, high volume during this period enhances confidence that the trend will continue.

Key Functions of Volume in Validating Wave 3

- Confirmation of Trend Strength: Elevated volume supports the idea that buyers are committed to pushing prices higher.

- Breakout Validation: When prices break through resistance levels with high volume, it signals a genuine breakout rather than a temporary fluctuation.

- Momentum Measurement: Rising volumes reflect growing investor interest; if volumes decline unexpectedly during what appears to be an ongoing wave, it may suggest waning momentum.

Recent Trends Highlighting Volume’s Importance

In recent years—particularly within cryptocurrency markets—volume has played an increasingly prominent role in validating major price moves associated with Elliott Waves:

- During Bitcoin's bull run in late 2020 and early 2021, high-volume surges coincided with rapid increases during what analysts identified as potential third-wave phases.

- Similarly, stock indices like S&P 500 experienced heightened trading activity during their own impulsive phases post-pandemic recovery; these periods saw significant gains supported by robust volumes.

Modern technical analysis tools now integrate volume metrics seamlessly into charting platforms such as TradingView or MetaTrader4/5. These tools enable traders to visualize relationships between price movements and traded quantities more effectively—making it easier to identify authentic Waves Three scenarios.

Potential Risks When Interpreting Volume During Wave 3

While high volume generally indicates strength during a bullish impulse like Wave 3—and thus offers valuable confirmation—it also carries some risks if misinterpreted:

- Excessively high volumes might signal overbought conditions where many investors have already entered positions; this could precede short-term corrections or reversals.

Conversely,

- A sudden drop in trading volume amid what appears to be an ongoing upward trend could indicate exhaustion among buyers—a warning sign that momentum may fade soon or reverse altogether.

Understanding these nuances helps prevent premature entries or exits based solely on raw data without context.

Key Facts About Volume’s Role in Market Movements

To deepen your understanding:

Ralph Nelson Elliott developed his theory back in the early1930s based on observing recurring patterns across various markets.

The lengthening or shortening of Waves often correlates with changes observed through accompanying volume shifts.

Modern technical analysis emphasizes combining multiple indicators—including moving averages alongside volumetric data—to improve accuracy when predicting future trends related to Waves like #3.

Important Considerations for Traders:

- Always verify whether rising prices are accompanied by increasing volumes before assuming strength.

- Be cautious about interpreting extremely high volumes without considering broader market conditions—they might signal overextension instead of continued growth.

By integrating these insights into your strategy rooted firmly within E-A-T principles (Expertise–Authoritativeness–Trustworthiness), you can develop more reliable interpretations aligned with sound analytical practices.

In summary, understanding how trading volume interacts with Elliot's third wave provides critical insights into market strength and potential reversals. High-volume confirmation supports bullish continuation signals while declining volumes warn against overconfidence or impending corrections—a nuanced approach essential for informed trading decisions today’s dynamic markets demand

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Is Dogecoin a Good Investment?

Dogecoin (DOGE) has garnered significant attention in the cryptocurrency world over recent years. Originally created as a joke, it has evolved into one of the most recognizable digital assets, largely due to its active community and high-profile endorsements. But is Dogecoin a good investment? To answer this question comprehensively, it's essential to explore its origins, market performance, risks, and potential future prospects.

Understanding Dogecoin: Origins and Purpose

Dogecoin was introduced in December 2013 by software engineers Billy Markus and Jackson Palmer. Its creation was inspired by the popular "Doge" meme featuring a Shiba Inu dog with captions written in broken English and Comic Sans font. Unlike Bitcoin or Ethereum, which aim to serve as decentralized currencies or platforms for smart contracts respectively, Dogecoin's initial purpose was more lighthearted—serving as a tipping system on social media platforms like Reddit and Twitter.

Despite its humorous beginnings, Dogecoin quickly gained popularity due to its friendly community and low transaction fees. Its inflationary supply model—meaning there’s no maximum cap on total DOGE tokens—has also contributed to its widespread use for microtransactions.

Market Performance and Price Volatility

One of the key factors investors consider is market performance. Dogecoin experienced dramatic price surges during 2021 when social media hype combined with endorsements from influential figures like Elon Musk propelled it into mainstream consciousness. At one point, DOGE reached an all-time high of over $0.70 per coin.

However, such rapid appreciation is often followed by equally swift declines—a hallmark of highly volatile assets like cryptocurrencies. Since then, DOGE's price has fluctuated significantly based on market sentiment rather than fundamental value or technological upgrades alone.

This volatility can be both an opportunity for traders seeking quick gains but also poses substantial risk for long-term investors who prefer stability.

Risks Associated with Investing in Dogecoin

Investing in any cryptocurrency involves inherent risks; Dogecoin is no exception:

- Market Volatility: As mentioned earlier, DOGE prices are highly sensitive to social media trends and celebrity endorsements.

- Lack of Fundamental Value: Unlike projects with clear use cases or technological innovations (e.g., blockchain scalability), DOGE’s primary appeal remains community-driven.

- Regulatory Uncertainty: Governments worldwide are scrutinizing cryptocurrencies more closely; regulatory changes could impact DOGE’s legality or trading environment.

- Inflationary Supply Model: The unlimited supply means that unless demand increases proportionally with supply growth—which isn't guaranteed—the value per coin may decline over time.

Potential investors should weigh these risks carefully against their financial goals before considering adding DOGE to their portfolio.

Factors Supporting Long-Term Potential

While some view Dogecoin primarily as a speculative asset, others see potential for long-term growth based on certain factors:

- Active Community Support: The passionate user base continues promoting adoption through tipping services and charitable donations.

- Mainstream Recognition: High-profile endorsements have increased visibility; if institutional interest grows alongside retail participation—similar to other cryptocurrencies—it could bolster demand.

- Integration Opportunities: Partnerships with payment processors or inclusion within broader crypto ecosystems might enhance utility beyond mere speculation.

However, it's important to note that these factors do not guarantee appreciation but suggest areas where future development could influence value positively.

How Does Dogecoin Compare With Other Cryptocurrencies?

When evaluating whether DOGE is a good investment relative to other digital assets like Bitcoin (BTC) or Ethereum (ETH), several distinctions emerge:

| Aspect | Dogecoin | Bitcoin | Ethereum |

|---|---|---|---|

| Purpose | Meme-based currency / tipping | Digital gold / store of value | Smart contracts platform |

| Supply Cap | No fixed limit | 21 million coins | No fixed limit |

| Market Maturity | Younger & more volatile | Established & relatively stable compared to altcoins | Growing ecosystem & innovation focus |

Investors should consider their risk tolerance: while BTC offers perceived stability among cryptos due to widespread acceptance; ETH provides utility through decentralized applications; DOGE remains more speculative but potentially offers higher short-term gains during hype cycles.

Best Practices Before Investing in Dogecoin

For those contemplating investing in DOGE—or any cryptocurrency—it’s crucial first to conduct thorough research aligned with your financial situation:

- Assess Your Risk Tolerance: Cryptocurrencies can experience extreme swings; only invest what you’re willing—and able—to lose.

- Diversify Portfolio: Avoid putting all funds into one asset class; diversify across different investments including traditional assets if appropriate.

- Use Reputable Exchanges: Purchase from well-known platforms that prioritize security measures such as two-factor authentication (2FA).

- Secure Your Holdings: Store your coins securely using hardware wallets rather than leaving them on exchanges susceptible to hacking.

- Stay Informed About Regulatory Changes: Keep abreast of legal developments affecting cryptocurrencies globally which may influence prices or accessibility.

By following these practices rooted in transparency and prudence—core principles aligned with building trustworthiness—you can better navigate the complex landscape of crypto investing.

In summary,

whether dogecoin represents a good investment depends heavily on individual goals—including appetite for risk—and understanding that it remains primarily driven by speculation rather than intrinsic technological advantages at present. While it boasts an enthusiastic community support base and notable public recognition—which could contribute positively over time—it also faces significant volatility risks typical among meme-based tokens without clear utility beyond social engagement purposes.

Always remember that investing responsibly involves careful consideration backed by credible information about market dynamics—not just hype—and aligning decisions within your broader financial strategy.

JCUSER-F1IIaxXA

2025-05-29 05:38

Is Dogecoin a good investment?

Is Dogecoin a Good Investment?

Dogecoin (DOGE) has garnered significant attention in the cryptocurrency world over recent years. Originally created as a joke, it has evolved into one of the most recognizable digital assets, largely due to its active community and high-profile endorsements. But is Dogecoin a good investment? To answer this question comprehensively, it's essential to explore its origins, market performance, risks, and potential future prospects.

Understanding Dogecoin: Origins and Purpose

Dogecoin was introduced in December 2013 by software engineers Billy Markus and Jackson Palmer. Its creation was inspired by the popular "Doge" meme featuring a Shiba Inu dog with captions written in broken English and Comic Sans font. Unlike Bitcoin or Ethereum, which aim to serve as decentralized currencies or platforms for smart contracts respectively, Dogecoin's initial purpose was more lighthearted—serving as a tipping system on social media platforms like Reddit and Twitter.

Despite its humorous beginnings, Dogecoin quickly gained popularity due to its friendly community and low transaction fees. Its inflationary supply model—meaning there’s no maximum cap on total DOGE tokens—has also contributed to its widespread use for microtransactions.

Market Performance and Price Volatility

One of the key factors investors consider is market performance. Dogecoin experienced dramatic price surges during 2021 when social media hype combined with endorsements from influential figures like Elon Musk propelled it into mainstream consciousness. At one point, DOGE reached an all-time high of over $0.70 per coin.

However, such rapid appreciation is often followed by equally swift declines—a hallmark of highly volatile assets like cryptocurrencies. Since then, DOGE's price has fluctuated significantly based on market sentiment rather than fundamental value or technological upgrades alone.

This volatility can be both an opportunity for traders seeking quick gains but also poses substantial risk for long-term investors who prefer stability.

Risks Associated with Investing in Dogecoin

Investing in any cryptocurrency involves inherent risks; Dogecoin is no exception:

- Market Volatility: As mentioned earlier, DOGE prices are highly sensitive to social media trends and celebrity endorsements.

- Lack of Fundamental Value: Unlike projects with clear use cases or technological innovations (e.g., blockchain scalability), DOGE’s primary appeal remains community-driven.

- Regulatory Uncertainty: Governments worldwide are scrutinizing cryptocurrencies more closely; regulatory changes could impact DOGE’s legality or trading environment.

- Inflationary Supply Model: The unlimited supply means that unless demand increases proportionally with supply growth—which isn't guaranteed—the value per coin may decline over time.

Potential investors should weigh these risks carefully against their financial goals before considering adding DOGE to their portfolio.

Factors Supporting Long-Term Potential

While some view Dogecoin primarily as a speculative asset, others see potential for long-term growth based on certain factors:

- Active Community Support: The passionate user base continues promoting adoption through tipping services and charitable donations.

- Mainstream Recognition: High-profile endorsements have increased visibility; if institutional interest grows alongside retail participation—similar to other cryptocurrencies—it could bolster demand.

- Integration Opportunities: Partnerships with payment processors or inclusion within broader crypto ecosystems might enhance utility beyond mere speculation.

However, it's important to note that these factors do not guarantee appreciation but suggest areas where future development could influence value positively.

How Does Dogecoin Compare With Other Cryptocurrencies?

When evaluating whether DOGE is a good investment relative to other digital assets like Bitcoin (BTC) or Ethereum (ETH), several distinctions emerge:

| Aspect | Dogecoin | Bitcoin | Ethereum |

|---|---|---|---|

| Purpose | Meme-based currency / tipping | Digital gold / store of value | Smart contracts platform |

| Supply Cap | No fixed limit | 21 million coins | No fixed limit |

| Market Maturity | Younger & more volatile | Established & relatively stable compared to altcoins | Growing ecosystem & innovation focus |

Investors should consider their risk tolerance: while BTC offers perceived stability among cryptos due to widespread acceptance; ETH provides utility through decentralized applications; DOGE remains more speculative but potentially offers higher short-term gains during hype cycles.

Best Practices Before Investing in Dogecoin

For those contemplating investing in DOGE—or any cryptocurrency—it’s crucial first to conduct thorough research aligned with your financial situation: