Popular Posts

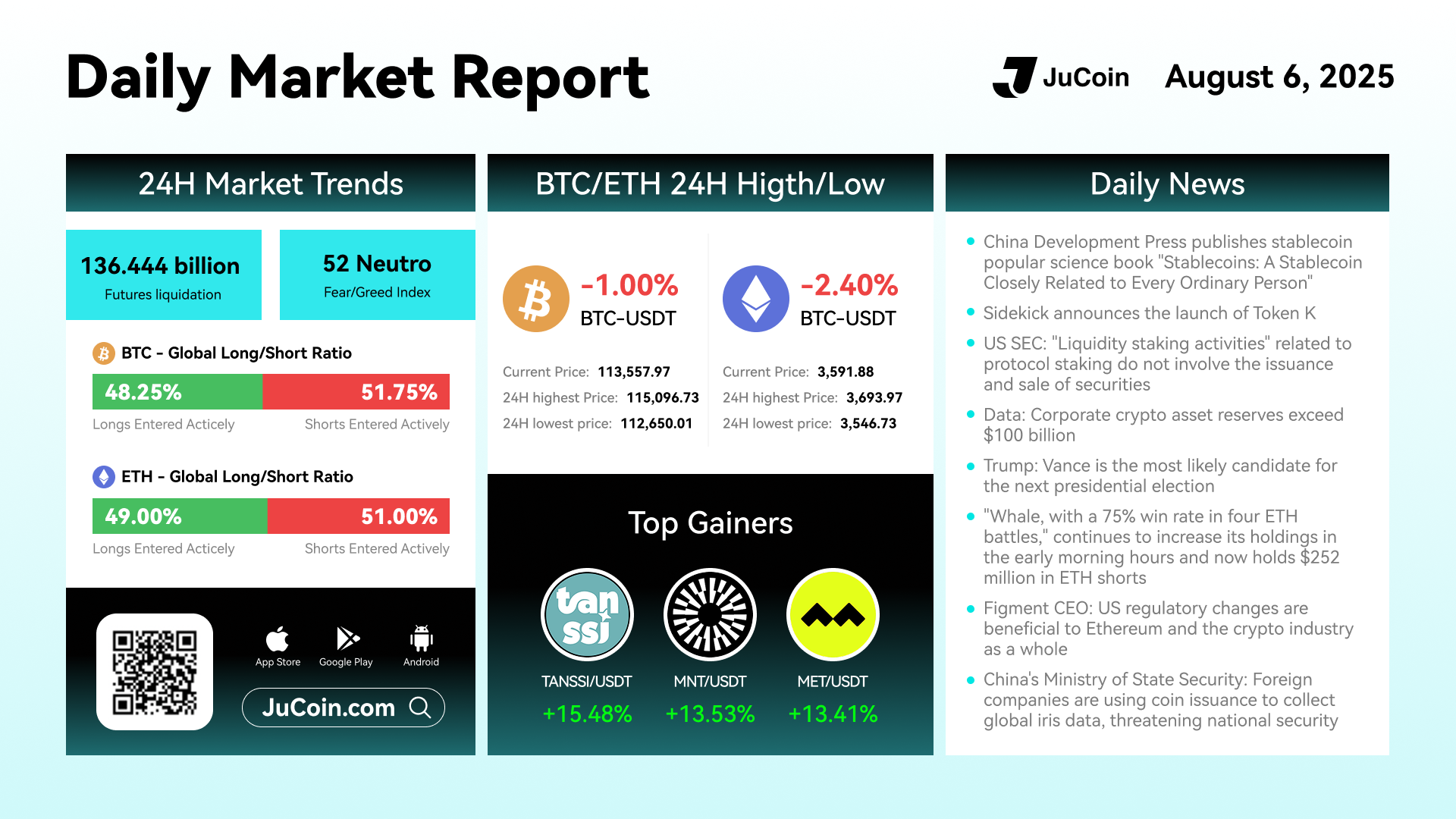

📅 August 6 2025

🎉 Stay updated with the latest crypto market trends!

👉 Trade on:https://bit.ly/3DFYq30

👉 X:https://twitter.com/Jucoinex

👉 APP download: https://www.jucoin.com/en/community-downloads

JuCoin Community

2025-08-06 04:51

#JuCoin Daily Market Report

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

The altcoin market is experiencing significant resurgence with institutional backing and regulatory clarity driving unprecedented growth opportunities. Here's what's shaping the current landscape:

💰 Market Dynamics:

-

Post-Bitcoin capital rotation (Bitcoin hit $118K in July 2025)

86% of institutional investors have or plan digital asset exposure

Altcoin Season Index at 50 (early-stage rotation phase)

Enhanced liquidity through potential altcoin ETPs

🎯 Leading Sectors & Narratives:

1️⃣ AI & Blockchain Integration

-

AI-powered altcoins transitioning from speculation to utility

Autonomous agents creating economic value in crypto ecosystems

2️⃣ Real-World Asset (RWA) Tokenization

-

Market surged to $25B in Q2 2025 (245x increase since 2020)

Bridging traditional finance with blockchain technology

Fractional ownership of real estate, commodities, and fine art

3️⃣ DeFi Evolution

-

Focus on Layer 2 solutions and high-performance blockchains

Innovative liquid staking and restaking protocols

More user-friendly and cost-effective transactions

4️⃣ Gaming & Metaverse

-

Sustainable play-to-earn models

Interoperable metaverse experiences

🏛️ Regulatory Catalysts:

-

EU's MiCA regulation providing comprehensive framework

U.S. stablecoin bills (GENIUS Act) enhancing stability

Spot altcoin ETP discussions (Solana, XRP gaining traction)

XRP hitting multi-year highs amid favorable regulations

💡 Key Investment Insights:

-

Diversify into altcoins with strong fundamentals in emerging sectors

Monitor regulatory developments for institutional flow opportunities

Prioritize projects with active communities and continuous innovation

Understand capital rotation patterns from Bitcoin to altcoins

Focus on utility-driven tokens over speculative assets

🔮 Market Outlook: The shift from speculative to utility-driven altcoins is accelerating, with institutional adoption providing stability and legitimacy. Projects solving real-world problems through AI integration, RWA tokenization, and advanced DeFi protocols are positioned for sustained growth.

Read the complete market analysis with detailed sector breakdowns and investment strategies: 👇 https://blog.jucoin.com/explore-the-current-altcoin-market-in-2025/

#Altcoin #Crypto #Blockchain #AI #RWA #DeFi #Institutional #Regulation #Bitcoin #Ethereum #Solana #XRP #JuCoin #Tokenization #Web3 #Investment #2025 #DigitalAssets #MiCA #ETP

JU Blog

2025-07-31 13:37

🚀 Altcoin Market in 2025: Institutional-Driven Growth & Innovation Surge!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Can Investors Evaluate Cryptocurrencies Other Than Bitcoin?

Understanding the landscape of cryptocurrencies beyond Bitcoin is essential for investors seeking diversification and growth opportunities. With thousands of digital assets available, evaluating their potential requires a strategic approach grounded in key factors such as market metrics, technological innovation, regulatory context, and market dynamics. This guide aims to provide clarity on how to assess these digital assets effectively.

Assessing Market Capitalization and Liquidity

Market capitalization remains one of the most straightforward indicators of a cryptocurrency’s size and stability. It reflects the total value of all circulating coins or tokens and can signal investor confidence. Larger market caps often correlate with higher liquidity, meaning assets can be bought or sold quickly without causing significant price fluctuations. For example, Ethereum (ETH), Binance Coin (BNB), and Solana (SOL) have experienced notable increases in market cap recently, making them more attractive options for investors looking for established projects with growth potential.

Liquidity is equally important because it affects trading flexibility. High liquidity reduces risks associated with large price swings during transactions and allows investors to enter or exit positions smoothly. The expansion of stablecoins like Tether (USDT) has contributed significantly to liquidity pools within crypto markets—offering a perceived safe haven amid volatility—and attracting both retail and institutional traders.

Evaluating Adoption Rates

Adoption rate measures how widely a cryptocurrency is being used by individuals, businesses, financial institutions, or governments. A high adoption rate indicates that the asset has practical utility beyond speculation—such as facilitating cross-border payments or powering decentralized applications—which enhances its long-term viability.

Recent developments show increasing corporate interest; for instance, Meta's exploration into integrating stablecoins into its platforms could dramatically boost adoption rates by enabling seamless international transactions for content creators worldwide. Such moves not only validate the technology but also expand user bases rapidly.

Understanding Regulatory Environments

The legal framework surrounding cryptocurrencies varies significantly across jurisdictions—and this variability influences investment decisions profoundly. Favorable regulations tend to attract more institutional participation by providing clarity on compliance requirements while reducing risks associated with legal uncertainties.

For example, BlackRock’s recent investment in Circle Internet—the issuer behind USDC stablecoin—signals growing institutional confidence supported by clearer regulatory pathways in certain regions like the United States. Conversely, ambiguous or restrictive policies can hinder growth prospects and lead to increased volatility due to sudden regulatory crackdowns or bans.

Technological Innovation: The Backbone of Growth

Technological advancements are crucial drivers shaping the future trajectory of cryptocurrencies other than Bitcoin. Innovations such as improved scalability solutions—like those seen with Solana’s high-throughput blockchain—or interoperability features exemplified by Polkadot enable different networks to communicate seamlessly.

These technological improvements enhance security protocols while expanding usability—for developers creating decentralized apps (dApps) or enterprises adopting blockchain solutions—making these assets more appealing from an investor perspective who values innovation-driven growth potential.

Recent Developments Impacting Market Dynamics

Partnerships between crypto projects and mainstream companies are increasingly common; they serve as validation points that can accelerate adoption rates further down the line.

- For instance: X partnered with Polymarket introduces real-time prediction markets that foster user engagement.

- Stablecoin markets have surged from $20 billion in 2020 to over $246 billion today according to Deutsche Bank research—a testament to their growing importance within crypto ecosystems.

- Institutional investments continue rising; BlackRock’s backing of USDC signals mainstream acceptance.

- Blockchain innovations like Solana's scalability improvements attract developers seeking efficient platforms capable of handling complex applications at scale.

These recent trends highlight an evolving ecosystem where strategic partnerships and technological progress play pivotal roles in shaping future opportunities but also introduce new challenges requiring careful analysis by investors aiming for sustainable gains.

Risks That Could Affect Cryptocurrency Valuations

While promising prospects exist outside Bitcoin’s dominance, several risks warrant attention:

- Regulatory Risks: Uncertain legal environments may lead to sudden restrictions impacting asset prices negatively.

- Market Volatility: Cryptocurrencies are known for sharp price swings driven by sentiment shifts or macroeconomic factors.

- Security Concerns: Hacks targeting exchanges or wallets undermine trust; recent breaches have caused significant losses across various projects.

- Competitive Landscape: Rapid technological advancements mean new entrants could disrupt existing leaders’ positions quickly if they offer superior features or better security measures.

Investors must weigh these risks carefully against potential rewards when diversifying into alternative cryptocurrencies.

Identifying Opportunities Through Due Diligence

To make informed decisions about investing outside Bitcoin:

- Analyze project fundamentals—including whitepapers detailing technology use cases

- Monitor development activity on repositories like GitHub

- Review community engagement levels across social media channels

- Stay updated on regulatory news affecting specific jurisdictions5.. Evaluate partnership announcements indicating industry validation

Combining technical analysis with fundamental insights ensures a balanced approach aligned with best practices recommended by financial experts specializing in digital assets.

Staying Ahead With Continuous Learning

The cryptocurrency space evolves rapidly; therefore,investors should commit ongoing education through reputable sources such as industry reports,regulatory updates,and expert analyses from trusted voices within blockchain communities.This proactive stance helps mitigate risks associated with misinformation while identifying emerging trends early enough for strategic positioning.

Final Thoughts on Evaluating Non-Bitcoin Cryptocurrencies

Assessing alternative cryptocurrencies involves examining multiple dimensions—from market metrics like capitalization and liquidity—to innovative aspects such as technology upgrades and real-world adoption initiatives—all within an evolving regulatory landscape that influences overall stability and growth prospects.

By maintaining diligent research practices combined with awareness of current developments—including partnerships fostering mainstream acceptance—and understanding inherent risks—investors can better navigate this dynamic environment toward making informed investment choices aligned with their risk tolerance levels.

Lo

2025-06-09 05:09

How can investors evaluate cryptocurrencies other than Bitcoin?

How Can Investors Evaluate Cryptocurrencies Other Than Bitcoin?

Understanding the landscape of cryptocurrencies beyond Bitcoin is essential for investors seeking diversification and growth opportunities. With thousands of digital assets available, evaluating their potential requires a strategic approach grounded in key factors such as market metrics, technological innovation, regulatory context, and market dynamics. This guide aims to provide clarity on how to assess these digital assets effectively.

Assessing Market Capitalization and Liquidity

Market capitalization remains one of the most straightforward indicators of a cryptocurrency’s size and stability. It reflects the total value of all circulating coins or tokens and can signal investor confidence. Larger market caps often correlate with higher liquidity, meaning assets can be bought or sold quickly without causing significant price fluctuations. For example, Ethereum (ETH), Binance Coin (BNB), and Solana (SOL) have experienced notable increases in market cap recently, making them more attractive options for investors looking for established projects with growth potential.

Liquidity is equally important because it affects trading flexibility. High liquidity reduces risks associated with large price swings during transactions and allows investors to enter or exit positions smoothly. The expansion of stablecoins like Tether (USDT) has contributed significantly to liquidity pools within crypto markets—offering a perceived safe haven amid volatility—and attracting both retail and institutional traders.

Evaluating Adoption Rates

Adoption rate measures how widely a cryptocurrency is being used by individuals, businesses, financial institutions, or governments. A high adoption rate indicates that the asset has practical utility beyond speculation—such as facilitating cross-border payments or powering decentralized applications—which enhances its long-term viability.

Recent developments show increasing corporate interest; for instance, Meta's exploration into integrating stablecoins into its platforms could dramatically boost adoption rates by enabling seamless international transactions for content creators worldwide. Such moves not only validate the technology but also expand user bases rapidly.

Understanding Regulatory Environments

The legal framework surrounding cryptocurrencies varies significantly across jurisdictions—and this variability influences investment decisions profoundly. Favorable regulations tend to attract more institutional participation by providing clarity on compliance requirements while reducing risks associated with legal uncertainties.

For example, BlackRock’s recent investment in Circle Internet—the issuer behind USDC stablecoin—signals growing institutional confidence supported by clearer regulatory pathways in certain regions like the United States. Conversely, ambiguous or restrictive policies can hinder growth prospects and lead to increased volatility due to sudden regulatory crackdowns or bans.

Technological Innovation: The Backbone of Growth

Technological advancements are crucial drivers shaping the future trajectory of cryptocurrencies other than Bitcoin. Innovations such as improved scalability solutions—like those seen with Solana’s high-throughput blockchain—or interoperability features exemplified by Polkadot enable different networks to communicate seamlessly.

These technological improvements enhance security protocols while expanding usability—for developers creating decentralized apps (dApps) or enterprises adopting blockchain solutions—making these assets more appealing from an investor perspective who values innovation-driven growth potential.

Recent Developments Impacting Market Dynamics

Partnerships between crypto projects and mainstream companies are increasingly common; they serve as validation points that can accelerate adoption rates further down the line.

- For instance: X partnered with Polymarket introduces real-time prediction markets that foster user engagement.

- Stablecoin markets have surged from $20 billion in 2020 to over $246 billion today according to Deutsche Bank research—a testament to their growing importance within crypto ecosystems.

- Institutional investments continue rising; BlackRock’s backing of USDC signals mainstream acceptance.

- Blockchain innovations like Solana's scalability improvements attract developers seeking efficient platforms capable of handling complex applications at scale.

These recent trends highlight an evolving ecosystem where strategic partnerships and technological progress play pivotal roles in shaping future opportunities but also introduce new challenges requiring careful analysis by investors aiming for sustainable gains.

Risks That Could Affect Cryptocurrency Valuations

While promising prospects exist outside Bitcoin’s dominance, several risks warrant attention:

- Regulatory Risks: Uncertain legal environments may lead to sudden restrictions impacting asset prices negatively.

- Market Volatility: Cryptocurrencies are known for sharp price swings driven by sentiment shifts or macroeconomic factors.

- Security Concerns: Hacks targeting exchanges or wallets undermine trust; recent breaches have caused significant losses across various projects.

- Competitive Landscape: Rapid technological advancements mean new entrants could disrupt existing leaders’ positions quickly if they offer superior features or better security measures.

Investors must weigh these risks carefully against potential rewards when diversifying into alternative cryptocurrencies.

Identifying Opportunities Through Due Diligence

To make informed decisions about investing outside Bitcoin:

- Analyze project fundamentals—including whitepapers detailing technology use cases

- Monitor development activity on repositories like GitHub

- Review community engagement levels across social media channels

- Stay updated on regulatory news affecting specific jurisdictions5.. Evaluate partnership announcements indicating industry validation

Combining technical analysis with fundamental insights ensures a balanced approach aligned with best practices recommended by financial experts specializing in digital assets.

Staying Ahead With Continuous Learning

The cryptocurrency space evolves rapidly; therefore,investors should commit ongoing education through reputable sources such as industry reports,regulatory updates,and expert analyses from trusted voices within blockchain communities.This proactive stance helps mitigate risks associated with misinformation while identifying emerging trends early enough for strategic positioning.

Final Thoughts on Evaluating Non-Bitcoin Cryptocurrencies

Assessing alternative cryptocurrencies involves examining multiple dimensions—from market metrics like capitalization and liquidity—to innovative aspects such as technology upgrades and real-world adoption initiatives—all within an evolving regulatory landscape that influences overall stability and growth prospects.

By maintaining diligent research practices combined with awareness of current developments—including partnerships fostering mainstream acceptance—and understanding inherent risks—investors can better navigate this dynamic environment toward making informed investment choices aligned with their risk tolerance levels.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Important Cryptocurrencies Besides Bitcoin: A Comprehensive Overview

The cryptocurrency landscape has expanded far beyond Bitcoin, which remains the most well-known and widely adopted digital currency. Today, a multitude of cryptocurrencies serve diverse purposes—from enabling smart contracts to facilitating decentralized finance (DeFi) and cross-chain interoperability. Understanding these key players is essential for investors, developers, and enthusiasts aiming to navigate the evolving blockchain ecosystem.

Ethereum (ETH): The Pioneer of Smart Contracts

Ethereum stands out as the second-largest cryptocurrency by market capitalization and is often regarded as the backbone of decentralized applications (dApps). Its primary innovation lies in its ability to execute smart contracts—self-executing agreements with code that run on its blockchain. This feature has catalyzed a boom in DeFi platforms, NFT marketplaces, and other decentralized services.

Recent developments have significantly enhanced Ethereum’s scalability and sustainability. In August 2022, Ethereum completed "The Merge," transitioning from proof-of-work (PoW) to proof-of-stake (PoS), drastically reducing energy consumption while increasing network efficiency. Additionally, layer 2 solutions like Polygon and Optimism are being integrated to address transaction speed limitations and high fees.

Ethereum’s robust ecosystem makes it a cornerstone for blockchain innovation. With a market cap exceeding $200 billion and over 120 million tokens in circulation, ETH continues to influence both technological advancements and investment strategies within crypto markets.

Binance Coin (BNB): Powering Binance Ecosystem

Binance Coin is primarily used within the Binance exchange environment but has grown into an integral component of various DeFi projects. As the native token of one of the world's largest crypto exchanges—Binance—BNB facilitates trading fee discounts, token sales on Binance Launchpad, and participation in staking programs.

Recent trends include BNB's integration into DeFi protocols such as lending platforms or yield farming tools built on Binance Smart Chain (BSC). The platform also employs regular token burns—a process where a portion of BNB tokens are permanently removed from circulation—to reduce supply artificially; this mechanism aims to support price stability amid growing demand.

With a market capitalization surpassing $50 billion and rapid transaction speeds—block times around three seconds—BNB exemplifies how exchange-native tokens can evolve into broader utility assets within decentralized finance networks.

Cardano (ADA): Focused on Security & Scalability

Cardano distinguishes itself through its research-driven approach emphasizing security through formal verification methods. It operates on a proof-of-stake consensus mechanism designed for scalability without compromising decentralization or security standards.

A pivotal upgrade was the Alonzo hard fork introduced in September 2021 that enabled smart contract functionality—a critical step toward competing with Ethereum's capabilities. Priorly launched Shelley in July 2020 transitioned Cardano from centralized control towards full decentralization by allowing ADA holders to stake their tokens directly on the network.

Market-wise, Cardano holds over $10 billion in capitalization with approximately 45 billion ADA tokens issued so far. Its relatively longer block time (~20 seconds) balances security considerations with transaction throughput needs—a key factor for developers considering it for scalable dApp deployment.

Solana (SOL): High-Speed Blockchain Platform

Solana offers one of the fastest blockchain networks available today—with block times around 400 milliseconds—and supports high-throughput applications such as NFTs or DeFi protocols requiring quick confirmation times at low costs. Its unique hybrid consensus combines proof-of-stake with innovative technologies like Tower BFT consensus algorithms that optimize performance at scale.

Recently integrating with Fantom enhances cross-chain compatibility between different Layer-1 blockchains—a vital feature given increasing interoperability demands across ecosystems. Solana's NFT marketplace growth via platforms like Magic Eden underscores its rising prominence among creators seeking fast transactions without hefty fees compared to traditional networks like Ethereum.

Market cap exceeding $10 billion reflects investor confidence in Solana’s potential as an infrastructure layer supporting scalable dApps across multiple sectors including gaming, NFTs, or financial services tailored for mass adoption.

Polkadot: Enabling Blockchain Interoperability

Polkadot addresses one fundamental challenge faced by many blockchains: interoperability—the ability for different chains to communicate seamlessly while maintaining their independence through shared security models known as parachains. This architecture allows developers to build specialized chains optimized for specific use cases but still connect them under Polkadot’s umbrella framework efficiently.

Recent activities include testing parachain functionalities via Kusama—the experimental network serving as Polkadot’s “canary” chain—and conducting multiple parachain auctions that attract significant developer interest due to their potential impact on cross-chain communication capabilities across diverse ecosystems globally operating independently yet interconnected effectively through Polkadot’s relay chain infrastructure.

With over $5 billion market cap distributed among nearly one-billion total supply units—and rapid six-second block times—it remains an attractive platform fostering innovation around multi-chain solutions essential for future blockchain development strategies.

Chainlink: Bridging Real-World Data & Smart Contracts

Chainlink specializes in providing reliable off-chain data feeds necessary for executing complex smart contracts securely outside traditional blockchain environments —a critical component underpinning many DeFi applications today.Its decentralized oracle network aggregates data from multiple sources ensuring accuracy before feeding it into various protocols such as lending pools or derivatives markets; this reduces reliance on single points of failure common with centralized data providers.In recent years, Chainlink has seen increased enterprise adoption—including collaborations with major financial institutions—which underscores its importance beyond just retail-focused projects.Market-wise valued at over $5 billion—with all tokens capped at one billion—the project continues expanding its integrations across numerous sectors requiring trustworthy external data inputs while maintaining off-chain operations efficiently.

Navigating Trends & Risks in Cryptocurrency Markets

The rapid growth trajectory observed recently stems largely from technological innovations like layer-2 scaling solutions improving transaction efficiency alongside expanding use cases such as NFTs or DeFi products attracting mainstream attention worldwide.However—as user interest intensifies—the sector faces notable risks including regulatory crackdowns aimed at curbing illicit activities or protecting consumers; technological vulnerabilities during protocol upgrades could introduce unforeseen bugs; plus inherent volatility may lead investors toward substantial gains—or losses—in short periods.Understanding these dynamics helps stakeholders make informed decisions amidst ongoing developments shaping digital asset landscapes globally.

Recognizing Potential Challenges Ahead

While promising prospects exist within these cryptocurrencies’ ecosystems—including increased institutional involvement—they face hurdles too:

- Regulatory Uncertainty: Governments worldwide are scrutinizing crypto activities more closely which might result in restrictive policies impacting trading volumes or project viability.

- Technological Risks: Transition phases like Ethereum's shift towards PoS involve complex upgrades susceptible initially to bugs or security flaws until fully stabilized.

- Market Volatility: Price swings driven by macroeconomic factors can cause sudden downturns affecting investor confidence significantly.

Staying Informed & Making Strategic Moves

For those interested in diversifying beyond Bitcoin investments—or simply understanding alternative cryptocurrencies' roles—it is crucial always to stay updated via reputable sources such as industry reports, official project communications, regulatory updates—and consider consulting financial professionals when making significant investment decisions.

By keeping abreast of technological advancements alongside regulatory shifts—and understanding each project's unique value proposition—you can better position yourself within this rapidly evolving space where innovation meets risk management effectively.

This overview provides foundational insights into some key cryptocurrencies besides Bitcoin. Whether you're exploring investment opportunities or seeking technical knowledge about emerging blockchain platforms — staying informed about these dynamic assets will help you navigate their complexities confidently while aligning your strategies with current trends shaping tomorrow's digital economy.*

JCUSER-F1IIaxXA

2025-06-09 04:58

What are important cryptocurrencies besides Bitcoin?

Important Cryptocurrencies Besides Bitcoin: A Comprehensive Overview

The cryptocurrency landscape has expanded far beyond Bitcoin, which remains the most well-known and widely adopted digital currency. Today, a multitude of cryptocurrencies serve diverse purposes—from enabling smart contracts to facilitating decentralized finance (DeFi) and cross-chain interoperability. Understanding these key players is essential for investors, developers, and enthusiasts aiming to navigate the evolving blockchain ecosystem.

Ethereum (ETH): The Pioneer of Smart Contracts

Ethereum stands out as the second-largest cryptocurrency by market capitalization and is often regarded as the backbone of decentralized applications (dApps). Its primary innovation lies in its ability to execute smart contracts—self-executing agreements with code that run on its blockchain. This feature has catalyzed a boom in DeFi platforms, NFT marketplaces, and other decentralized services.

Recent developments have significantly enhanced Ethereum’s scalability and sustainability. In August 2022, Ethereum completed "The Merge," transitioning from proof-of-work (PoW) to proof-of-stake (PoS), drastically reducing energy consumption while increasing network efficiency. Additionally, layer 2 solutions like Polygon and Optimism are being integrated to address transaction speed limitations and high fees.

Ethereum’s robust ecosystem makes it a cornerstone for blockchain innovation. With a market cap exceeding $200 billion and over 120 million tokens in circulation, ETH continues to influence both technological advancements and investment strategies within crypto markets.

Binance Coin (BNB): Powering Binance Ecosystem

Binance Coin is primarily used within the Binance exchange environment but has grown into an integral component of various DeFi projects. As the native token of one of the world's largest crypto exchanges—Binance—BNB facilitates trading fee discounts, token sales on Binance Launchpad, and participation in staking programs.

Recent trends include BNB's integration into DeFi protocols such as lending platforms or yield farming tools built on Binance Smart Chain (BSC). The platform also employs regular token burns—a process where a portion of BNB tokens are permanently removed from circulation—to reduce supply artificially; this mechanism aims to support price stability amid growing demand.

With a market capitalization surpassing $50 billion and rapid transaction speeds—block times around three seconds—BNB exemplifies how exchange-native tokens can evolve into broader utility assets within decentralized finance networks.

Cardano (ADA): Focused on Security & Scalability

Cardano distinguishes itself through its research-driven approach emphasizing security through formal verification methods. It operates on a proof-of-stake consensus mechanism designed for scalability without compromising decentralization or security standards.

A pivotal upgrade was the Alonzo hard fork introduced in September 2021 that enabled smart contract functionality—a critical step toward competing with Ethereum's capabilities. Priorly launched Shelley in July 2020 transitioned Cardano from centralized control towards full decentralization by allowing ADA holders to stake their tokens directly on the network.

Market-wise, Cardano holds over $10 billion in capitalization with approximately 45 billion ADA tokens issued so far. Its relatively longer block time (~20 seconds) balances security considerations with transaction throughput needs—a key factor for developers considering it for scalable dApp deployment.

Solana (SOL): High-Speed Blockchain Platform

Solana offers one of the fastest blockchain networks available today—with block times around 400 milliseconds—and supports high-throughput applications such as NFTs or DeFi protocols requiring quick confirmation times at low costs. Its unique hybrid consensus combines proof-of-stake with innovative technologies like Tower BFT consensus algorithms that optimize performance at scale.

Recently integrating with Fantom enhances cross-chain compatibility between different Layer-1 blockchains—a vital feature given increasing interoperability demands across ecosystems. Solana's NFT marketplace growth via platforms like Magic Eden underscores its rising prominence among creators seeking fast transactions without hefty fees compared to traditional networks like Ethereum.

Market cap exceeding $10 billion reflects investor confidence in Solana’s potential as an infrastructure layer supporting scalable dApps across multiple sectors including gaming, NFTs, or financial services tailored for mass adoption.

Polkadot: Enabling Blockchain Interoperability

Polkadot addresses one fundamental challenge faced by many blockchains: interoperability—the ability for different chains to communicate seamlessly while maintaining their independence through shared security models known as parachains. This architecture allows developers to build specialized chains optimized for specific use cases but still connect them under Polkadot’s umbrella framework efficiently.

Recent activities include testing parachain functionalities via Kusama—the experimental network serving as Polkadot’s “canary” chain—and conducting multiple parachain auctions that attract significant developer interest due to their potential impact on cross-chain communication capabilities across diverse ecosystems globally operating independently yet interconnected effectively through Polkadot’s relay chain infrastructure.

With over $5 billion market cap distributed among nearly one-billion total supply units—and rapid six-second block times—it remains an attractive platform fostering innovation around multi-chain solutions essential for future blockchain development strategies.

Chainlink: Bridging Real-World Data & Smart Contracts

Chainlink specializes in providing reliable off-chain data feeds necessary for executing complex smart contracts securely outside traditional blockchain environments —a critical component underpinning many DeFi applications today.Its decentralized oracle network aggregates data from multiple sources ensuring accuracy before feeding it into various protocols such as lending pools or derivatives markets; this reduces reliance on single points of failure common with centralized data providers.In recent years, Chainlink has seen increased enterprise adoption—including collaborations with major financial institutions—which underscores its importance beyond just retail-focused projects.Market-wise valued at over $5 billion—with all tokens capped at one billion—the project continues expanding its integrations across numerous sectors requiring trustworthy external data inputs while maintaining off-chain operations efficiently.

Navigating Trends & Risks in Cryptocurrency Markets

The rapid growth trajectory observed recently stems largely from technological innovations like layer-2 scaling solutions improving transaction efficiency alongside expanding use cases such as NFTs or DeFi products attracting mainstream attention worldwide.However—as user interest intensifies—the sector faces notable risks including regulatory crackdowns aimed at curbing illicit activities or protecting consumers; technological vulnerabilities during protocol upgrades could introduce unforeseen bugs; plus inherent volatility may lead investors toward substantial gains—or losses—in short periods.Understanding these dynamics helps stakeholders make informed decisions amidst ongoing developments shaping digital asset landscapes globally.

Recognizing Potential Challenges Ahead

While promising prospects exist within these cryptocurrencies’ ecosystems—including increased institutional involvement—they face hurdles too:

- Regulatory Uncertainty: Governments worldwide are scrutinizing crypto activities more closely which might result in restrictive policies impacting trading volumes or project viability.

- Technological Risks: Transition phases like Ethereum's shift towards PoS involve complex upgrades susceptible initially to bugs or security flaws until fully stabilized.

- Market Volatility: Price swings driven by macroeconomic factors can cause sudden downturns affecting investor confidence significantly.

Staying Informed & Making Strategic Moves

For those interested in diversifying beyond Bitcoin investments—or simply understanding alternative cryptocurrencies' roles—it is crucial always to stay updated via reputable sources such as industry reports, official project communications, regulatory updates—and consider consulting financial professionals when making significant investment decisions.

By keeping abreast of technological advancements alongside regulatory shifts—and understanding each project's unique value proposition—you can better position yourself within this rapidly evolving space where innovation meets risk management effectively.

This overview provides foundational insights into some key cryptocurrencies besides Bitcoin. Whether you're exploring investment opportunities or seeking technical knowledge about emerging blockchain platforms — staying informed about these dynamic assets will help you navigate their complexities confidently while aligning your strategies with current trends shaping tomorrow's digital economy.*

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Is the Community Around Dogecoin?

Dogecoin has become one of the most recognizable cryptocurrencies, not just because of its unique origin but also due to its vibrant and dedicated community. Understanding this community provides insight into how Dogecoin sustains its relevance in the fast-evolving world of digital assets. This article explores the characteristics, activities, and recent developments that define the Dogecoin community.

The Origins and Nature of the Dogecoin Community

Created in December 2013 by Jackson Palmer and Billy Markus, Dogecoin started as a parody aimed at poking fun at the hype surrounding cryptocurrencies like Bitcoin. Despite its humorous beginnings, it quickly cultivated a large following known as the "Doge Army." This nickname reflects both their loyalty and their collective identity rooted in friendliness, supportiveness, and humor.

The community’s culture is characterized by inclusivity—welcoming newcomers regardless of their experience level with cryptocurrency. Members often participate in discussions on social media platforms such as Reddit, Twitter, and Discord. These channels serve as hubs for sharing news, memes (notably featuring Shiba Inu dog images), charity drives, and project updates.

This approachable atmosphere has helped foster trust among members who see themselves not just as investors but also as part of a larger movement promoting decentralization and charitable causes.

Key Activities That Define The Community

Charity Initiatives And Social Impact

One hallmark of the Dogecoin community is its active involvement in philanthropy. Over years, members have organized fundraisers for various causes—from supporting disaster relief efforts to helping sports teams like Jamaica’s Bobsled Team qualify for international competitions. These initiatives demonstrate how communal effort can translate into tangible social benefits while reinforcing positive perceptions about cryptocurrency communities.

Engagement In Development And Innovation

While initially launched without much technological sophistication—being based on Litecoin's code—the Dogecoin ecosystem has evolved through several upgrades aimed at improving scalability and efficiency. Notably:

- Transition to proof-of-stake (PoS) consensus algorithm in 2021

- Efforts to reduce energy consumption

- Enhancements designed to increase transaction speed

Community members actively participate in these development discussions via forums or official channels—highlighting their commitment beyond mere trading or speculation.

Active Social Media Presence

Social media remains central to maintaining engagement within this community. Platforms like Twitter are filled with memes celebrating Doge’s mascot while sharing news about price movements or upcoming projects. Reddit hosts dedicated subreddits where users exchange ideas or seek advice related to investing strategies or technical issues.

This constant stream of interaction fosters a sense of belonging among members worldwide—making it more than just an investment group but rather a supportive network centered around shared values.

Challenges Facing The Dogecoin Community

Despite its strengths, the community faces notable challenges that could impact long-term sustainability:

Market Volatility: As with many cryptocurrencies driven by speculative interest rather than fundamentals alone, prices can fluctuate wildly over short periods.

Regulatory Uncertainty: Governments worldwide are still formulating policies regarding digital currencies; regulatory crackdowns could affect trading activity or project development.

However, resilience appears ingrained within this group; they tend to adapt quickly through increased awareness campaigns or technological innovations aimed at addressing concerns such as energy consumption.

Recent Trends And Future Outlook

As per data from May 2025—a snapshot reflecting ongoing market dynamics—the value of Dogecoin continues experiencing fluctuations influenced by broader crypto trends alongside macroeconomic factors globally. Nonetheless,

- The community remains optimistic about long-term prospects.

- New projects aim at expanding utility—for example: integrating with payment platforms or developing decentralized applications built on top of doge blockchain.

Furthermore,

Social media activity remains high, indicating sustained interest from both retail investors and enthusiasts alike who see potential beyond mere meme status toward real-world adoption possibilities.

How Does The Community Contribute To Its Success?

The strength behind any cryptocurrency lies significantly within its user base—and for Dogecoin that means:

- Active Participation: Regular engagement on social platforms helps spread awareness.

- Charitable Actions: Fundraising efforts enhance reputation while creating positive societal impacts.

- Technological Support: Contributions towards software upgrades ensure continuous improvement.

- Advocacy & Education: Informing others about blockchain benefits promotes wider acceptance.

These elements collectively reinforce trustworthiness (E-A-T principles) essential for credibility among users seeking reliable information about digital currencies' communities.

By understanding these facets—the origins rooted in humor yet driven by genuine communal spirit—it becomes clear whyDogecoin's supporters remain committed despite market ups-and-downs.Their focus on charity work combined with technological progress exemplifies how online communities can shape sustainable ecosystems around even unconventional projects like meme coins.

Keywords: dogecoin community | doge army | cryptocurrency charity | social media crypto groups | blockchain development | crypto market trends

JCUSER-WVMdslBw

2025-05-29 05:47

What is the community like around Dogecoin?

What Is the Community Around Dogecoin?

Dogecoin has become one of the most recognizable cryptocurrencies, not just because of its unique origin but also due to its vibrant and dedicated community. Understanding this community provides insight into how Dogecoin sustains its relevance in the fast-evolving world of digital assets. This article explores the characteristics, activities, and recent developments that define the Dogecoin community.

The Origins and Nature of the Dogecoin Community

Created in December 2013 by Jackson Palmer and Billy Markus, Dogecoin started as a parody aimed at poking fun at the hype surrounding cryptocurrencies like Bitcoin. Despite its humorous beginnings, it quickly cultivated a large following known as the "Doge Army." This nickname reflects both their loyalty and their collective identity rooted in friendliness, supportiveness, and humor.

The community’s culture is characterized by inclusivity—welcoming newcomers regardless of their experience level with cryptocurrency. Members often participate in discussions on social media platforms such as Reddit, Twitter, and Discord. These channels serve as hubs for sharing news, memes (notably featuring Shiba Inu dog images), charity drives, and project updates.

This approachable atmosphere has helped foster trust among members who see themselves not just as investors but also as part of a larger movement promoting decentralization and charitable causes.

Key Activities That Define The Community

Charity Initiatives And Social Impact

One hallmark of the Dogecoin community is its active involvement in philanthropy. Over years, members have organized fundraisers for various causes—from supporting disaster relief efforts to helping sports teams like Jamaica’s Bobsled Team qualify for international competitions. These initiatives demonstrate how communal effort can translate into tangible social benefits while reinforcing positive perceptions about cryptocurrency communities.

Engagement In Development And Innovation

While initially launched without much technological sophistication—being based on Litecoin's code—the Dogecoin ecosystem has evolved through several upgrades aimed at improving scalability and efficiency. Notably:

- Transition to proof-of-stake (PoS) consensus algorithm in 2021

- Efforts to reduce energy consumption

- Enhancements designed to increase transaction speed

Community members actively participate in these development discussions via forums or official channels—highlighting their commitment beyond mere trading or speculation.

Active Social Media Presence

Social media remains central to maintaining engagement within this community. Platforms like Twitter are filled with memes celebrating Doge’s mascot while sharing news about price movements or upcoming projects. Reddit hosts dedicated subreddits where users exchange ideas or seek advice related to investing strategies or technical issues.

This constant stream of interaction fosters a sense of belonging among members worldwide—making it more than just an investment group but rather a supportive network centered around shared values.

Challenges Facing The Dogecoin Community

Despite its strengths, the community faces notable challenges that could impact long-term sustainability:

Market Volatility: As with many cryptocurrencies driven by speculative interest rather than fundamentals alone, prices can fluctuate wildly over short periods.

Regulatory Uncertainty: Governments worldwide are still formulating policies regarding digital currencies; regulatory crackdowns could affect trading activity or project development.

However, resilience appears ingrained within this group; they tend to adapt quickly through increased awareness campaigns or technological innovations aimed at addressing concerns such as energy consumption.

Recent Trends And Future Outlook

As per data from May 2025—a snapshot reflecting ongoing market dynamics—the value of Dogecoin continues experiencing fluctuations influenced by broader crypto trends alongside macroeconomic factors globally. Nonetheless,

- The community remains optimistic about long-term prospects.

- New projects aim at expanding utility—for example: integrating with payment platforms or developing decentralized applications built on top of doge blockchain.

Furthermore,

Social media activity remains high, indicating sustained interest from both retail investors and enthusiasts alike who see potential beyond mere meme status toward real-world adoption possibilities.

How Does The Community Contribute To Its Success?

The strength behind any cryptocurrency lies significantly within its user base—and for Dogecoin that means:

- Active Participation: Regular engagement on social platforms helps spread awareness.

- Charitable Actions: Fundraising efforts enhance reputation while creating positive societal impacts.

- Technological Support: Contributions towards software upgrades ensure continuous improvement.

- Advocacy & Education: Informing others about blockchain benefits promotes wider acceptance.

These elements collectively reinforce trustworthiness (E-A-T principles) essential for credibility among users seeking reliable information about digital currencies' communities.

By understanding these facets—the origins rooted in humor yet driven by genuine communal spirit—it becomes clear whyDogecoin's supporters remain committed despite market ups-and-downs.Their focus on charity work combined with technological progress exemplifies how online communities can shape sustainable ecosystems around even unconventional projects like meme coins.

Keywords: dogecoin community | doge army | cryptocurrency charity | social media crypto groups | blockchain development | crypto market trends

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.