Popular Posts

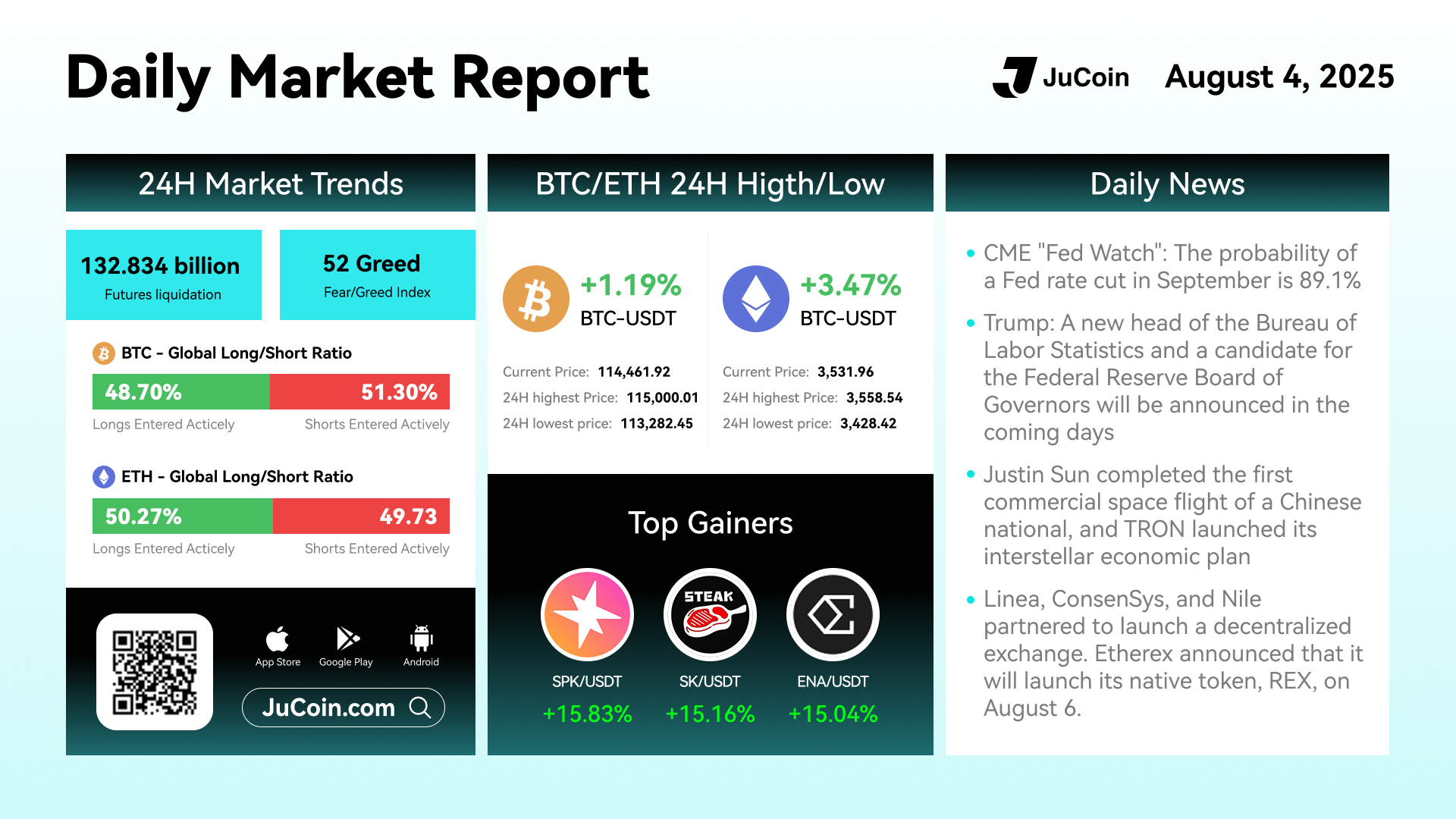

📅 August 4 2025

🎉 Stay updated with the latest crypto market trends!

👉 Trade on:https://bit.ly/3DFYq30

👉 X:https://twitter.com/Jucoinex

👉 APP download: https://www.jucoin.com/en/community-downloads

JuCoin Community

2025-08-04 04:34

🚀 #JuCoin Daily Market Report

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Do Credit Spreads Compare to Other Investment Strategies?

Understanding the role of credit spreads in investment decision-making is essential for investors seeking to optimize their portfolios. While credit spreads are a key indicator within fixed-income markets, they are often compared with other strategies such as equity investing, diversification techniques, and alternative assets. This article explores how credit spread-based strategies stack up against other approaches, providing clarity on their advantages and limitations.

What Are Credit Spread Strategies?

Credit spread strategies involve analyzing the difference in yields between bonds of similar credit quality but different maturities or risk profiles. Investors leverage this information to identify opportunities for higher returns or risk mitigation. For example, buying high-yield bonds when spreads are wide can offer attractive income potential if market conditions improve. Conversely, narrowing spreads might signal a safer environment suitable for more conservative investments.

These strategies are rooted in market sentiment and economic outlooks; widening spreads often indicate increased default risk or economic downturns, while narrowing spreads suggest confidence and stability. As such, credit spread analysis provides real-time insights into market health that can inform tactical investment decisions.

Comparing Credit Spreads with Equity Investment Strategies

Equity investing focuses on purchasing shares of companies with growth potential or dividend income. Unlike fixed-income securities where returns depend largely on interest rates and credit risk perceptions (reflected through credit spreads), equities are driven by company performance, earnings growth, and broader economic factors.

While both approaches aim for capital appreciation or income generation:

- Risk Profile: Equities tend to be more volatile than bonds; however, they also offer higher return potential over the long term.

- Market Sensitivity: Equity prices react sharply to corporate news and macroeconomic shifts; bond markets respond primarily through changes in interest rates and credit conditions.

- Diversification Benefits: Combining equities with fixed-income instruments like bonds can reduce overall portfolio volatility—credit spreads help gauge when bond markets may be more attractive relative to stocks.

In essence, while equity strategies focus on company fundamentals and growth prospects, credit spread-based bond strategies provide insight into macroeconomic risks that influence debt markets.

How Do Credit Spread Strategies Compare With Diversification Techniques?

Diversification is a fundamental principle across all investment styles—spreading investments across asset classes reduces exposure to any single source of risk. Using credit spreads as part of a diversification strategy involves adjusting bond holdings based on perceived risks indicated by spread movements.

For example:

- When credit spreads widen significantly due to economic uncertainty or rising default fears, an investor might reduce exposure to high-yield bonds.

- Conversely, narrowing spreads could signal an opportunity to increase allocations toward corporate debt for better yield prospects without taking excessive additional risk.

Compared with broad diversification across stocks and commodities alone,

- Credit Spread Analysis Offers Tactical Edge: It allows investors to fine-tune their fixed-income allocations based on current market signals.

- Limitations: Relying solely on spread movements without considering other factors like macroeconomic data may lead to misjudgments during volatile periods when signals become noisy.

Thus, integrating credit spread analysis enhances traditional diversification by adding a layer of tactical insight specific to bond markets' dynamics.

Comparing Credit Spreads With Alternative Asset Classes

Alternative investments include real estate (REITs), commodities (gold), hedge funds, private equity—and increasingly cryptocurrencies. These assets often serve as hedges against inflation or sources of uncorrelated returns but come with distinct risks compared to traditional bonds influenced by credit spreads.

For instance:

- Cryptocurrencies have shown high volatility unrelated directly to traditional financial indicators like interest rates or default risks reflected in bond yields.

- Real estate investments tend not directly tied but can be affected indirectly through broader economic conditions impacting borrowing costs signaled via widening or narrowing credits spreds.

Investors comparing these options should consider:

- The liquidity profile

- Risk-return characteristics

- Correlation patterns during different economic cycles

While alternative assets diversify away from fixed-income risks indicated by changing credits spreds—they do not replace the predictive power that analyzing these spreds offers regarding macroeconomic health.

Strengths & Limitations of Using Credit Spreads Compared To Other Strategies

Credit-spread-based investing provides valuable insights into market sentiment about default risk which is crucial during periods of economic stress—such as recessions—or rapid rate hikes by central banks[1]. Its strength lies in its abilityto act as an early warning system for deteriorating financial conditions before they fully materialize in stock prices or GDP figures[2].

However,

Strengths:

– Provides timely signals about systemic risks– Enhances tactical asset allocation decisions– Helps identify undervalued debt securities during turbulent times

Limitations:

– Can be misleading if used without considering macroeconomic context– Sensitive to liquidity shocks affecting bond markets disproportionately– Not always predictive during unprecedented events like pandemics

Compared with passive buy-and-hold equity approaches—which rely heavily on long-term fundamentals—credit-spread trading demands active management skills but offers potentially higher short-term gains if executed correctly.

Integrating Multiple Approaches for Better Portfolio Management

The most effective investment portfolios typically combine multiple strategies tailored accordingto individual goalsandrisk tolerance.[3] Incorporating insights fromcreditspread analysis alongside equity valuation modelsand diversifications techniques creates a balanced approach capableof navigating varyingmarket environments effectively.[4]

For example,

- Usecreditspread trendsas partof your macroeconomic outlook assessment,

- Combine thiswith fundamental analysisof individual stocks,

- Maintain diversified holdingsacross asset classes including equities,reits,and commodities,

- Adjust allocations dynamically basedon evolving signalsfrom all sources,

This integrated approach leverages each strategy's strengths while mitigating weaknesses inherentin any single method.

Final Thoughts: Choosing Between Different Investment Approaches

When evaluating whether tousecredit-spread-basedstrategies versus others,it’s importantto consider yourinvestment horizon,timeframe,andrisk appetite.[5] Fixed-income tactics centered around monitoringcreditspreds excel at capturing short-to-medium-term shiftsin market sentimentanddefault expectations,but may underperformduring prolonged bull runsor whenmacro indicators diverge frombond-market signals.[6]

Meanwhile,equity-focusedinvestmentsoffergrowthpotentialbutcomewithhighervolatilityand longer recovery periodsafter downturns.[7] Diversification remains key—blending multiple methods ensures resilienceagainst unpredictablemarket shockswhile aligningwith personalfinancial goals.[8]

By understanding how each approach compares—and recognizingthe unique advantagesofferedbycredit-spread analysis—youcan crafta well-informedstrategy suitedtothe currentmarket landscape.

References

[1] Smith J., "The Role Of Credit Spreads In Economic Forecasting," Journal Of Financial Markets 2022

[2] Lee A., "Market Sentiment Indicators And Their Predictive Power," Financial Analysts Journal 2023

[3] Brown P., "Portfolio Diversification Techniques," Investopedia 2020

[4] Johnson M., "Combining Asset Allocation Models," CFA Institute Publications 2021

[5] Davis R., "Investment Time Horizons And Strategy Selection," Harvard Business Review 2019

[6] Patel S., "Risks Of Fixed Income Investing During Economic Cycles," Bloomberg Markets 2020

[7] Nguyen T., "Equity vs Bond Investing During Market Volatility," Wall Street Journal 2021

[8] Carter L., "Building Resilient Portfolios Through Multi-Asset Strategies," Financial Times 2022

Lo

2025-06-09 22:25

How do credit spreads compare to other investment strategies?

How Do Credit Spreads Compare to Other Investment Strategies?

Understanding the role of credit spreads in investment decision-making is essential for investors seeking to optimize their portfolios. While credit spreads are a key indicator within fixed-income markets, they are often compared with other strategies such as equity investing, diversification techniques, and alternative assets. This article explores how credit spread-based strategies stack up against other approaches, providing clarity on their advantages and limitations.

What Are Credit Spread Strategies?

Credit spread strategies involve analyzing the difference in yields between bonds of similar credit quality but different maturities or risk profiles. Investors leverage this information to identify opportunities for higher returns or risk mitigation. For example, buying high-yield bonds when spreads are wide can offer attractive income potential if market conditions improve. Conversely, narrowing spreads might signal a safer environment suitable for more conservative investments.

These strategies are rooted in market sentiment and economic outlooks; widening spreads often indicate increased default risk or economic downturns, while narrowing spreads suggest confidence and stability. As such, credit spread analysis provides real-time insights into market health that can inform tactical investment decisions.

Comparing Credit Spreads with Equity Investment Strategies

Equity investing focuses on purchasing shares of companies with growth potential or dividend income. Unlike fixed-income securities where returns depend largely on interest rates and credit risk perceptions (reflected through credit spreads), equities are driven by company performance, earnings growth, and broader economic factors.

While both approaches aim for capital appreciation or income generation:

- Risk Profile: Equities tend to be more volatile than bonds; however, they also offer higher return potential over the long term.

- Market Sensitivity: Equity prices react sharply to corporate news and macroeconomic shifts; bond markets respond primarily through changes in interest rates and credit conditions.

- Diversification Benefits: Combining equities with fixed-income instruments like bonds can reduce overall portfolio volatility—credit spreads help gauge when bond markets may be more attractive relative to stocks.

In essence, while equity strategies focus on company fundamentals and growth prospects, credit spread-based bond strategies provide insight into macroeconomic risks that influence debt markets.

How Do Credit Spread Strategies Compare With Diversification Techniques?

Diversification is a fundamental principle across all investment styles—spreading investments across asset classes reduces exposure to any single source of risk. Using credit spreads as part of a diversification strategy involves adjusting bond holdings based on perceived risks indicated by spread movements.

For example:

- When credit spreads widen significantly due to economic uncertainty or rising default fears, an investor might reduce exposure to high-yield bonds.

- Conversely, narrowing spreads could signal an opportunity to increase allocations toward corporate debt for better yield prospects without taking excessive additional risk.

Compared with broad diversification across stocks and commodities alone,

- Credit Spread Analysis Offers Tactical Edge: It allows investors to fine-tune their fixed-income allocations based on current market signals.

- Limitations: Relying solely on spread movements without considering other factors like macroeconomic data may lead to misjudgments during volatile periods when signals become noisy.

Thus, integrating credit spread analysis enhances traditional diversification by adding a layer of tactical insight specific to bond markets' dynamics.

Comparing Credit Spreads With Alternative Asset Classes

Alternative investments include real estate (REITs), commodities (gold), hedge funds, private equity—and increasingly cryptocurrencies. These assets often serve as hedges against inflation or sources of uncorrelated returns but come with distinct risks compared to traditional bonds influenced by credit spreads.

For instance:

- Cryptocurrencies have shown high volatility unrelated directly to traditional financial indicators like interest rates or default risks reflected in bond yields.

- Real estate investments tend not directly tied but can be affected indirectly through broader economic conditions impacting borrowing costs signaled via widening or narrowing credits spreds.

Investors comparing these options should consider:

- The liquidity profile

- Risk-return characteristics

- Correlation patterns during different economic cycles

While alternative assets diversify away from fixed-income risks indicated by changing credits spreds—they do not replace the predictive power that analyzing these spreds offers regarding macroeconomic health.

Strengths & Limitations of Using Credit Spreads Compared To Other Strategies

Credit-spread-based investing provides valuable insights into market sentiment about default risk which is crucial during periods of economic stress—such as recessions—or rapid rate hikes by central banks[1]. Its strength lies in its abilityto act as an early warning system for deteriorating financial conditions before they fully materialize in stock prices or GDP figures[2].

However,

Strengths:

– Provides timely signals about systemic risks– Enhances tactical asset allocation decisions– Helps identify undervalued debt securities during turbulent times

Limitations:

– Can be misleading if used without considering macroeconomic context– Sensitive to liquidity shocks affecting bond markets disproportionately– Not always predictive during unprecedented events like pandemics

Compared with passive buy-and-hold equity approaches—which rely heavily on long-term fundamentals—credit-spread trading demands active management skills but offers potentially higher short-term gains if executed correctly.

Integrating Multiple Approaches for Better Portfolio Management

The most effective investment portfolios typically combine multiple strategies tailored accordingto individual goalsandrisk tolerance.[3] Incorporating insights fromcreditspread analysis alongside equity valuation modelsand diversifications techniques creates a balanced approach capableof navigating varyingmarket environments effectively.[4]

For example,

- Usecreditspread trendsas partof your macroeconomic outlook assessment,

- Combine thiswith fundamental analysisof individual stocks,

- Maintain diversified holdingsacross asset classes including equities,reits,and commodities,

- Adjust allocations dynamically basedon evolving signalsfrom all sources,

This integrated approach leverages each strategy's strengths while mitigating weaknesses inherentin any single method.

Final Thoughts: Choosing Between Different Investment Approaches

When evaluating whether tousecredit-spread-basedstrategies versus others,it’s importantto consider yourinvestment horizon,timeframe,andrisk appetite.[5] Fixed-income tactics centered around monitoringcreditspreds excel at capturing short-to-medium-term shiftsin market sentimentanddefault expectations,but may underperformduring prolonged bull runsor whenmacro indicators diverge frombond-market signals.[6]

Meanwhile,equity-focusedinvestmentsoffergrowthpotentialbutcomewithhighervolatilityand longer recovery periodsafter downturns.[7] Diversification remains key—blending multiple methods ensures resilienceagainst unpredictablemarket shockswhile aligningwith personalfinancial goals.[8]

By understanding how each approach compares—and recognizingthe unique advantagesofferedbycredit-spread analysis—youcan crafta well-informedstrategy suitedtothe currentmarket landscape.

References

[1] Smith J., "The Role Of Credit Spreads In Economic Forecasting," Journal Of Financial Markets 2022

[2] Lee A., "Market Sentiment Indicators And Their Predictive Power," Financial Analysts Journal 2023

[3] Brown P., "Portfolio Diversification Techniques," Investopedia 2020

[4] Johnson M., "Combining Asset Allocation Models," CFA Institute Publications 2021

[5] Davis R., "Investment Time Horizons And Strategy Selection," Harvard Business Review 2019

[6] Patel S., "Risks Of Fixed Income Investing During Economic Cycles," Bloomberg Markets 2020

[7] Nguyen T., "Equity vs Bond Investing During Market Volatility," Wall Street Journal 2021

[8] Carter L., "Building Resilient Portfolios Through Multi-Asset Strategies," Financial Times 2022

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Why Is Bithumb Warning Users About Bitcoin Gold?

Bithumb, one of South Korea’s leading cryptocurrency exchanges, has recently issued a warning to its users regarding Bitcoin Gold (BTG). This move has sparked curiosity and concern among traders and investors. To understand the implications fully, it’s essential to explore the background of Bitcoin Gold, the reasons behind Bithumb's cautionary stance, and what this means for the broader crypto community.

Understanding Bitcoin Gold: A Brief History

Bitcoin Gold was launched in October 2017 as a hard fork of the original Bitcoin blockchain. The primary motivation behind BTG was to create a more decentralized mining environment by making it resistant to ASIC (Application-Specific Integrated Circuit) hardware. Unlike traditional Bitcoin mining that relies heavily on specialized equipment, BTG aimed to enable GPU-based mining—allowing individual miners with standard graphics cards to participate more easily.

This vision resonated with many in the crypto community who believed that decentralization is fundamental for maintaining security and fairness within blockchain networks. However, despite its initial promise, Bitcoin Gold has faced numerous challenges over time.

Security Concerns Surrounding Bitcoin Gold

One of the most significant issues associated with BTG is security vulnerabilities. In 2018, BTG suffered a major hacking incident where approximately 17,000 coins were stolen—valued at around $18 million at that time. Hackers exploited weaknesses in its network or wallet infrastructure to carry out this theft.

Such incidents have raised red flags about BTG's security protocols and overall resilience against cyberattacks. For exchanges like Bithumb operating in highly regulated environments such as South Korea—which enforces strict compliance standards—supporting or even listing cryptocurrencies with known security issues can pose substantial risks.

Regulatory Environment Impact on Cryptocurrency Support

South Korea maintains rigorous regulations concerning cryptocurrency trading platforms. The government emphasizes investor protection and anti-money laundering measures while closely monitoring digital assets' compliance status.

In this context, exchanges like Bithumb are cautious about supporting cryptocurrencies that might attract regulatory scrutiny due to past security breaches or ambiguous legal standing. Supporting an asset like BTG—which has experienced notable hacks—could potentially expose them to legal liabilities or reputational damage if users suffer losses linked directly or indirectly from these vulnerabilities.

Market Volatility and Investor Risks

Cryptocurrencies are inherently volatile; prices can fluctuate dramatically within short periods due to market sentiment shifts or external events. For coins like BTG—with relatively lower liquidity compared to mainstream assets—the volatility can be even more pronounced.

Investors holding BTG may face sudden value drops during market downturns or after negative news reports related to security concerns or governance disputes within its community. Such instability makes it less attractive for risk-averse traders seeking safer investment options on platforms like Bithumb.

Community Disputes Affecting Trustworthiness

The development community behind Bitcoin Gold has experienced internal disagreements over governance decisions and future development directions. These controversies sometimes lead to skepticism among users regarding project transparency and long-term viability.

When trust diminishes within a cryptocurrency’s ecosystem due to internal conflicts—or perceived mismanagement—it often results in decreased user confidence across trading platforms supporting that coin—a factor likely influencing Bithumb's decision-making process when issuing warnings about BTG support.

Recent Developments Without Major Security Breaches

As of June 2025, there have been no recent major hacks targeting Bithumb’s holdings specifically related directly to BTC holdings; however, ongoing market trends continue affecting perceptions around BTC-related assets including BTG:

- Fluctuating prices driven by macroeconomic factors

- Regulatory updates impacting how exchanges handle certain tokens

- Community debates influencing project credibility

These elements contribute cumulatively toward cautious stances taken by prominent exchanges such as Bithumb regarding specific cryptocurrencies like BTC-Gold.

Potential Impacts of Bithumb’s Warning on Users & Markets

Bithumb's warning could influence various aspects of trading activity:

User Confidence: Traders might become hesitant about holding or trading BTG through Bithumb if they perceive increased risk.

Market Dynamics: Negative sentiment stemming from warnings can lead investors toward liquidating their positions faster than usual—potentially causing price declines.

Regulatory Scrutiny: Authorities may interpret such warnings as signals indicating potential issues within certain tokens’ ecosystems—prompting further investigations.

Community Reactions: Supporters of Bitcoin Gold might respond defensively against perceived unfair treatment from major exchanges which could impact future project developments or collaborations.

Understanding these potential outcomes helps investors make informed decisions aligned with their risk appetite while recognizing broader industry trends influenced by exchange policies.

Key Takeaways for Investors:

- Always verify an exchange’s official communications before making trades involving high-risk tokens.

- Be aware that past security breaches significantly influence current regulatory attitudes towards specific cryptocurrencies.

- Diversify holdings across different assets rather than concentrating investments solely in volatile tokens like BTG.

In summary, BithUMB's warning about Bitcoin Gold reflects ongoing concerns surrounding its security history, regulatory environment considerations in South Korea, market volatility risks, and internal community disputes affecting trustworthiness—all critical factors for traders evaluating whether support for such assets aligns with their safety standards and investment goals. Staying informed through credible sources remains essential amid evolving developments within the crypto landscape.

Keywords: bitcoin gold warning bithubb | btg hack history | south korea crypto regulation | cryptocurrency market volatility | crypto community disputes

kai

2025-06-05 07:05

Why is Bithumb warning users about Bitcoin Gold?

Why Is Bithumb Warning Users About Bitcoin Gold?

Bithumb, one of South Korea’s leading cryptocurrency exchanges, has recently issued a warning to its users regarding Bitcoin Gold (BTG). This move has sparked curiosity and concern among traders and investors. To understand the implications fully, it’s essential to explore the background of Bitcoin Gold, the reasons behind Bithumb's cautionary stance, and what this means for the broader crypto community.

Understanding Bitcoin Gold: A Brief History

Bitcoin Gold was launched in October 2017 as a hard fork of the original Bitcoin blockchain. The primary motivation behind BTG was to create a more decentralized mining environment by making it resistant to ASIC (Application-Specific Integrated Circuit) hardware. Unlike traditional Bitcoin mining that relies heavily on specialized equipment, BTG aimed to enable GPU-based mining—allowing individual miners with standard graphics cards to participate more easily.

This vision resonated with many in the crypto community who believed that decentralization is fundamental for maintaining security and fairness within blockchain networks. However, despite its initial promise, Bitcoin Gold has faced numerous challenges over time.

Security Concerns Surrounding Bitcoin Gold

One of the most significant issues associated with BTG is security vulnerabilities. In 2018, BTG suffered a major hacking incident where approximately 17,000 coins were stolen—valued at around $18 million at that time. Hackers exploited weaknesses in its network or wallet infrastructure to carry out this theft.

Such incidents have raised red flags about BTG's security protocols and overall resilience against cyberattacks. For exchanges like Bithumb operating in highly regulated environments such as South Korea—which enforces strict compliance standards—supporting or even listing cryptocurrencies with known security issues can pose substantial risks.

Regulatory Environment Impact on Cryptocurrency Support

South Korea maintains rigorous regulations concerning cryptocurrency trading platforms. The government emphasizes investor protection and anti-money laundering measures while closely monitoring digital assets' compliance status.

In this context, exchanges like Bithumb are cautious about supporting cryptocurrencies that might attract regulatory scrutiny due to past security breaches or ambiguous legal standing. Supporting an asset like BTG—which has experienced notable hacks—could potentially expose them to legal liabilities or reputational damage if users suffer losses linked directly or indirectly from these vulnerabilities.

Market Volatility and Investor Risks

Cryptocurrencies are inherently volatile; prices can fluctuate dramatically within short periods due to market sentiment shifts or external events. For coins like BTG—with relatively lower liquidity compared to mainstream assets—the volatility can be even more pronounced.

Investors holding BTG may face sudden value drops during market downturns or after negative news reports related to security concerns or governance disputes within its community. Such instability makes it less attractive for risk-averse traders seeking safer investment options on platforms like Bithumb.

Community Disputes Affecting Trustworthiness

The development community behind Bitcoin Gold has experienced internal disagreements over governance decisions and future development directions. These controversies sometimes lead to skepticism among users regarding project transparency and long-term viability.

When trust diminishes within a cryptocurrency’s ecosystem due to internal conflicts—or perceived mismanagement—it often results in decreased user confidence across trading platforms supporting that coin—a factor likely influencing Bithumb's decision-making process when issuing warnings about BTG support.

Recent Developments Without Major Security Breaches

As of June 2025, there have been no recent major hacks targeting Bithumb’s holdings specifically related directly to BTC holdings; however, ongoing market trends continue affecting perceptions around BTC-related assets including BTG:

- Fluctuating prices driven by macroeconomic factors

- Regulatory updates impacting how exchanges handle certain tokens

- Community debates influencing project credibility

These elements contribute cumulatively toward cautious stances taken by prominent exchanges such as Bithumb regarding specific cryptocurrencies like BTC-Gold.

Potential Impacts of Bithumb’s Warning on Users & Markets

Bithumb's warning could influence various aspects of trading activity:

User Confidence: Traders might become hesitant about holding or trading BTG through Bithumb if they perceive increased risk.

Market Dynamics: Negative sentiment stemming from warnings can lead investors toward liquidating their positions faster than usual—potentially causing price declines.

Regulatory Scrutiny: Authorities may interpret such warnings as signals indicating potential issues within certain tokens’ ecosystems—prompting further investigations.

Community Reactions: Supporters of Bitcoin Gold might respond defensively against perceived unfair treatment from major exchanges which could impact future project developments or collaborations.

Understanding these potential outcomes helps investors make informed decisions aligned with their risk appetite while recognizing broader industry trends influenced by exchange policies.

Key Takeaways for Investors:

- Always verify an exchange’s official communications before making trades involving high-risk tokens.

- Be aware that past security breaches significantly influence current regulatory attitudes towards specific cryptocurrencies.

- Diversify holdings across different assets rather than concentrating investments solely in volatile tokens like BTG.

In summary, BithUMB's warning about Bitcoin Gold reflects ongoing concerns surrounding its security history, regulatory environment considerations in South Korea, market volatility risks, and internal community disputes affecting trustworthiness—all critical factors for traders evaluating whether support for such assets aligns with their safety standards and investment goals. Staying informed through credible sources remains essential amid evolving developments within the crypto landscape.

Keywords: bitcoin gold warning bithubb | btg hack history | south korea crypto regulation | cryptocurrency market volatility | crypto community disputes

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Are the Risks Associated with Liquidity Pools?

Liquidity pools are a fundamental component of decentralized finance (DeFi), enabling seamless trading and liquidity provision on blockchain platforms. While they offer numerous benefits, such as earning fees and supporting decentralized markets, they also carry significant risks that users must understand. This article explores the primary dangers associated with liquidity pools, providing insights into how these risks can impact investors and platform operators alike.

Understanding Impermanent Loss in Liquidity Pools

One of the most well-known risks for liquidity providers is impermanent loss. This occurs when the relative prices of assets within a pool change significantly after you’ve deposited your tokens. Since liquidity pools operate on automated market maker (AMM) models—like those used by Uniswap or SushiSwap—the ratio of assets adjusts based on trades happening within the pool. If one asset appreciates while another depreciates, your share’s value may be less than if you had simply held onto your tokens outside the pool.

Impermanent loss is particularly concerning during periods of high market volatility when asset prices fluctuate rapidly. Although it can sometimes be offset by trading fees earned from providing liquidity, in volatile markets, these earnings might not fully compensate for potential losses. Therefore, understanding this risk is crucial for anyone considering participating in DeFi liquidity provisioning.

Smart Contract Vulnerabilities

Since liquidity pools operate through smart contracts—self-executing code stored on blockchain networks—they are inherently susceptible to bugs or vulnerabilities in their codebase. Despite rigorous audits and security measures, exploits have occurred that allow malicious actors to drain funds from pools or manipulate contract behavior.

For example, notable incidents like the Curve Finance exploit in August 2021 resulted in losses exceeding $60 million due to vulnerabilities exploited within smart contracts managing pooled assets. Such events highlight that even well-established DeFi platforms are not immune to security flaws. Users should consider this risk seriously and prefer platforms with transparent audit histories and active security communities.

Market Volatility Impact

Cryptocurrency markets are known for their extreme volatility; prices can swing dramatically within short timeframes due to macroeconomic factors, regulatory news, or technological developments. When participating in liquidity pools containing volatile assets like tokens or stablecoins tied to fluctuating fiat currencies, providers face exposure to sudden value changes.

High volatility can lead to rapid devaluation of pooled assets if exit strategies aren’t executed swiftly enough during downturns. Conversely, during bullish runs where asset values surge unexpectedly, providers might experience gains—but only if they manage their positions carefully before market corrections occur.

Regulatory Uncertainty Surrounding DeFi

The regulatory landscape for decentralized finance remains uncertain worldwide. Governments and financial authorities are increasingly scrutinizing DeFi protocols due to concerns over money laundering, fraud prevention, investor protection—and compliance with existing financial laws.

Changes in regulation could impose restrictions on certain types of transactions or require licensing that many DeFi projects currently lack compliance with voluntarily—potentially leading to platform shutdowns or operational disruptions affecting users’ funds stored within liquidity pools.

This regulatory ambiguity adds an additional layer of risk for participants who may find themselves unable to withdraw funds freely or face legal challenges unexpectedly—a concern especially relevant as governments develop clearer policies around crypto-assets and DeFi activities.

Counterparty Risks: Lending Your Assets into a Pool

When providing liquidity via pooling mechanisms like AMMs (Automated Market Makers), users essentially lend their tokens into a shared smart contract ecosystem rather than directly trading with other individuals. This introduces counterparty risk—the possibility that the pool operator could misuse funds intentionally or neglect proper management practices leading to losses.

While most reputable platforms implement safeguards such as multisignature wallets and transparency reports—these do not eliminate all risks entirely—especially if malicious actors gain control over key governance functions or exploit vulnerabilities allowing them access beyond intended permissions.

Key Points:

- Pool operators might mismanage funds

- Governance attacks could alter protocol rules

- Lack of oversight increases vulnerability

Front-Running Attacks & Market Manipulation

Front-running is a common threat specific to blockchain-based systems where miners—or bots acting quickly—can see pending transactions before they’re confirmed on-chain—and then act upon this information unfairly by executing similar trades at advantageous prices before others do so naturally.

In liqudity pools using AMMs like Uniswap V3’s concentrated LPs—which allow providers more control over price ranges—the risk intensifies because attackers can manipulate transaction ordering through techniques such as sandwich attacks—that artificially inflate trade costs for unsuspecting traders while profiting at their expense.

Examples include:

- Exploiting delays between order placement & execution

- Manipulating price feeds via flash loans

- Creating artificial volume spikes

These tactics undermine fair trading conditions and erode trust among users who rely on transparent pricing mechanisms inherent in decentralized exchanges (DEXs).

Recent Incidents Highlighting Risks

The fast-paced evolution of DeFi has seen several high-profile security breaches emphasizing these risks:

SushiSwap Hack (September 2020): Approximately $13 million worth stolen due primarily to vulnerabilities exploited during deployment.

Curve Finance Exploit (August 2021): Losses exceeding $60 million caused by flaws within its smart contract architecture.

Such incidents underscore why continuous security audits—and community vigilance—are vital components when engaging with complex financial instruments like liquidity pools.

Impact:

Security breaches shake user confidencePotentially lead regulators’ increased scrutinyFinancial losses discourage participation

How Participants Can Mitigate These Risks

While no investment is entirely without danger—including traditional finance—it’s essential for users involved in DeFI ecosystems involving liquidity pools to adopt best practices:

- Conduct Due Diligence: Review audit reports; assess platform reputation; understand underlying smart contract mechanics.

- Diversify Investments: Avoid putting all capital into one pool; spread across multiple protocols/assets.3.. Stay Informed: Follow updates about platform upgrades/security patches/regulatory changes.4.. Use Risk Management Tools: Consider setting stop-loss orders where possible; utilize insurance protocols designed specifically for crypto-assets.5.. Monitor Asset Prices Regularly: Be prepared quickly during volatile periods—to minimize potential impermanent loss.

Understanding these inherent risks helps both individual investors and developers build more resilient strategies around participation in decentralized finance ecosystems involving liquidty pooling mechanisms — ultimately fostering safer innovation amid rapid growth trends shaping today’s crypto landscape.

Keywords:liquidity pools risks | impermanent loss | smart contract vulnerability | market volatility | DeFi regulation | front-running attacks | crypto security

Lo

2025-05-29 07:52

What are the risks associated with liquidity pools?

What Are the Risks Associated with Liquidity Pools?

Liquidity pools are a fundamental component of decentralized finance (DeFi), enabling seamless trading and liquidity provision on blockchain platforms. While they offer numerous benefits, such as earning fees and supporting decentralized markets, they also carry significant risks that users must understand. This article explores the primary dangers associated with liquidity pools, providing insights into how these risks can impact investors and platform operators alike.

Understanding Impermanent Loss in Liquidity Pools

One of the most well-known risks for liquidity providers is impermanent loss. This occurs when the relative prices of assets within a pool change significantly after you’ve deposited your tokens. Since liquidity pools operate on automated market maker (AMM) models—like those used by Uniswap or SushiSwap—the ratio of assets adjusts based on trades happening within the pool. If one asset appreciates while another depreciates, your share’s value may be less than if you had simply held onto your tokens outside the pool.

Impermanent loss is particularly concerning during periods of high market volatility when asset prices fluctuate rapidly. Although it can sometimes be offset by trading fees earned from providing liquidity, in volatile markets, these earnings might not fully compensate for potential losses. Therefore, understanding this risk is crucial for anyone considering participating in DeFi liquidity provisioning.

Smart Contract Vulnerabilities

Since liquidity pools operate through smart contracts—self-executing code stored on blockchain networks—they are inherently susceptible to bugs or vulnerabilities in their codebase. Despite rigorous audits and security measures, exploits have occurred that allow malicious actors to drain funds from pools or manipulate contract behavior.

For example, notable incidents like the Curve Finance exploit in August 2021 resulted in losses exceeding $60 million due to vulnerabilities exploited within smart contracts managing pooled assets. Such events highlight that even well-established DeFi platforms are not immune to security flaws. Users should consider this risk seriously and prefer platforms with transparent audit histories and active security communities.

Market Volatility Impact

Cryptocurrency markets are known for their extreme volatility; prices can swing dramatically within short timeframes due to macroeconomic factors, regulatory news, or technological developments. When participating in liquidity pools containing volatile assets like tokens or stablecoins tied to fluctuating fiat currencies, providers face exposure to sudden value changes.

High volatility can lead to rapid devaluation of pooled assets if exit strategies aren’t executed swiftly enough during downturns. Conversely, during bullish runs where asset values surge unexpectedly, providers might experience gains—but only if they manage their positions carefully before market corrections occur.

Regulatory Uncertainty Surrounding DeFi

The regulatory landscape for decentralized finance remains uncertain worldwide. Governments and financial authorities are increasingly scrutinizing DeFi protocols due to concerns over money laundering, fraud prevention, investor protection—and compliance with existing financial laws.

Changes in regulation could impose restrictions on certain types of transactions or require licensing that many DeFi projects currently lack compliance with voluntarily—potentially leading to platform shutdowns or operational disruptions affecting users’ funds stored within liquidity pools.

This regulatory ambiguity adds an additional layer of risk for participants who may find themselves unable to withdraw funds freely or face legal challenges unexpectedly—a concern especially relevant as governments develop clearer policies around crypto-assets and DeFi activities.

Counterparty Risks: Lending Your Assets into a Pool

When providing liquidity via pooling mechanisms like AMMs (Automated Market Makers), users essentially lend their tokens into a shared smart contract ecosystem rather than directly trading with other individuals. This introduces counterparty risk—the possibility that the pool operator could misuse funds intentionally or neglect proper management practices leading to losses.

While most reputable platforms implement safeguards such as multisignature wallets and transparency reports—these do not eliminate all risks entirely—especially if malicious actors gain control over key governance functions or exploit vulnerabilities allowing them access beyond intended permissions.

Key Points:

- Pool operators might mismanage funds

- Governance attacks could alter protocol rules

- Lack of oversight increases vulnerability

Front-Running Attacks & Market Manipulation

Front-running is a common threat specific to blockchain-based systems where miners—or bots acting quickly—can see pending transactions before they’re confirmed on-chain—and then act upon this information unfairly by executing similar trades at advantageous prices before others do so naturally.

In liqudity pools using AMMs like Uniswap V3’s concentrated LPs—which allow providers more control over price ranges—the risk intensifies because attackers can manipulate transaction ordering through techniques such as sandwich attacks—that artificially inflate trade costs for unsuspecting traders while profiting at their expense.

Examples include:

- Exploiting delays between order placement & execution

- Manipulating price feeds via flash loans

- Creating artificial volume spikes

These tactics undermine fair trading conditions and erode trust among users who rely on transparent pricing mechanisms inherent in decentralized exchanges (DEXs).

Recent Incidents Highlighting Risks

The fast-paced evolution of DeFi has seen several high-profile security breaches emphasizing these risks:

SushiSwap Hack (September 2020): Approximately $13 million worth stolen due primarily to vulnerabilities exploited during deployment.

Curve Finance Exploit (August 2021): Losses exceeding $60 million caused by flaws within its smart contract architecture.

Such incidents underscore why continuous security audits—and community vigilance—are vital components when engaging with complex financial instruments like liquidity pools.

Impact:

Security breaches shake user confidencePotentially lead regulators’ increased scrutinyFinancial losses discourage participation

How Participants Can Mitigate These Risks

While no investment is entirely without danger—including traditional finance—it’s essential for users involved in DeFI ecosystems involving liquidity pools to adopt best practices:

- Conduct Due Diligence: Review audit reports; assess platform reputation; understand underlying smart contract mechanics.

- Diversify Investments: Avoid putting all capital into one pool; spread across multiple protocols/assets.3.. Stay Informed: Follow updates about platform upgrades/security patches/regulatory changes.4.. Use Risk Management Tools: Consider setting stop-loss orders where possible; utilize insurance protocols designed specifically for crypto-assets.5.. Monitor Asset Prices Regularly: Be prepared quickly during volatile periods—to minimize potential impermanent loss.

Understanding these inherent risks helps both individual investors and developers build more resilient strategies around participation in decentralized finance ecosystems involving liquidty pooling mechanisms — ultimately fostering safer innovation amid rapid growth trends shaping today’s crypto landscape.

Keywords:liquidity pools risks | impermanent loss | smart contract vulnerability | market volatility | DeFi regulation | front-running attacks | crypto security

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Sets Wave 3 Apart in Cryptocurrency and Investment?

Understanding the evolution of cryptocurrency markets is essential for investors, developers, and enthusiasts alike. Among the various phases or "waves" that have marked this journey, Wave 3 stands out as a transformative period characterized by technological innovation, regulatory maturation, and mainstream acceptance. This article explores what distinguishes Wave 3 from previous phases and why these differences matter for the future of digital assets.

Technological Breakthroughs Define Wave 3

One of the most notable features setting Wave 3 apart is its focus on technological advancements aimed at solving longstanding issues such as scalability and usability. During this phase, blockchain projects introduced solutions like sharding—dividing networks into smaller parts to process transactions more efficiently—and layer 2 scaling protocols such as Lightning Network or Optimistic Rollups. These innovations significantly increased transaction speeds while reducing costs, making cryptocurrencies more practical for everyday use.

Additionally, smart contracts became mainstream during this period. Originally popularized by Ethereum, smart contracts enable self-executing agreements without intermediaries. This capability has led to an explosion of decentralized applications (dApps) across finance (DeFi), gaming, supply chain management, and more sectors—broadening the scope of blockchain utility beyond simple peer-to-peer transfers.

Regulatory Maturity and Institutional Involvement

Unlike earlier waves driven primarily by retail investors’ hype or speculative trading, Wave 3 witnesses a shift toward regulatory clarity and institutional participation. Governments worldwide began establishing clearer guidelines for exchanges operating within their jurisdictions—covering anti-money laundering (AML) measures and Know Your Customer (KYC) procedures—to foster safer environments for investors.

The rise of stablecoins—cryptocurrencies pegged to fiat currencies like USD or EUR—also exemplifies this maturation process. Stablecoins provide stability amid volatile markets; their adoption has facilitated smoother transactions between traditional finance systems and crypto platforms. As a result, institutional players such as hedge funds or asset managers started allocating significant capital into cryptocurrencies during this phase.

Mainstream Adoption Accelerates

Wave 3 marks a turning point where cryptocurrencies transition from niche assets to widely accepted financial instruments across various sectors—including retail businesses accepting crypto payments or governments exploring digital currencies. The increasing involvement of large corporations in blockchain projects further legitimizes digital assets’ role in global economies.

This broader acceptance is partly driven by consumer demand but also supported by infrastructure improvements like user-friendly wallets and integrated payment solutions that make buying or spending crypto easier than ever before.

Security Enhancements Respond to Growing Risks

As market value surged during Wave 3—with Bitcoin halving events reducing supply—the importance of security intensified accordingly. Developers prioritized implementing robust security protocols to protect against hacking attempts targeting exchanges or individual wallets—a critical step given high-profile breaches in earlier years had shaken investor confidence.

These efforts include multi-signature wallets, advanced encryption methods, regular audits of smart contract codebases—and ongoing education initiatives aimed at raising awareness about best practices among users.

Recent Developments That Highlight Distinctiveness

Several key developments underscore how different Wave 3 is compared to prior phases:

- Bitcoin Halving Events: Occurring approximately every four years during this wave have historically led to price rallies due to reduced mining rewards—a phenomenon that influences market sentiment significantly.

- Decentralized Finance (DeFi): The rapid growth of DeFi platforms like Compound or Aave exemplifies innovative financial services built on blockchain technology—offering lending/borrowing without traditional banks.

- Central Bank Digital Currencies (CBDCs): Multiple countries announced plans for CBDCs during this period; these government-backed digital currencies aim at modernizing monetary systems while potentially challenging existing banking models.

- Environmental Concerns: Increased scrutiny over energy consumption associated with proof-of-work mining prompted development toward greener consensus mechanisms such as proof-of-stake—which are now gaining traction within the industry.

Potential Challenges Unique To This Phase

Despite its many strengths—the technological progressions alone mark a significant leap forward—Wave 3 faces specific hurdles:

- Regulatory Uncertainty: While regulations are becoming clearer overall, ongoing debates around compliance could lead some projects into legal gray areas—or even shutdowns if they fail to meet new standards.

- Market Volatility: Rapid adoption can cause sharp price swings that may deter risk-averse investors but also attract speculative traders seeking quick gains.

- Security Risks: As user bases grow exponentially with increased mainstream access—including institutional investments—the attack surface expands correspondingly; cyber threats remain an ongoing concern requiring constant vigilance.

- Environmental Impact: Despite efforts toward sustainable mining practices—and shifts towards energy-efficient consensus algorithms—the environmental footprint remains under scrutiny which could influence future regulations affecting certain cryptocurrencies' viability.

How Differentiating Features Shape Future Trends

Wave 3’s defining characteristics set it apart from Waves 1 & 2 not only through technological innovation but also via evolving market dynamics involving regulation and societal acceptance—all factors likely influencing subsequent phases' development trajectories.

For example:

- The integration of CBDCs might redefine central banking operations,

- Continued improvements in scalability could facilitate mass adoption,

- Enhanced security measures will be crucial as competition intensifies,

- Environmental considerations may drive further innovation towards eco-friendly consensus mechanisms.

Why Recognizing These Differences Matters

Understanding what makes Wave 3 unique helps stakeholders—from individual investors to policymakers—to navigate risks effectively while capitalizing on emerging opportunities within the cryptocurrency ecosystem. It highlights how technological progress combined with regulatory clarity fosters trustworthiness—a vital component when considering long-term investments in digital assets.

In summary,

Wave 3 represents a pivotal era marked by groundbreaking innovations like scalable blockchains and widespread use cases enabled through smart contracts; increased regulatory oversight coupled with growing institutional involvement; broader societal acceptance leading towards mainstream integration; alongside challenges related to security risks & environmental impact management—all shaping today’s rapidly evolving crypto landscape.

Keywords:cryptocurrency waves | wave three cryptocurrency | blockchain technology advancements | DeFi boom | stablecoins regulation | Bitcoin halving effect | CBDC development | crypto market volatility

Lo

2025-05-29 07:11

What distinguishes Wave 3 from other waves?

What Sets Wave 3 Apart in Cryptocurrency and Investment?

Understanding the evolution of cryptocurrency markets is essential for investors, developers, and enthusiasts alike. Among the various phases or "waves" that have marked this journey, Wave 3 stands out as a transformative period characterized by technological innovation, regulatory maturation, and mainstream acceptance. This article explores what distinguishes Wave 3 from previous phases and why these differences matter for the future of digital assets.

Technological Breakthroughs Define Wave 3

One of the most notable features setting Wave 3 apart is its focus on technological advancements aimed at solving longstanding issues such as scalability and usability. During this phase, blockchain projects introduced solutions like sharding—dividing networks into smaller parts to process transactions more efficiently—and layer 2 scaling protocols such as Lightning Network or Optimistic Rollups. These innovations significantly increased transaction speeds while reducing costs, making cryptocurrencies more practical for everyday use.

Additionally, smart contracts became mainstream during this period. Originally popularized by Ethereum, smart contracts enable self-executing agreements without intermediaries. This capability has led to an explosion of decentralized applications (dApps) across finance (DeFi), gaming, supply chain management, and more sectors—broadening the scope of blockchain utility beyond simple peer-to-peer transfers.

Regulatory Maturity and Institutional Involvement

Unlike earlier waves driven primarily by retail investors’ hype or speculative trading, Wave 3 witnesses a shift toward regulatory clarity and institutional participation. Governments worldwide began establishing clearer guidelines for exchanges operating within their jurisdictions—covering anti-money laundering (AML) measures and Know Your Customer (KYC) procedures—to foster safer environments for investors.

The rise of stablecoins—cryptocurrencies pegged to fiat currencies like USD or EUR—also exemplifies this maturation process. Stablecoins provide stability amid volatile markets; their adoption has facilitated smoother transactions between traditional finance systems and crypto platforms. As a result, institutional players such as hedge funds or asset managers started allocating significant capital into cryptocurrencies during this phase.

Mainstream Adoption Accelerates

Wave 3 marks a turning point where cryptocurrencies transition from niche assets to widely accepted financial instruments across various sectors—including retail businesses accepting crypto payments or governments exploring digital currencies. The increasing involvement of large corporations in blockchain projects further legitimizes digital assets’ role in global economies.

This broader acceptance is partly driven by consumer demand but also supported by infrastructure improvements like user-friendly wallets and integrated payment solutions that make buying or spending crypto easier than ever before.

Security Enhancements Respond to Growing Risks

As market value surged during Wave 3—with Bitcoin halving events reducing supply—the importance of security intensified accordingly. Developers prioritized implementing robust security protocols to protect against hacking attempts targeting exchanges or individual wallets—a critical step given high-profile breaches in earlier years had shaken investor confidence.

These efforts include multi-signature wallets, advanced encryption methods, regular audits of smart contract codebases—and ongoing education initiatives aimed at raising awareness about best practices among users.

Recent Developments That Highlight Distinctiveness

Several key developments underscore how different Wave 3 is compared to prior phases:

- Bitcoin Halving Events: Occurring approximately every four years during this wave have historically led to price rallies due to reduced mining rewards—a phenomenon that influences market sentiment significantly.

- Decentralized Finance (DeFi): The rapid growth of DeFi platforms like Compound or Aave exemplifies innovative financial services built on blockchain technology—offering lending/borrowing without traditional banks.

- Central Bank Digital Currencies (CBDCs): Multiple countries announced plans for CBDCs during this period; these government-backed digital currencies aim at modernizing monetary systems while potentially challenging existing banking models.

- Environmental Concerns: Increased scrutiny over energy consumption associated with proof-of-work mining prompted development toward greener consensus mechanisms such as proof-of-stake—which are now gaining traction within the industry.

Potential Challenges Unique To This Phase

Despite its many strengths—the technological progressions alone mark a significant leap forward—Wave 3 faces specific hurdles:

- Regulatory Uncertainty: While regulations are becoming clearer overall, ongoing debates around compliance could lead some projects into legal gray areas—or even shutdowns if they fail to meet new standards.

- Market Volatility: Rapid adoption can cause sharp price swings that may deter risk-averse investors but also attract speculative traders seeking quick gains.

- Security Risks: As user bases grow exponentially with increased mainstream access—including institutional investments—the attack surface expands correspondingly; cyber threats remain an ongoing concern requiring constant vigilance.

- Environmental Impact: Despite efforts toward sustainable mining practices—and shifts towards energy-efficient consensus algorithms—the environmental footprint remains under scrutiny which could influence future regulations affecting certain cryptocurrencies' viability.

How Differentiating Features Shape Future Trends

Wave 3’s defining characteristics set it apart from Waves 1 & 2 not only through technological innovation but also via evolving market dynamics involving regulation and societal acceptance—all factors likely influencing subsequent phases' development trajectories.

For example:

- The integration of CBDCs might redefine central banking operations,

- Continued improvements in scalability could facilitate mass adoption,

- Enhanced security measures will be crucial as competition intensifies,

- Environmental considerations may drive further innovation towards eco-friendly consensus mechanisms.

Why Recognizing These Differences Matters

Understanding what makes Wave 3 unique helps stakeholders—from individual investors to policymakers—to navigate risks effectively while capitalizing on emerging opportunities within the cryptocurrency ecosystem. It highlights how technological progress combined with regulatory clarity fosters trustworthiness—a vital component when considering long-term investments in digital assets.

In summary,

Wave 3 represents a pivotal era marked by groundbreaking innovations like scalable blockchains and widespread use cases enabled through smart contracts; increased regulatory oversight coupled with growing institutional involvement; broader societal acceptance leading towards mainstream integration; alongside challenges related to security risks & environmental impact management—all shaping today’s rapidly evolving crypto landscape.

Keywords:cryptocurrency waves | wave three cryptocurrency | blockchain technology advancements | DeFi boom | stablecoins regulation | Bitcoin halving effect | CBDC development | crypto market volatility

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Can I Buy Chainlink (LINK)?

Investing in cryptocurrencies like Chainlink (LINK) can be an attractive opportunity for those interested in blockchain technology and decentralized finance. However, understanding how to purchase LINK securely and efficiently is essential for both beginners and experienced traders. This guide provides a comprehensive overview of the steps involved in buying Chainlink, along with important considerations to ensure a safe transaction.

Understanding What Chainlink (LINK) Is

Before purchasing LINK, it’s helpful to understand its role within the blockchain ecosystem. Chainlink is a decentralized oracle network that connects smart contracts with real-world data sources. Its native token, LINK, incentivizes node operators who provide accurate data feeds to the network. As one of the leading projects in the decentralized oracle space, LINK has gained significant market value and widespread adoption.

Knowing this background helps investors appreciate why they might want to buy LINK—whether for long-term holding or trading purposes—and what factors influence its price movements.

Choosing a Reputable Cryptocurrency Exchange

The first step in buying Chainlink is selecting a trustworthy cryptocurrency exchange that supports trading of LINK tokens. Not all platforms offer access to every digital asset; therefore, verifying whether an exchange lists LINK is crucial.

When evaluating exchanges, consider these key factors:

- Security measures: Look for platforms with robust security protocols such as two-factor authentication (2FA), cold storage options, and regular audits.

- User interface: A user-friendly interface simplifies navigation and transaction execution.

- Liquidity: Higher liquidity ensures you can buy or sell larger amounts without significant price slippage.

- Regulatory compliance: Choose exchanges compliant with local regulations to avoid legal issues.

Popular exchanges supporting LINK include Coinbase, Binance, Kraken, Gemini, and KuCoin among others. These platforms are well-established within the crypto community and have demonstrated reliability over time.

Creating Your Account on an Exchange

Once you've selected an exchange:

- Sign up by providing your email address or phone number.

- Complete identity verification procedures as required by Know Your Customer (KYC) regulations—this may involve submitting identification documents like passports or driver’s licenses.

- Enable security features such as 2FA for added protection against unauthorized access.

This process ensures your account complies with regulatory standards while safeguarding your assets from potential cyber threats.

Funding Your Account

After successfully creating your account:

- Deposit funds using fiat currency options available on the platform—such as bank transfers via wire transfer or credit/debit card payments.

- Some exchanges also support deposits through other cryptocurrencies if you already hold digital assets elsewhere.

It’s advisable to fund your account with only what you intend to invest initially since cryptocurrency markets are volatile.

Buying Chainlink (LINK)

With funds available in your exchange account:

- Navigate to the trading section specific for LINK tokens.

- Choose between different order types:

- Market order: Executes immediately at current market prices; suitable if you want quick purchase execution but may incur higher costs during volatile periods.

- Limit order: Sets a specific price at which you're willing to buy; ideal if you want more control over entry points but requires patience until market reaches that level.

- Enter the amount of LINK tokens you'd like to purchase based on your budget or investment plan.

- Confirm details before executing the trade—review fees involved and total cost including any transaction charges imposed by the platform.

Once completed, you'll see your purchased Link tokens reflected in your exchange wallet balance.

Transferring Your Tokens To A Secure Wallet

While keeping cryptocurrencies on exchanges is convenient for trading purposes,

it’s generally safer long-term practice — especially considering potential hacking risks —to transfer holdings into a private wallet:

- Use hardware wallets such as Ledger Nano S/X or Trezor for maximum security

- Or opt for reputable software wallets compatible with Ethereum-based tokens like MetaMask

- Always double-check wallet addresses before transferring funds

This step minimizes exposure risk associated with centralized exchange vulnerabilities while giving you full control over your assets.

Monitoring Market Trends & Security Tips

After acquiring Link tokens:

- Stay informed about market developments affecting Chainlink's ecosystem through news outlets and official project channels

- Keep track of regulatory updates that could impact token valuation

- Regularly update wallet software/security settings

Additionally,

Security best practices include:

- Using strong passwords*

- Enabling two-factor authentication*

- Avoiding phishing scams*

- Keeping backup recovery phrases secure*

These measures help protect investments against thefts or loss due to cyber threats.

Final Thoughts: Is Buying Chainlink Right For You?

Purchasing Link involves choosing reliable platforms supported by thorough research into their reputation and security features—a vital aspect aligned with building trustworthiness (E-A-T). Whether you're interested in holding long-term based on belief in its technological advancements like VRF or Keepers—or engaging actively through trading—the process remains straightforward when following proper steps outlined above.

Remember always to assess current market conditions carefully before making any investment decisions since cryptocurrency prices can fluctuate rapidly due primarily to external factors such as regulatory changes or technological developments within projects like Chainlink itself.

By understanding these core aspects—from selecting reputable exchanges through securing wallets—you'll be better equipped not only how-to but also why strategic planning matters when entering crypto markets involving innovative projects like Chainlink (LINK).

JCUSER-IC8sJL1q

2025-05-29 02:37

How can I buy Chainlink (LINK)?

How Can I Buy Chainlink (LINK)?

Investing in cryptocurrencies like Chainlink (LINK) can be an attractive opportunity for those interested in blockchain technology and decentralized finance. However, understanding how to purchase LINK securely and efficiently is essential for both beginners and experienced traders. This guide provides a comprehensive overview of the steps involved in buying Chainlink, along with important considerations to ensure a safe transaction.

Understanding What Chainlink (LINK) Is

Before purchasing LINK, it’s helpful to understand its role within the blockchain ecosystem. Chainlink is a decentralized oracle network that connects smart contracts with real-world data sources. Its native token, LINK, incentivizes node operators who provide accurate data feeds to the network. As one of the leading projects in the decentralized oracle space, LINK has gained significant market value and widespread adoption.

Knowing this background helps investors appreciate why they might want to buy LINK—whether for long-term holding or trading purposes—and what factors influence its price movements.

Choosing a Reputable Cryptocurrency Exchange

The first step in buying Chainlink is selecting a trustworthy cryptocurrency exchange that supports trading of LINK tokens. Not all platforms offer access to every digital asset; therefore, verifying whether an exchange lists LINK is crucial.

When evaluating exchanges, consider these key factors:

- Security measures: Look for platforms with robust security protocols such as two-factor authentication (2FA), cold storage options, and regular audits.

- User interface: A user-friendly interface simplifies navigation and transaction execution.

- Liquidity: Higher liquidity ensures you can buy or sell larger amounts without significant price slippage.

- Regulatory compliance: Choose exchanges compliant with local regulations to avoid legal issues.

Popular exchanges supporting LINK include Coinbase, Binance, Kraken, Gemini, and KuCoin among others. These platforms are well-established within the crypto community and have demonstrated reliability over time.

Creating Your Account on an Exchange

Once you've selected an exchange:

- Sign up by providing your email address or phone number.

- Complete identity verification procedures as required by Know Your Customer (KYC) regulations—this may involve submitting identification documents like passports or driver’s licenses.

- Enable security features such as 2FA for added protection against unauthorized access.

This process ensures your account complies with regulatory standards while safeguarding your assets from potential cyber threats.

Funding Your Account

After successfully creating your account:

- Deposit funds using fiat currency options available on the platform—such as bank transfers via wire transfer or credit/debit card payments.

- Some exchanges also support deposits through other cryptocurrencies if you already hold digital assets elsewhere.

It’s advisable to fund your account with only what you intend to invest initially since cryptocurrency markets are volatile.

Buying Chainlink (LINK)

With funds available in your exchange account:

- Navigate to the trading section specific for LINK tokens.

- Choose between different order types:

- Market order: Executes immediately at current market prices; suitable if you want quick purchase execution but may incur higher costs during volatile periods.

- Limit order: Sets a specific price at which you're willing to buy; ideal if you want more control over entry points but requires patience until market reaches that level.

- Enter the amount of LINK tokens you'd like to purchase based on your budget or investment plan.

- Confirm details before executing the trade—review fees involved and total cost including any transaction charges imposed by the platform.

Once completed, you'll see your purchased Link tokens reflected in your exchange wallet balance.

Transferring Your Tokens To A Secure Wallet

While keeping cryptocurrencies on exchanges is convenient for trading purposes,

it’s generally safer long-term practice — especially considering potential hacking risks —to transfer holdings into a private wallet:

- Use hardware wallets such as Ledger Nano S/X or Trezor for maximum security

- Or opt for reputable software wallets compatible with Ethereum-based tokens like MetaMask

- Always double-check wallet addresses before transferring funds

This step minimizes exposure risk associated with centralized exchange vulnerabilities while giving you full control over your assets.

Monitoring Market Trends & Security Tips

After acquiring Link tokens:

- Stay informed about market developments affecting Chainlink's ecosystem through news outlets and official project channels

- Keep track of regulatory updates that could impact token valuation

- Regularly update wallet software/security settings

Additionally,

Security best practices include:

- Using strong passwords*

- Enabling two-factor authentication*

- Avoiding phishing scams*

- Keeping backup recovery phrases secure*

These measures help protect investments against thefts or loss due to cyber threats.

Final Thoughts: Is Buying Chainlink Right For You?

Purchasing Link involves choosing reliable platforms supported by thorough research into their reputation and security features—a vital aspect aligned with building trustworthiness (E-A-T). Whether you're interested in holding long-term based on belief in its technological advancements like VRF or Keepers—or engaging actively through trading—the process remains straightforward when following proper steps outlined above.

Remember always to assess current market conditions carefully before making any investment decisions since cryptocurrency prices can fluctuate rapidly due primarily to external factors such as regulatory changes or technological developments within projects like Chainlink itself.

By understanding these core aspects—from selecting reputable exchanges through securing wallets—you'll be better equipped not only how-to but also why strategic planning matters when entering crypto markets involving innovative projects like Chainlink (LINK).

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Are Investing.com’s Mobile and Web Interfaces the Same?

Investing.com is a well-known platform among traders, investors, and financial enthusiasts for its comprehensive coverage of global markets. Whether accessed via desktop or mobile device, users expect a seamless experience that provides quick access to real-time data, news updates, and analytical tools. A common question among users is whether the mobile app and web interface of Investing.com are identical in design and functionality. Understanding this can help users navigate the platform more effectively and set realistic expectations.

How Do Investing.com’s Web and Mobile Interfaces Compare in Design?

The design consistency between Investing.com’s web version and its mobile app plays a crucial role in user experience. The web interface is crafted with a clean layout that emphasizes clarity, making it easy for users to find market news, charts, or detailed analysis sections. It typically offers more space for displaying information simultaneously due to larger screens.

In contrast, the mobile interface has been optimized for smaller screens without sacrificing core features. While it maintains visual consistency with the web version—using similar color schemes, icons, and navigation elements—the layout adapts to fit limited screen real estate. This often means consolidating menus or simplifying certain sections so that essential data remains accessible without overwhelming the user.

Despite these differences in layout presentation driven by device constraints, Investing.com ensures that both interfaces uphold high standards of usability. This approach aligns with best practices in responsive design—creating an experience where core functionalities are preserved across platforms while optimizing each for specific device types.

Are Features on Mobile Devices Similar to Those on Desktop?

Both versions of Investing.com offer key features such as real-time market data updates across stocks, forex pairs, commodities, cryptocurrencies—and access to breaking news relevant to global markets. Users can also utilize analytical tools like charts or watchlists on both platforms.

However, there are some distinctions based on device capabilities:

- Web Interface: Offers more detailed analysis options; extensive research articles; advanced charting tools; customizable dashboards.

- Mobile App: Focuses on quick access features like push notifications for market alerts; personalized news feeds; simplified chart views suitable for rapid decision-making.

This differentiation caters to different user needs—desktop users may prefer deep dives into data while mobile users often seek immediate updates during trading hours or when away from their desks.

How Does Recent Development Impact Interface Consistency?