Popular Posts

Bitcoin Investment — every time she walks by, even the ETH crowd turns their heads 🫣 Main character energy in the crypto streets 🧿 She’s the MVP of the blockchain

Check out our YouTube Channel 👉

#BitcoinInvestment #MainCharacterVibes #CryptoAttraction

JuCoin Media

2025-08-01 11:21

How a Bitcoin Investment Steals the Show Every Time ✨

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Succinct Network combines the world's fastest zkVM (SP1) with a decentralized marketplace for proof generation, making zero-knowledge proofs accessible to mainstream developers without deep cryptographic expertise.

💰 Key Highlights:

-

World's Fastest zkVM: SP1 is 28x faster than competing zkVMs on real-world workloads

PROVE Token Economics: Payment medium + staking security + governance rights

Real-Time Ethereum Proving: Under 40 seconds per block, 93% success rate with 200 RTX 4090s

$55M Series A: Led by Paradigm, demonstrating strong institutional confidence

🎯 Technical Breakthroughs:

-

SP1 Turbo (v4.0.0): Blazing fast performance with precompile-centric architecture

SP1 Hypercube: Sub-12-second Ethereum block proving milestone

Developer-Friendly: Write normal Rust code, automatically generate ZK proofs

100% Open Source: MIT licensed, all constraint logic public

🏆 Market Position:

-

Major Integrations: Polygon, Celestia, Avail, Taiko already using SP1

$1B+ TVL: Securing over $1 billion in total value locked

AggLayer Partnership: Will use SP1 for pessimistic proofs

💡 Use Cases:

-

ZK Rollups: Reduce finality from 7 days to minutes

Cross-Chain Bridges: Trustless blockchain interoperability

Verifiable AI: Cryptographic proof of AI model outputs

Privacy Identity: Verification without revealing sensitive data

Enterprise Auditing: Prove compliance without exposing proprietary data

⏰ Development Timeline:

-

Current: Testnet Stage 2

Coming Soon: Stage 2.5 with competitive auctions

February 10, 2025: "Crisis of Trust" testnet program launch

Future: Mainnet with full PROVE token functionality

⚠️ Investment Risks:

-

Technical competition (RISC Zero, Jolt, Nexus)

Computational resource requirements for real-time proving

Regulatory uncertainty around ZK privacy capabilities

Enterprise adoption timeline dependencies

🔥 Why It Matters: This democratization of ZK technology mirrors how cloud computing made enterprise infrastructure accessible to all developers. SP1's breakthrough performance enables real-time verification for next-gen blockchain applications.

PROVE token launch marks a significant milestone in decentralizing ZK infrastructure, potentially creating the economic foundation for verifiable applications across blockchain and traditional computing.

Read our complete technical analysis and investment guide: 👇

https://blog.jucoin.com/succinct-network-zkvm-prove-token/?utm_source=blog

#SuccinctNetwork #SP1 #PROVE #zkVM #ZeroKnowledge #Blockchain #Scalability #Polygon #Ethereum #Layer2 #ZKRollups #CrossChain #JuCoin #Web3 #Crypto #Decentralized #Paradigm #VerifiableAI #Privacy

JU Blog

2025-08-01 08:49

🚀 Succinct Network: Revolutionary SP1 zkVM & PROVE Token Launch!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

StableCoinX Inc. completed a SPAC merger with TLGY Acquisition Corp, becoming the first stablecoin-focused treasury company set to trade on Nasdaq under ticker "USDE" in Q4 2025. Here's what makes this groundbreaking:

💰 Deal Highlights:

-

$360M total funding through SPAC merger

$60M from Ethena Foundation + $300M from institutional investors

Major backers: Dragonfly Capital, Galaxy Digital, Pantera Capital, Haun Ventures

Single focus: Accumulating and permanently holding ENA tokens

📈 Massive ENA Buyback Program:

-

$260M deployed for systematic ENA token purchases

$5M daily buying pressure over 6 weeks

Targeting ~8% of ENA's circulating supply

All purchased tokens held permanently - never sold!

🎯 Business Model:

-

Operating as treasury vehicle for Ethena ecosystem (3rd largest stablecoin issuer)

Running validator infrastructure for USDe protocol

Using 100% of earnings exclusively for more ENA accumulation

Ethena Foundation has veto power over any token sales

💡 Market Impact:

-

ENA price jumped 8-11% within 24 hours of announcement

Current trading: $0.57-$0.58 with $900M+ daily volume

Creates first regulated equity vehicle for stablecoin exposure

Similar to MicroStrategy's Bitcoin strategy but for stablecoins

🏆 Key Advantages:

-

SEC-registered entity with standard equity oversight

Institutional access through familiar investment vehicle

Partnership with BlackRock's BUIDL tokenized fund

Permanent capital with no selling pressure

⚠️ Risk Considerations:

-

High concentration risk tied to ENA token performance

Token volatility typical of governance assets

Success depends on Ethena protocol growth and stablecoin market expansion

Regulatory changes could impact synthetic dollar operations

🔮 Timeline:

-

Buyback Program: Started immediately (July 2025)

Nasdaq Listing: Expected Q4 2025

Ticker Symbol: "USDE"

This innovative model bridges traditional finance with DeFi, offering regulated exposure to the rapidly growing synthetic dollar ecosystem. With Ethena's USDe being the 3rd largest stablecoin globally, early positioning could provide significant returns as the market matures.

Read the complete analysis with detailed risk assessment and strategic insights: 👇

https://blog.jucoin.com/stablecoinx-usde-nasdaq-analysis/

#StableCoinX #USDE #ENA #Ethena #Nasdaq #SPAC #Stablecoin #DeFi #Treasury #Crypto #Blockchain #TradFi #Buyback #JuCoin #Investment #DigitalDollar #USDe #Regulation #Institutional

JU Blog

2025-07-31 13:29

🚀 StableCoinX Secured $360M SPAC Merger - First Stablecoin Treasury Company to Trade on Nasdaq!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🚀AJMD officially joins the JuCoin ecosystem

🔓AJMD is a new Web3.0 aggregated financial ecosystem with JU as its core. The platform revolves around four innovative tracks: DeFi, NFT, GameFi, and AI intelligence, building an open and scalable ecological matrix.

👉 More Detail https://support.jucoin.blog/hc/en-001/articles/49370946719897?utm_campaign=ann_AJMD_0731&utm_source=twitter&utm_medium=post

JuCoin Official

2025-07-31 09:11

🚀AJMD officially joins the JuCoin ecosystem

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

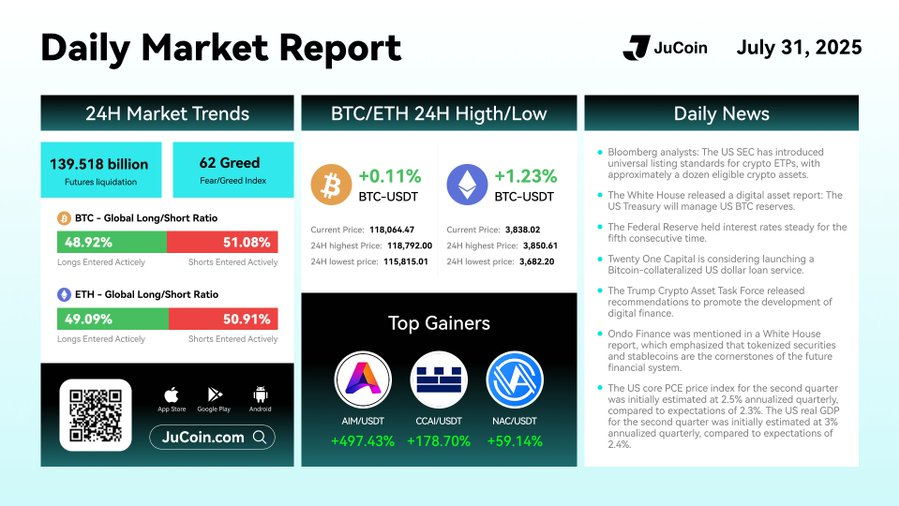

🚀 JuCoin Daily Market Report|July 31, 2025

📅 Stay updated with the latest crypto market trends!

Sign up👉 http://bit.ly/3BVxlZ2

Blog👉 https://blog.jucoin.com/btc-eth-us-treasury-btc-reserves-july31-2025/

#JuCoin #CryptoNews

JuCoin Official

2025-07-31 09:10

🚀 JuCoin Daily Market Report|July 31, 2025

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

🕙Event Duration: July 24, 16:00 – August 24, 15:59 (UTC)

🏆 Weekly Prize Pool: $25,000 in JU Hashrate

Eligible Trading Pairs: All MEME tokens in the Spot MEME Zone + On-Chain Preferred Zone

❕Hashrate Mining Highlights:

Mine While You Trade: Earn JU hashrate based on tasks, settled weekly

High-Yield Bonus: Earn JU continuously from your awarded hashrate

On-Chain Transparency: All JU earnings are verifiable on-chain

JuCoin Community

2025-07-31 06:21

🎁 MEME Trading Carnival is Here! Share $100,000 JU Hashrate – Trade & Mine at the Same Time!

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

How Does the Rebranding of EOS to Vaulta Affect Its Market Perception and Value?

The recent rebranding of EOS to Vaulta marks a significant shift in the cryptocurrency landscape, sparking widespread discussion among investors, developers, and industry analysts. This strategic move aims to reshape how the project is perceived in terms of security, innovation, and market relevance. Understanding its implications requires examining both the background of EOS and what Vaulta represents moving forward.

Background of EOS: From Launch to Challenges

EOS was launched in 2017 by blockchain pioneers Dan Larimer and Brendan Blumer. It quickly gained attention for its high-performance decentralized operating system designed for scalable smart contracts and dApps (decentralized applications). At its peak, EOS was considered one of the leading platforms in blockchain technology due to its innovative consensus mechanism—Delegated Proof-of-Stake (DPoS)—and developer-friendly environment.

However, despite early success, EOS faced persistent governance issues such as centralization concerns and disputes over decision-making processes. Security vulnerabilities also emerged over time, raising questions about platform stability. These challenges affected community trust and investor confidence—factors crucial for long-term sustainability.

Despite these hurdles, EOS maintained a dedicated user base that continued contributing to its ecosystem's growth. Over time, efforts were made to improve protocol security and governance structures; however, perceptions around past controversies lingered within broader market narratives.

The Rationale Behind Rebranding: From EOS to Vaulta

In late 2024, the project announced it would rebrand from EOS to Vaulta—a move signaling a fresh start aimed at overcoming previous limitations. The primary motivation appears rooted in distancing itself from past governance scandals while emphasizing new strategic priorities centered on decentralized finance (DeFi).

Vaulta’s branding underscores a renewed focus on security enhancements—an essential aspect given recent DeFi exploits across various platforms—and aims at positioning itself as a trustworthy player within this rapidly expanding sector. By aligning with DeFi trends such as lending protocols or stablecoins integration, Vaulta seeks not only technological upgrades but also improved market perception among investors seeking reliable financial services on blockchain.

This rebranding can be viewed as an effort by leadership to redefine identity amidst fierce competition among DeFi projects like Aave or Compound that are capturing investor interest through transparency and robust security measures.

Market Context: Why Rebranding Matters Now

The cryptocurrency industry has experienced exponential growth in DeFi applications over recent years. As users increasingly look toward decentralized financial solutions for borrowing/lending or asset management without intermediaries—the sector has become highly competitive yet fragmented.

In this environment:

- Projects that successfully reposition themselves with clear value propositions tend to attract more investment.

- Transparency around technical improvements enhances credibility.

- Community engagement fosters trust during transitional phases like rebranding.

Rebranding efforts like Vaulta’s are therefore critical—they serve both marketing purposes by signaling change—and practical ones by implementing technical upgrades aligned with current industry standards.

Impact on Market Perception

Market perception following such a major change depends heavily on community response and tangible progress made post-rebrand:

- Community Engagement: Active communication through updates or meetings helps build trust; positive feedback can boost confidence.

- Technical Improvements: Upgrades focusing on smart contract efficiency alongside enhanced security protocols demonstrate commitment toward reliability—a key factor influencing investor sentiment.

- Partnerships & Collaborations: Strategic alliances within DeFi ecosystems reinforce credibility; they suggest validation from established players which can positively influence perception.

However, skepticism remains prevalent among some segments who question whether rebranding alone addresses core issues like governance transparency or whether it is merely superficial branding effort aimed at attracting new investors without substantial changes underneath.

Short-Term Market Effects: Token Price Fluctuations

Following any major announcement—including rebrands—cryptocurrency tokens often experience volatility driven by speculative trading behaviors:

- Some investors interpret the move optimistically expecting future growth opportunities.

- Others may react cautiously due to uncertainties about actual implementation success or lingering doubts about past controversies affecting long-term viability.

Since specific data points are limited regarding immediate price movements post-rebrand for Vaulta/EOS specifically—but generally speaking—such transitions tend initially toward increased volatility before settling into new valuation levels based on subsequent developments.

Factors Influencing Short-Term Price Movements:

- Investor sentiment shifts

- Technical upgrade announcements

- Partnership news

- Broader market conditions during transition periods

Risks & Challenges Ahead

While rebranding offers potential benefits—including improved brand image—it also introduces risks that could impact future performance:

Regulatory Scrutiny

Regulators worldwide are increasingly attentive towards crypto projects involved in financial activities like DeFi services; any perceived attempt at evasion or lack of compliance could invite legal challenges impacting operations negatively.

Community Trust & Adoption

Maintaining community support is vital; if stakeholders perceive insufficient progress or mismanagement during transition phases—as seen historically with other projects—they may withdraw support leading to decreased adoption rates which directly affect token value stability.

Competitive Landscape

Vaulta faces stiff competition from well-established DeFi platforms offering similar features but with proven track records for transparency/security—which means differentiation through innovation becomes critical.

Technical Complexity During Transition

Implementing significant upgrades while ensuring network stability poses inherent risks; bugs or vulnerabilities introduced inadvertently could undermine user confidence further if not managed carefully.

Strategic Recommendations Moving Forward

For vaulta’s sustained success—and ultimately improving market perception—the following strategies should be prioritized:

Transparent Communication

Regular updates regarding development milestones help reassure stakeholders about ongoing progress.Delivering Tangible Results

Focus on deploying secure smart contracts coupled with real-world partnerships demonstrating ecosystem expansion.Engaging Community

Active forums where users can voice concerns foster loyalty amid change processes.Compliance Readiness

Proactively addressing regulatory requirements minimizes legal risks down the line.

Final Thoughts: Navigating Change Effectively

Rebranding from EOS to Vaulta signifies an ambitious attempt at revitalizing a legacy project amid evolving industry demands—in particular emphasizing decentralization-focused finance solutions backed by stronger security measures.. While initial reactions show mixed sentiments influenced largely by speculation rather than concrete outcomes yet—success will depend heavily upon how well technical improvements translate into real-world utility combined with transparent stakeholder engagement..

As the crypto space continues shifting rapidly towards more sophisticated financial instruments built atop secure blockchains—with increasing regulatory oversight—the ability of projects like Vaulta/EOS's successor—to adapt swiftly will determine their long-term relevance—and ultimately their impact on market perception and valuation.

JCUSER-F1IIaxXA

2025-06-09 20:19

How does the rebranding of EOS to Vaulta affect its market perception and value?

How Does the Rebranding of EOS to Vaulta Affect Its Market Perception and Value?

The recent rebranding of EOS to Vaulta marks a significant shift in the cryptocurrency landscape, sparking widespread discussion among investors, developers, and industry analysts. This strategic move aims to reshape how the project is perceived in terms of security, innovation, and market relevance. Understanding its implications requires examining both the background of EOS and what Vaulta represents moving forward.

Background of EOS: From Launch to Challenges

EOS was launched in 2017 by blockchain pioneers Dan Larimer and Brendan Blumer. It quickly gained attention for its high-performance decentralized operating system designed for scalable smart contracts and dApps (decentralized applications). At its peak, EOS was considered one of the leading platforms in blockchain technology due to its innovative consensus mechanism—Delegated Proof-of-Stake (DPoS)—and developer-friendly environment.

However, despite early success, EOS faced persistent governance issues such as centralization concerns and disputes over decision-making processes. Security vulnerabilities also emerged over time, raising questions about platform stability. These challenges affected community trust and investor confidence—factors crucial for long-term sustainability.

Despite these hurdles, EOS maintained a dedicated user base that continued contributing to its ecosystem's growth. Over time, efforts were made to improve protocol security and governance structures; however, perceptions around past controversies lingered within broader market narratives.

The Rationale Behind Rebranding: From EOS to Vaulta

In late 2024, the project announced it would rebrand from EOS to Vaulta—a move signaling a fresh start aimed at overcoming previous limitations. The primary motivation appears rooted in distancing itself from past governance scandals while emphasizing new strategic priorities centered on decentralized finance (DeFi).

Vaulta’s branding underscores a renewed focus on security enhancements—an essential aspect given recent DeFi exploits across various platforms—and aims at positioning itself as a trustworthy player within this rapidly expanding sector. By aligning with DeFi trends such as lending protocols or stablecoins integration, Vaulta seeks not only technological upgrades but also improved market perception among investors seeking reliable financial services on blockchain.

This rebranding can be viewed as an effort by leadership to redefine identity amidst fierce competition among DeFi projects like Aave or Compound that are capturing investor interest through transparency and robust security measures.

Market Context: Why Rebranding Matters Now

The cryptocurrency industry has experienced exponential growth in DeFi applications over recent years. As users increasingly look toward decentralized financial solutions for borrowing/lending or asset management without intermediaries—the sector has become highly competitive yet fragmented.

In this environment:

- Projects that successfully reposition themselves with clear value propositions tend to attract more investment.

- Transparency around technical improvements enhances credibility.

- Community engagement fosters trust during transitional phases like rebranding.

Rebranding efforts like Vaulta’s are therefore critical—they serve both marketing purposes by signaling change—and practical ones by implementing technical upgrades aligned with current industry standards.

Impact on Market Perception

Market perception following such a major change depends heavily on community response and tangible progress made post-rebrand:

- Community Engagement: Active communication through updates or meetings helps build trust; positive feedback can boost confidence.

- Technical Improvements: Upgrades focusing on smart contract efficiency alongside enhanced security protocols demonstrate commitment toward reliability—a key factor influencing investor sentiment.

- Partnerships & Collaborations: Strategic alliances within DeFi ecosystems reinforce credibility; they suggest validation from established players which can positively influence perception.

However, skepticism remains prevalent among some segments who question whether rebranding alone addresses core issues like governance transparency or whether it is merely superficial branding effort aimed at attracting new investors without substantial changes underneath.

Short-Term Market Effects: Token Price Fluctuations

Following any major announcement—including rebrands—cryptocurrency tokens often experience volatility driven by speculative trading behaviors:

- Some investors interpret the move optimistically expecting future growth opportunities.

- Others may react cautiously due to uncertainties about actual implementation success or lingering doubts about past controversies affecting long-term viability.

Since specific data points are limited regarding immediate price movements post-rebrand for Vaulta/EOS specifically—but generally speaking—such transitions tend initially toward increased volatility before settling into new valuation levels based on subsequent developments.

Factors Influencing Short-Term Price Movements:

- Investor sentiment shifts

- Technical upgrade announcements

- Partnership news

- Broader market conditions during transition periods

Risks & Challenges Ahead

While rebranding offers potential benefits—including improved brand image—it also introduces risks that could impact future performance:

Regulatory Scrutiny

Regulators worldwide are increasingly attentive towards crypto projects involved in financial activities like DeFi services; any perceived attempt at evasion or lack of compliance could invite legal challenges impacting operations negatively.

Community Trust & Adoption

Maintaining community support is vital; if stakeholders perceive insufficient progress or mismanagement during transition phases—as seen historically with other projects—they may withdraw support leading to decreased adoption rates which directly affect token value stability.

Competitive Landscape

Vaulta faces stiff competition from well-established DeFi platforms offering similar features but with proven track records for transparency/security—which means differentiation through innovation becomes critical.

Technical Complexity During Transition

Implementing significant upgrades while ensuring network stability poses inherent risks; bugs or vulnerabilities introduced inadvertently could undermine user confidence further if not managed carefully.

Strategic Recommendations Moving Forward

For vaulta’s sustained success—and ultimately improving market perception—the following strategies should be prioritized:

Transparent Communication

Regular updates regarding development milestones help reassure stakeholders about ongoing progress.Delivering Tangible Results

Focus on deploying secure smart contracts coupled with real-world partnerships demonstrating ecosystem expansion.Engaging Community

Active forums where users can voice concerns foster loyalty amid change processes.Compliance Readiness

Proactively addressing regulatory requirements minimizes legal risks down the line.

Final Thoughts: Navigating Change Effectively

Rebranding from EOS to Vaulta signifies an ambitious attempt at revitalizing a legacy project amid evolving industry demands—in particular emphasizing decentralization-focused finance solutions backed by stronger security measures.. While initial reactions show mixed sentiments influenced largely by speculation rather than concrete outcomes yet—success will depend heavily upon how well technical improvements translate into real-world utility combined with transparent stakeholder engagement..

As the crypto space continues shifting rapidly towards more sophisticated financial instruments built atop secure blockchains—with increasing regulatory oversight—the ability of projects like Vaulta/EOS's successor—to adapt swiftly will determine their long-term relevance—and ultimately their impact on market perception and valuation.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Recent Bitcoin Rally and Its Effect on Bearish Market Positions

Understanding the Impact of Bitcoin’s Price Surge on Short-Selling Strategies

The recent rally in Bitcoin (BTC) has captured significant attention within the cryptocurrency community and financial markets at large. On June 8, 2025, Bitcoin surged to a new high of $105,460, representing a 2.36% increase from the previous day. This sharp upward movement has not only influenced market sentiment but also reshaped investor behavior—particularly among those holding bearish bets or short positions.

How Price Movements Influence Market Sentiment

Bitcoin’s rapid price appreciation often triggers shifts in investor outlooks. Historically, such rallies tend to reduce bearish sentiment as traders become more optimistic about future gains. The current rally exemplifies this trend: many investors who previously anticipated a decline are now reconsidering their positions. As a result, there has been a notable decrease in bearish bets—investors are closing short positions or converting them into long ones to capitalize on the bullish momentum.

Futures Contracts Indicate Continued Optimism

Despite the rally's immediate effects on spot trading and investor sentiment, futures markets reveal an even more bullish outlook among certain segments of traders. Futures contracts with higher premiums suggest that some investors still believe in potential further increases in Bitcoin’s price down the line. These derivatives serve as indicators of market expectations for future volatility and growth; elevated premiums imply confidence that prices could rise beyond current levels.

The Role of ETFs During Market Fluctuations

Exchange-traded funds (ETFs), which provide exposure to cryptocurrencies without direct ownership, have shown nearly flat performance during this period. This stability indicates mixed sentiments: while some investors remain optimistic about short-term gains driven by recent rallies, others exhibit caution regarding long-term stability amid ongoing market uncertainties. ETFs’ muted response underscores that not all market participants are uniformly convinced about sustained upward momentum.

Investor Behavior Shifts Amid Price Surges

The surge in Bitcoin's value has prompted significant behavioral changes among traders and institutional investors alike:

- Closing Short Positions: Traders who bet against BTC are increasingly liquidating their shorts.

- Increasing Long Positions: Many are shifting strategies toward buying or holding long positions to benefit from continued growth.

- Adjusting Risk Tolerance: Investors appear more willing to accept higher risk levels given positive recent trends.

This collective shift reflects an overarching move toward optimism but also highlights increased vulnerability if prices reverse suddenly.

Broader Cryptocurrency Market Trends Supporting Bullish Sentiment

Bitcoin does not operate in isolation; its movements often influence broader crypto markets:

- Growing interest from institutional investors

- Increased retail participation

- Rising adoption rates across various sectors

These factors contribute to overall bullish trends within cryptocurrencies and help explain why bearish bets have diminished during this rally phase.

Potential Risks Associated With Rapid Market Changes

While rising prices can generate profit opportunities, they also carry inherent risks:

- Market Volatility: Rapid surges can lead to sharp corrections if investor enthusiasm wanes unexpectedly.

- Overleveraging: Elevated futures premiums may encourage risky leverage strategies that amplify losses during downturns.

- Market Manipulation Concerns: Sudden price spikes sometimes attract manipulative practices which can distort true market fundamentals.

Investors should remain cautious and employ risk management techniques when navigating such volatile environments.

Historical Context: Cycles of Bullish Rallies and Corrections

Cryptocurrency markets have historically experienced cycles characterized by rapid rallies followed by corrections:

- Past bull runs were often preceded by accumulation phases where bearish bets declined sharply.

- Corrections typically follow after speculative excesses or macroeconomic shifts.

Understanding these patterns helps contextualize current developments—highlighting that while optimism is justified now, prudence remains essential due to past volatility cycles.

Expert Forecasts on Future Trends

Financial analysts closely monitor these developments for signs of sustainability:

- Some experts predict continued upward momentum if institutional interest persists

- Others warn against overexposure amid potential correction risks

Overall consensus emphasizes balancing optimism with caution—recognizing that while recent gains boost confidence temporarily, underlying fundamentals must support sustained growth for lasting market health.

Monitoring Investor Strategies Moving Forward

As Bitcoin continues its upward trajectory post-rally:

- Investors should stay informed about macroeconomic factors influencing crypto markets

- Diversification remains key amidst fluctuating sentiment

- Regularly reviewing open positions helps manage exposure effectively

Adapting strategies based on evolving data ensures better resilience against sudden reversals typical of volatile cryptocurrency environments.

Tracking Broader Economic Indicators Affecting Crypto Markets

Beyond internal crypto dynamics, external economic variables play crucial roles:

- Currency exchange rates (e.g., SGD/CHF)

- Regulatory developments worldwide

- Macroeconomic policies impacting liquidity

For example, fluctuations like those seen recently between SGD/CHF reflect ongoing global financial activity influencing investment flows into cryptocurrencies like BTC.

How Recent Rally Shapes Long-Term Investment Outlook

The swift shift from bearishness toward optimism following BTC’s rally signifies changing perceptions among both retail and institutional players alike. While this environment offers promising opportunities for profit-taking or portfolio diversification,

it is vital for investors—and especially newcomers—to approach with due diligence,

considering both technical signals (such as moving averages) and fundamental factors (like network adoption). Maintaining awareness of historical patterns helps mitigate risks associated with sudden corrections after rapid surges.

Staying Informed Is Key During Volatile Periods

Given how quickly sentiment can change—as evidenced by past cycles—it is essential for stakeholders at all levels:

- To follow credible news sources covering regulatory updates,

- To analyze technical charts regularly,

- To understand macroeconomic influences shaping crypto valuations,

This comprehensive approach enables better decision-making amid unpredictable swings characteristic of cryptocurrency markets.

In summary,

the recent Bitcoin rally has significantly altered trader positioning—from widespread bearish bets towards increased bullishness—reflecting heightened confidence driven by rising prices and positive market signals. However,investors must remain vigilant regarding potential volatility spikes,continuously adapt their strategies based on evolving data,and maintain a balanced perspective rooted in historical context when navigating these dynamic digital asset landscapes

JCUSER-WVMdslBw

2025-06-09 20:03

How did the recent BTC rally impact bearish bets in the market?

Recent Bitcoin Rally and Its Effect on Bearish Market Positions

Understanding the Impact of Bitcoin’s Price Surge on Short-Selling Strategies

The recent rally in Bitcoin (BTC) has captured significant attention within the cryptocurrency community and financial markets at large. On June 8, 2025, Bitcoin surged to a new high of $105,460, representing a 2.36% increase from the previous day. This sharp upward movement has not only influenced market sentiment but also reshaped investor behavior—particularly among those holding bearish bets or short positions.

How Price Movements Influence Market Sentiment

Bitcoin’s rapid price appreciation often triggers shifts in investor outlooks. Historically, such rallies tend to reduce bearish sentiment as traders become more optimistic about future gains. The current rally exemplifies this trend: many investors who previously anticipated a decline are now reconsidering their positions. As a result, there has been a notable decrease in bearish bets—investors are closing short positions or converting them into long ones to capitalize on the bullish momentum.

Futures Contracts Indicate Continued Optimism

Despite the rally's immediate effects on spot trading and investor sentiment, futures markets reveal an even more bullish outlook among certain segments of traders. Futures contracts with higher premiums suggest that some investors still believe in potential further increases in Bitcoin’s price down the line. These derivatives serve as indicators of market expectations for future volatility and growth; elevated premiums imply confidence that prices could rise beyond current levels.

The Role of ETFs During Market Fluctuations

Exchange-traded funds (ETFs), which provide exposure to cryptocurrencies without direct ownership, have shown nearly flat performance during this period. This stability indicates mixed sentiments: while some investors remain optimistic about short-term gains driven by recent rallies, others exhibit caution regarding long-term stability amid ongoing market uncertainties. ETFs’ muted response underscores that not all market participants are uniformly convinced about sustained upward momentum.

Investor Behavior Shifts Amid Price Surges

The surge in Bitcoin's value has prompted significant behavioral changes among traders and institutional investors alike:

- Closing Short Positions: Traders who bet against BTC are increasingly liquidating their shorts.

- Increasing Long Positions: Many are shifting strategies toward buying or holding long positions to benefit from continued growth.

- Adjusting Risk Tolerance: Investors appear more willing to accept higher risk levels given positive recent trends.

This collective shift reflects an overarching move toward optimism but also highlights increased vulnerability if prices reverse suddenly.

Broader Cryptocurrency Market Trends Supporting Bullish Sentiment

Bitcoin does not operate in isolation; its movements often influence broader crypto markets:

- Growing interest from institutional investors

- Increased retail participation

- Rising adoption rates across various sectors

These factors contribute to overall bullish trends within cryptocurrencies and help explain why bearish bets have diminished during this rally phase.

Potential Risks Associated With Rapid Market Changes

While rising prices can generate profit opportunities, they also carry inherent risks:

- Market Volatility: Rapid surges can lead to sharp corrections if investor enthusiasm wanes unexpectedly.

- Overleveraging: Elevated futures premiums may encourage risky leverage strategies that amplify losses during downturns.

- Market Manipulation Concerns: Sudden price spikes sometimes attract manipulative practices which can distort true market fundamentals.

Investors should remain cautious and employ risk management techniques when navigating such volatile environments.

Historical Context: Cycles of Bullish Rallies and Corrections

Cryptocurrency markets have historically experienced cycles characterized by rapid rallies followed by corrections:

- Past bull runs were often preceded by accumulation phases where bearish bets declined sharply.

- Corrections typically follow after speculative excesses or macroeconomic shifts.

Understanding these patterns helps contextualize current developments—highlighting that while optimism is justified now, prudence remains essential due to past volatility cycles.

Expert Forecasts on Future Trends

Financial analysts closely monitor these developments for signs of sustainability:

- Some experts predict continued upward momentum if institutional interest persists

- Others warn against overexposure amid potential correction risks

Overall consensus emphasizes balancing optimism with caution—recognizing that while recent gains boost confidence temporarily, underlying fundamentals must support sustained growth for lasting market health.

Monitoring Investor Strategies Moving Forward

As Bitcoin continues its upward trajectory post-rally:

- Investors should stay informed about macroeconomic factors influencing crypto markets

- Diversification remains key amidst fluctuating sentiment

- Regularly reviewing open positions helps manage exposure effectively

Adapting strategies based on evolving data ensures better resilience against sudden reversals typical of volatile cryptocurrency environments.

Tracking Broader Economic Indicators Affecting Crypto Markets

Beyond internal crypto dynamics, external economic variables play crucial roles:

- Currency exchange rates (e.g., SGD/CHF)

- Regulatory developments worldwide

- Macroeconomic policies impacting liquidity

For example, fluctuations like those seen recently between SGD/CHF reflect ongoing global financial activity influencing investment flows into cryptocurrencies like BTC.

How Recent Rally Shapes Long-Term Investment Outlook

The swift shift from bearishness toward optimism following BTC’s rally signifies changing perceptions among both retail and institutional players alike. While this environment offers promising opportunities for profit-taking or portfolio diversification,

it is vital for investors—and especially newcomers—to approach with due diligence,

considering both technical signals (such as moving averages) and fundamental factors (like network adoption). Maintaining awareness of historical patterns helps mitigate risks associated with sudden corrections after rapid surges.

Staying Informed Is Key During Volatile Periods

Given how quickly sentiment can change—as evidenced by past cycles—it is essential for stakeholders at all levels:

- To follow credible news sources covering regulatory updates,

- To analyze technical charts regularly,

- To understand macroeconomic influences shaping crypto valuations,

This comprehensive approach enables better decision-making amid unpredictable swings characteristic of cryptocurrency markets.

In summary,

the recent Bitcoin rally has significantly altered trader positioning—from widespread bearish bets towards increased bullishness—reflecting heightened confidence driven by rising prices and positive market signals. However,investors must remain vigilant regarding potential volatility spikes,continuously adapt their strategies based on evolving data,and maintain a balanced perspective rooted in historical context when navigating these dynamic digital asset landscapes

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Best Times to Trade During the XT Carnival

The XT Carnival is one of the most anticipated events in the cryptocurrency trading calendar. It attracts thousands of traders, investors, and enthusiasts eager to capitalize on heightened market activity. Understanding when to trade during this event can significantly influence your success, especially given its characteristic high liquidity and volatility. This guide aims to help traders identify the most strategic times for trading during the XT Carnival based on recent insights and market patterns.

What Is the XT Carnival?

The XT Carnival is an annual gathering organized by XT.com, a leading cryptocurrency exchange. It features a series of activities including trading competitions, workshops, seminars, and networking opportunities designed for both novice and experienced traders. The event's core appeal lies in its ability to generate increased market activity—traders are motivated by prizes from competitions and educational content that enhances their skills.

This event typically spans several days with fluctuating schedules each year but consistently draws large participation due to its reputation for high liquidity and volatility. These conditions create both opportunities for profit through quick trades or swing strategies as well as risks that require careful risk management.

Why Timing Matters During the XT Carnival

Timing your trades during such a dynamic period can make a significant difference in outcomes. High liquidity means more buying and selling activity which often leads to rapid price movements—both upward surges and sharp declines. For traders aiming to maximize gains or minimize losses, understanding when these movements are likely occurs is crucial.

Market openings at the start of each day or session tend to be volatile as new information enters markets or participants react collectively after overnight developments. Similarly, periods around scheduled activities like workshops or competition deadlines often see spikes in trading volume because participants adjust their positions based on new insights gained from educational sessions or competitive results.

Key Periods When Trading Is Most Active

Based on recent trends observed during past editions of the XT Carnival—and supported by general market behavior—the following periods are typically characterized by increased activity:

Market Openings: The beginning of each trading day within the event usually witnesses notable price swings as traders digest overnight news or react quickly after initial announcements.

Mid-Day Sessions (Lunch Breaks): Around midday—often coinciding with breaks in scheduled events—trading volume tends to increase as participants reassess their strategies based on early-day developments.

During Trading Competitions: When specific contests are active—such as "Crypto Trading Challenge" winners being announced—the surge in participant engagement leads directly to higher liquidity.

Post-Educational Workshops: After seminars focusing on technical analysis or risk management conclude, many attendees actively implement learned strategies immediately afterward; this creates short-term volatility spikes.

Pre-Event Announcements & Market Updates: Any significant news released just before key segments can trigger rapid price adjustments across various cryptocurrencies involved in those updates.

How Traders Can Maximize Opportunities

To effectively leverage these peak periods:

- Monitor Event Schedules Closely: Keep track of daily agendas including workshop timings, competition phases, and announcement windows.

- Use Real-Time Data & Alerts: Employ tools like live charts with alerts set around expected volatile periods so you can act swiftly when opportunities arise.

- Practice Risk Management: Given high volatility potential—even during prime times—it’s essential always to use stop-loss orders and position sizing appropriate for your risk appetite.

- Focus on Liquid Pairs: During busy periods like competition peaks or session openings, prioritize highly liquid cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), or top altcoins which facilitate smoother entry/exit points without slippage.

Risks Associated With Peak Trading Times

While these windows offer lucrative opportunities due to increased movement, they also come with heightened risks:

- Sudden Price Swings: Rapid fluctuations may lead inexperienced traders into significant losses if not managed properly.

- Market Manipulation Concerns: High-liquidity events sometimes attract manipulative practices; however, reputable platforms like XT.com implement measures against such activities.

- Emotional Trading: Increased excitement might lead some traders into impulsive decisions rather than disciplined strategies.

Understanding these risks underscores why preparation—including education about technical analysis—is vital before engaging heavily during peak times at events like the XT Carnival.

Final Thoughts: Strategic Planning Enhances Success

Knowing when best times occur isn’t enough; successful trading also depends on preparation beforehand — including analyzing historical data from previous Carnivals—and maintaining discipline throughout volatile sessions. By aligning your trading schedule with key activity windows identified above while practicing sound risk management principles you stand better chances at capitalizing on this vibrant event’s full potential without exposing yourself unnecessarily to downside risks.

In summary:

- Focus on opening hours

- Watch mid-day shifts

- Participate actively during competitions

- Stay alert post-workshopsThese strategic timings combined with proper planning will help you navigate one of crypto’s most exciting seasons effectively while safeguarding your investments amidst unpredictable swings typical of high-volatility environments like the XT Carnival.

Lo

2025-06-09 08:03

What are the best times to trade during the XT Carnival?

Best Times to Trade During the XT Carnival

The XT Carnival is one of the most anticipated events in the cryptocurrency trading calendar. It attracts thousands of traders, investors, and enthusiasts eager to capitalize on heightened market activity. Understanding when to trade during this event can significantly influence your success, especially given its characteristic high liquidity and volatility. This guide aims to help traders identify the most strategic times for trading during the XT Carnival based on recent insights and market patterns.

What Is the XT Carnival?

The XT Carnival is an annual gathering organized by XT.com, a leading cryptocurrency exchange. It features a series of activities including trading competitions, workshops, seminars, and networking opportunities designed for both novice and experienced traders. The event's core appeal lies in its ability to generate increased market activity—traders are motivated by prizes from competitions and educational content that enhances their skills.

This event typically spans several days with fluctuating schedules each year but consistently draws large participation due to its reputation for high liquidity and volatility. These conditions create both opportunities for profit through quick trades or swing strategies as well as risks that require careful risk management.

Why Timing Matters During the XT Carnival

Timing your trades during such a dynamic period can make a significant difference in outcomes. High liquidity means more buying and selling activity which often leads to rapid price movements—both upward surges and sharp declines. For traders aiming to maximize gains or minimize losses, understanding when these movements are likely occurs is crucial.

Market openings at the start of each day or session tend to be volatile as new information enters markets or participants react collectively after overnight developments. Similarly, periods around scheduled activities like workshops or competition deadlines often see spikes in trading volume because participants adjust their positions based on new insights gained from educational sessions or competitive results.

Key Periods When Trading Is Most Active

Based on recent trends observed during past editions of the XT Carnival—and supported by general market behavior—the following periods are typically characterized by increased activity:

Market Openings: The beginning of each trading day within the event usually witnesses notable price swings as traders digest overnight news or react quickly after initial announcements.

Mid-Day Sessions (Lunch Breaks): Around midday—often coinciding with breaks in scheduled events—trading volume tends to increase as participants reassess their strategies based on early-day developments.

During Trading Competitions: When specific contests are active—such as "Crypto Trading Challenge" winners being announced—the surge in participant engagement leads directly to higher liquidity.

Post-Educational Workshops: After seminars focusing on technical analysis or risk management conclude, many attendees actively implement learned strategies immediately afterward; this creates short-term volatility spikes.

Pre-Event Announcements & Market Updates: Any significant news released just before key segments can trigger rapid price adjustments across various cryptocurrencies involved in those updates.

How Traders Can Maximize Opportunities

To effectively leverage these peak periods:

- Monitor Event Schedules Closely: Keep track of daily agendas including workshop timings, competition phases, and announcement windows.

- Use Real-Time Data & Alerts: Employ tools like live charts with alerts set around expected volatile periods so you can act swiftly when opportunities arise.

- Practice Risk Management: Given high volatility potential—even during prime times—it’s essential always to use stop-loss orders and position sizing appropriate for your risk appetite.

- Focus on Liquid Pairs: During busy periods like competition peaks or session openings, prioritize highly liquid cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), or top altcoins which facilitate smoother entry/exit points without slippage.

Risks Associated With Peak Trading Times

While these windows offer lucrative opportunities due to increased movement, they also come with heightened risks:

- Sudden Price Swings: Rapid fluctuations may lead inexperienced traders into significant losses if not managed properly.

- Market Manipulation Concerns: High-liquidity events sometimes attract manipulative practices; however, reputable platforms like XT.com implement measures against such activities.

- Emotional Trading: Increased excitement might lead some traders into impulsive decisions rather than disciplined strategies.

Understanding these risks underscores why preparation—including education about technical analysis—is vital before engaging heavily during peak times at events like the XT Carnival.

Final Thoughts: Strategic Planning Enhances Success

Knowing when best times occur isn’t enough; successful trading also depends on preparation beforehand — including analyzing historical data from previous Carnivals—and maintaining discipline throughout volatile sessions. By aligning your trading schedule with key activity windows identified above while practicing sound risk management principles you stand better chances at capitalizing on this vibrant event’s full potential without exposing yourself unnecessarily to downside risks.

In summary:

- Focus on opening hours

- Watch mid-day shifts

- Participate actively during competitions

- Stay alert post-workshopsThese strategic timings combined with proper planning will help you navigate one of crypto’s most exciting seasons effectively while safeguarding your investments amidst unpredictable swings typical of high-volatility environments like the XT Carnival.

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

Precedents Set by Countries Adopting Bitcoin

Understanding the Global Shift Toward Bitcoin Adoption

In recent years, countries around the world have begun to recognize Bitcoin not just as a digital asset but as a strategic tool with geopolitical and economic implications. This shift reflects a broader trend of integrating cryptocurrencies into national policies, financial systems, and international diplomacy. As governments explore ways to leverage Bitcoin’s decentralized nature, they are setting important precedents that could influence global finance for decades to come.

How Countries Are Using Bitcoin as a Strategic Asset

One of the most notable developments is how nations are positioning Bitcoin as part of their geopolitical strategies. For example, during the 2025 BRICS summit in Las Vegas, Vice President JD Vance highlighted Bitcoin’s potential role in countering China's influence and strengthening alliances among Brazil, Russia, India, China, and South Africa. This move signals an emerging pattern where countries view cryptocurrencies not merely as investment opportunities but also as tools for economic sovereignty and diplomatic leverage.

This approach marks a significant departure from traditional monetary policy reliance on fiat currencies controlled by central banks. Instead, adopting Bitcoin allows nations to diversify their reserves and reduce dependence on Western-dominated financial systems. Such strategic positioning could reshape international relations by fostering new alliances centered around shared interests in cryptocurrency technology.

Investment Trends Reflecting Growing Acceptance

The increasing interest from institutional investors further underscores how countries are setting new precedents with cryptocurrency adoption. The launch of investment vehicles like the Global X Blockchain & Bitcoin Strategy ETF exemplifies this trend; analysts predict that such funds could see substantial growth in 2025 due to rising investor confidence.

Additionally, high-profile events like former U.S. President Donald Trump’s meme coin contest have attracted hundreds of millions of dollars in investments within short periods—highlighting mainstream acceptance of crypto assets beyond speculative trading. These developments suggest that governments may increasingly view cryptocurrencies both as investment assets and components of national economic strategies.

Corporate Adoption: Mainstream Integration of Cryptocurrencies

Beyond government initiatives and investor interest lies an evolving corporate landscape embracing cryptocurrencies for operational purposes. Heritage Distilling Holding Company’s recent adoption of a Cryptocurrency Treasury Reserve Policy illustrates this point clearly: businesses are beginning to hold digital assets like Bitcoin on their balance sheets to diversify treasury holdings or facilitate innovative sales strategies such as crypto giveaways.

This corporate integration sets important precedents because it signals mainstream acceptance among private enterprises—traditionally cautious entities—that see value in leveraging blockchain technology for financial resilience or competitive advantage.

Regulatory Challenges Emerging from Cryptocurrency Expansion

As more countries adopt or explore using cryptocurrencies strategically or commercially, regulatory frameworks face mounting pressure to keep pace with rapid innovation. The expansion of stablecoins—from $20 billion in 2020 to over $246 billion today—demonstrates both market growth and regulatory complexity.

Institutions like Deutsche Bank contemplating launching their own stablecoins highlight how traditional banking sectors are responding but also underscore risks associated with unregulated markets—such as fraud risk or systemic instability if oversight remains weak. Establishing clear regulations will be crucial for ensuring consumer protection while fostering innovation within legal boundaries.

Potential Risks Associated With Widespread Adoption

While adopting Bitcoin offers numerous benefits—including increased financial inclusion and geopolitical flexibility—it also introduces significant risks:

- Market Volatility: Cryptocurrencies remain highly volatile; sudden price swings can lead to substantial losses for investors unfamiliar with market dynamics.

- Geopolitical Tensions: Using digital currencies strategically might escalate tensions between nations engaged in economic competition or conflict.

- Regulatory Uncertainty: Lack of comprehensive regulation can result in market manipulation or fraud scandals that undermine trust.

- Mainstream Scrutiny: As more businesses integrate crypto assets into their operations, governments may impose stricter regulations which could hamper growth prospects if not managed carefully.

These risks emphasize the importance for policymakers worldwide to develop balanced frameworks that promote responsible adoption without stifling innovation.

How These Precedents Influence Future Financial Policies

The examples set by various nations demonstrate an evolving landscape where cryptocurrency is no longer peripheral but central to national strategy discussions. Governments now face critical decisions about whether—and how—to regulate these emerging assets effectively while harnessing their potential benefits.

By adopting proactive policies—such as creating clear legal standards for stablecoins or integrating blockchain technology into public services—they can foster sustainable growth while mitigating associated risks. Furthermore, these precedents encourage international cooperation aimed at establishing global norms governing cryptocurrency use—a step vital for maintaining stability amid rapid technological change.

Key Takeaways

- Countries are increasingly viewing Bitcoin through strategic lenses rather than purely investment perspectives.

- Geopolitical considerations drive some nations’ efforts toward using cryptocurrencies for sovereignty enhancement.

- Institutional investments reflect growing mainstream acceptance; ETFs symbolize this shift.

- Corporate adoption indicates broader integration into everyday business operations.

- Regulatory challenges must be addressed proactively given rapid market expansion.

Understanding these trends helps grasp how current actions set foundational standards influencing future policies worldwide regarding digital currencies' role within global finance ecosystems.

Semantic & LSI Keywords Used:cryptocurrency regulation | bitcoin geopolitics | institutional crypto investments | stablecoin market growth | corporate blockchain adoption | global crypto policies | digital currency strategy | fintech innovation | decentralized finance (DeFi) | cross-border payments

kai

2025-06-09 07:27

What precedents are being set by countries adopting Bitcoin?

Precedents Set by Countries Adopting Bitcoin

Understanding the Global Shift Toward Bitcoin Adoption

In recent years, countries around the world have begun to recognize Bitcoin not just as a digital asset but as a strategic tool with geopolitical and economic implications. This shift reflects a broader trend of integrating cryptocurrencies into national policies, financial systems, and international diplomacy. As governments explore ways to leverage Bitcoin’s decentralized nature, they are setting important precedents that could influence global finance for decades to come.

How Countries Are Using Bitcoin as a Strategic Asset

One of the most notable developments is how nations are positioning Bitcoin as part of their geopolitical strategies. For example, during the 2025 BRICS summit in Las Vegas, Vice President JD Vance highlighted Bitcoin’s potential role in countering China's influence and strengthening alliances among Brazil, Russia, India, China, and South Africa. This move signals an emerging pattern where countries view cryptocurrencies not merely as investment opportunities but also as tools for economic sovereignty and diplomatic leverage.

This approach marks a significant departure from traditional monetary policy reliance on fiat currencies controlled by central banks. Instead, adopting Bitcoin allows nations to diversify their reserves and reduce dependence on Western-dominated financial systems. Such strategic positioning could reshape international relations by fostering new alliances centered around shared interests in cryptocurrency technology.

Investment Trends Reflecting Growing Acceptance

The increasing interest from institutional investors further underscores how countries are setting new precedents with cryptocurrency adoption. The launch of investment vehicles like the Global X Blockchain & Bitcoin Strategy ETF exemplifies this trend; analysts predict that such funds could see substantial growth in 2025 due to rising investor confidence.

Additionally, high-profile events like former U.S. President Donald Trump’s meme coin contest have attracted hundreds of millions of dollars in investments within short periods—highlighting mainstream acceptance of crypto assets beyond speculative trading. These developments suggest that governments may increasingly view cryptocurrencies both as investment assets and components of national economic strategies.

Corporate Adoption: Mainstream Integration of Cryptocurrencies

Beyond government initiatives and investor interest lies an evolving corporate landscape embracing cryptocurrencies for operational purposes. Heritage Distilling Holding Company’s recent adoption of a Cryptocurrency Treasury Reserve Policy illustrates this point clearly: businesses are beginning to hold digital assets like Bitcoin on their balance sheets to diversify treasury holdings or facilitate innovative sales strategies such as crypto giveaways.

This corporate integration sets important precedents because it signals mainstream acceptance among private enterprises—traditionally cautious entities—that see value in leveraging blockchain technology for financial resilience or competitive advantage.

Regulatory Challenges Emerging from Cryptocurrency Expansion

As more countries adopt or explore using cryptocurrencies strategically or commercially, regulatory frameworks face mounting pressure to keep pace with rapid innovation. The expansion of stablecoins—from $20 billion in 2020 to over $246 billion today—demonstrates both market growth and regulatory complexity.

Institutions like Deutsche Bank contemplating launching their own stablecoins highlight how traditional banking sectors are responding but also underscore risks associated with unregulated markets—such as fraud risk or systemic instability if oversight remains weak. Establishing clear regulations will be crucial for ensuring consumer protection while fostering innovation within legal boundaries.

Potential Risks Associated With Widespread Adoption

While adopting Bitcoin offers numerous benefits—including increased financial inclusion and geopolitical flexibility—it also introduces significant risks:

- Market Volatility: Cryptocurrencies remain highly volatile; sudden price swings can lead to substantial losses for investors unfamiliar with market dynamics.

- Geopolitical Tensions: Using digital currencies strategically might escalate tensions between nations engaged in economic competition or conflict.

- Regulatory Uncertainty: Lack of comprehensive regulation can result in market manipulation or fraud scandals that undermine trust.

- Mainstream Scrutiny: As more businesses integrate crypto assets into their operations, governments may impose stricter regulations which could hamper growth prospects if not managed carefully.

These risks emphasize the importance for policymakers worldwide to develop balanced frameworks that promote responsible adoption without stifling innovation.

How These Precedents Influence Future Financial Policies

The examples set by various nations demonstrate an evolving landscape where cryptocurrency is no longer peripheral but central to national strategy discussions. Governments now face critical decisions about whether—and how—to regulate these emerging assets effectively while harnessing their potential benefits.

By adopting proactive policies—such as creating clear legal standards for stablecoins or integrating blockchain technology into public services—they can foster sustainable growth while mitigating associated risks. Furthermore, these precedents encourage international cooperation aimed at establishing global norms governing cryptocurrency use—a step vital for maintaining stability amid rapid technological change.

Key Takeaways

- Countries are increasingly viewing Bitcoin through strategic lenses rather than purely investment perspectives.

- Geopolitical considerations drive some nations’ efforts toward using cryptocurrencies for sovereignty enhancement.

- Institutional investments reflect growing mainstream acceptance; ETFs symbolize this shift.

- Corporate adoption indicates broader integration into everyday business operations.

- Regulatory challenges must be addressed proactively given rapid market expansion.

Understanding these trends helps grasp how current actions set foundational standards influencing future policies worldwide regarding digital currencies' role within global finance ecosystems.

Semantic & LSI Keywords Used:cryptocurrency regulation | bitcoin geopolitics | institutional crypto investments | stablecoin market growth | corporate blockchain adoption | global crypto policies | digital currency strategy | fintech innovation | decentralized finance (DeFi) | cross-border payments

Disclaimer:Contains third-party content. Not financial advice.

See Terms and Conditions.

What Are 5819 CARV Tokens?

The 5819 CARV tokens are a part of the rapidly expanding decentralized finance (DeFi) ecosystem, representing a digital asset that could serve multiple functions within its native blockchain platform. Typically built on popular blockchain networks like Ethereum or Binance Smart Chain, these tokens are designed to facilitate transactions, governance, or both within their specific DeFi protocol. As with many tokens in this space, understanding their purpose and potential impact requires examining their role in the broader DeFi landscape.

The Role of CARV Tokens in Decentralized Finance

CARV tokens are likely intended to support various activities within a particular DeFi ecosystem. These can include enabling seamless peer-to-peer transactions, participating in protocol governance through voting rights, or incentivizing user engagement via staking rewards. In essence, they act as utility and governance tools that empower users to actively participate in shaping the platform’s future.

In recent years, DeFi has revolutionized traditional financial services by removing intermediaries such as banks and brokers. Tokens like CARV contribute to this transformation by providing decentralized access to financial products such as lending pools, liquidity provision, and yield farming opportunities. Their significance lies not only in their immediate utility but also in how they foster community-driven development and decision-making.

Key Features of 5819 CARV Tokens

- Token Name & Symbol: The token is called CARV with the symbol 5819.

- Blockchain Platform: While specifics may vary, these tokens are typically issued on Ethereum or Binance Smart Chain due to their robust smart contract capabilities.

- Supply & Distribution: Most projects cap total supply to prevent inflationary issues; distribution often involves initial coin offerings (ICOs), private sales for early investors, followed by public sales for wider adoption.

- Purpose & Utility: Primarily designed for transactional purposes within its ecosystem—such as paying fees—or serving as a governance token allowing holders voting rights on protocol upgrades.

Understanding these features helps gauge how well-positioned the token is for long-term growth and stability within competitive DeFi markets.

Recent Developments Impacting CARV Tokens

Launch Timeline & Market Performance

While exact launch dates might not be publicly available yet for some projects involving CARV tokens, initial market performance metrics such as market capitalization and trading volume provide insights into investor interest. Early trading activity can indicate whether there’s strong community backing or institutional interest driving demand.

Strategic Partnerships & Collaborations

Partnerships with other DeFi protocols or traditional financial institutions can significantly boost credibility and usability of CARV tokens. For example—collaborations that integrate with major exchanges or cross-chain platforms enhance liquidity options while expanding user reach.

Regulatory Environment & Compliance Efforts

Regulatory developments remain crucial factors influencing any cryptocurrency's success. Governments worldwide continue refining policies around digital assets; compliance efforts ensure project longevity amid evolving legal landscapes. Projects demonstrating proactive regulatory adherence tend to attract more institutional investors seeking safer exposure routes.

Community Engagement & Social Media Presence

Active social media channels like Twitter and Telegram reflect strong community support—a vital component for sustained growth in crypto markets where decentralization emphasizes collective participation over centralized control. Forums such as Reddit also serve as hubs where users discuss updates—providing valuable sentiment indicators about future price movements.

Market Trends & Competitive Landscape

Analyzing current trends reveals whether cryptocurrencies similar to CARV are gaining traction against competitors offering comparable functionalities like staking rewards or governance rights—highlighting unique selling points that differentiate it from others competing within the same niche.

Risks That Could Affect 5819 CARV Token Value

Despite promising prospects, several risks could threaten long-term viability:

Security Vulnerabilities: Blockchain security breaches could compromise user funds if underlying protocols have vulnerabilities.

Scalability Challenges: As transaction volumes grow rapidly during bull markets—or unforeseen surges—the network might face congestion issues leading to higher fees or slower processing times.

Market Volatility: Cryptocurrency prices tend toward high volatility driven by macroeconomic factors; sudden price swings can erode investor confidence quickly.

Regulatory Changes: Stricter regulations could restrict certain activities associated with these tokens—potentially limiting use cases or forcing compliance costs upon developers—and impacting overall value stability.

How Do 5819 CARV Tokens Fit Into Broader Crypto Trends?

The emergence of tokens like CARV exemplifies key trends shaping today’s crypto environment: decentralization-driven decision making through governance models; increased integration between different blockchain platforms; growing emphasis on transparency via open-source protocols; plus an expanding focus on regulatory compliance alongside innovation efforts.

Historically speaking—from Bitcoin’s inception as a decentralized currency—to Ethereum’s smart contract revolution—the evolution has consistently aimed at democratizing access while reducing reliance on centralized authorities. Within this context, CARTokens symbolize an ongoing effort toward creating more inclusive financial systems powered by blockchain technology.

Comparing With Other Similar Crypto Assets

When evaluating the significance of 5819 CARV tokens against peers:

Strengths:

- Potentially innovative utility features tailored specifically for its ecosystem

- Active community engagement fostering trust

- Strategic partnerships enhancing credibility

Weaknesses:

- Limited track record compared with established giants

- Possible scalability hurdles depending on underlying infrastructure

Opportunities:

- Growing demand for decentralized governance solutions

- Expansion into new markets via cross-chain interoperability

Threats:

- Intense competition from similar DeFi projects

- Regulatory crackdowns affecting operational scope

By understanding these comparative aspects — including technological advantages versus challenges — investors can better assess its long-term potential relative to other assets.

Addressing Security Concerns And Future Outlook

Security remains paramount when dealing with digital assets like CAREtokens because vulnerabilities directly threaten investor confidence—and ultimately project success. Regular audits by reputable cybersecurity firms help identify weaknesses before malicious actors exploit them—a best practice increasingly adopted across reputable crypto projects.

Looking ahead—with ongoing developments around scalability solutions (like layer-two technologies), enhanced interoperability standards (such as Polkadot), plus evolving regulatory frameworks—the future outlook appears cautiously optimistic if project teams maintain transparency and adapt proactively.

This comprehensive overview underscores why understanding the dynamics surrounding 5819 CARV tokens is essential—not just from an investment perspective but also considering broader technological innovations shaping our financial future today.*

JCUSER-F1IIaxXA

2025-06-09 02:47

What is the significance of 5819 CARV tokens?

What Are 5819 CARV Tokens?

The 5819 CARV tokens are a part of the rapidly expanding decentralized finance (DeFi) ecosystem, representing a digital asset that could serve multiple functions within its native blockchain platform. Typically built on popular blockchain networks like Ethereum or Binance Smart Chain, these tokens are designed to facilitate transactions, governance, or both within their specific DeFi protocol. As with many tokens in this space, understanding their purpose and potential impact requires examining their role in the broader DeFi landscape.

The Role of CARV Tokens in Decentralized Finance

CARV tokens are likely intended to support various activities within a particular DeFi ecosystem. These can include enabling seamless peer-to-peer transactions, participating in protocol governance through voting rights, or incentivizing user engagement via staking rewards. In essence, they act as utility and governance tools that empower users to actively participate in shaping the platform’s future.

In recent years, DeFi has revolutionized traditional financial services by removing intermediaries such as banks and brokers. Tokens like CARV contribute to this transformation by providing decentralized access to financial products such as lending pools, liquidity provision, and yield farming opportunities. Their significance lies not only in their immediate utility but also in how they foster community-driven development and decision-making.

Key Features of 5819 CARV Tokens

- Token Name & Symbol: The token is called CARV with the symbol 5819.

- Blockchain Platform: While specifics may vary, these tokens are typically issued on Ethereum or Binance Smart Chain due to their robust smart contract capabilities.

- Supply & Distribution: Most projects cap total supply to prevent inflationary issues; distribution often involves initial coin offerings (ICOs), private sales for early investors, followed by public sales for wider adoption.

- Purpose & Utility: Primarily designed for transactional purposes within its ecosystem—such as paying fees—or serving as a governance token allowing holders voting rights on protocol upgrades.

Understanding these features helps gauge how well-positioned the token is for long-term growth and stability within competitive DeFi markets.

Recent Developments Impacting CARV Tokens

Launch Timeline & Market Performance

While exact launch dates might not be publicly available yet for some projects involving CARV tokens, initial market performance metrics such as market capitalization and trading volume provide insights into investor interest. Early trading activity can indicate whether there’s strong community backing or institutional interest driving demand.

Strategic Partnerships & Collaborations

Partnerships with other DeFi protocols or traditional financial institutions can significantly boost credibility and usability of CARV tokens. For example—collaborations that integrate with major exchanges or cross-chain platforms enhance liquidity options while expanding user reach.

Regulatory Environment & Compliance Efforts

Regulatory developments remain crucial factors influencing any cryptocurrency's success. Governments worldwide continue refining policies around digital assets; compliance efforts ensure project longevity amid evolving legal landscapes. Projects demonstrating proactive regulatory adherence tend to attract more institutional investors seeking safer exposure routes.

Community Engagement & Social Media Presence

Active social media channels like Twitter and Telegram reflect strong community support—a vital component for sustained growth in crypto markets where decentralization emphasizes collective participation over centralized control. Forums such as Reddit also serve as hubs where users discuss updates—providing valuable sentiment indicators about future price movements.

Market Trends & Competitive Landscape

Analyzing current trends reveals whether cryptocurrencies similar to CARV are gaining traction against competitors offering comparable functionalities like staking rewards or governance rights—highlighting unique selling points that differentiate it from others competing within the same niche.

Risks That Could Affect 5819 CARV Token Value

Despite promising prospects, several risks could threaten long-term viability: